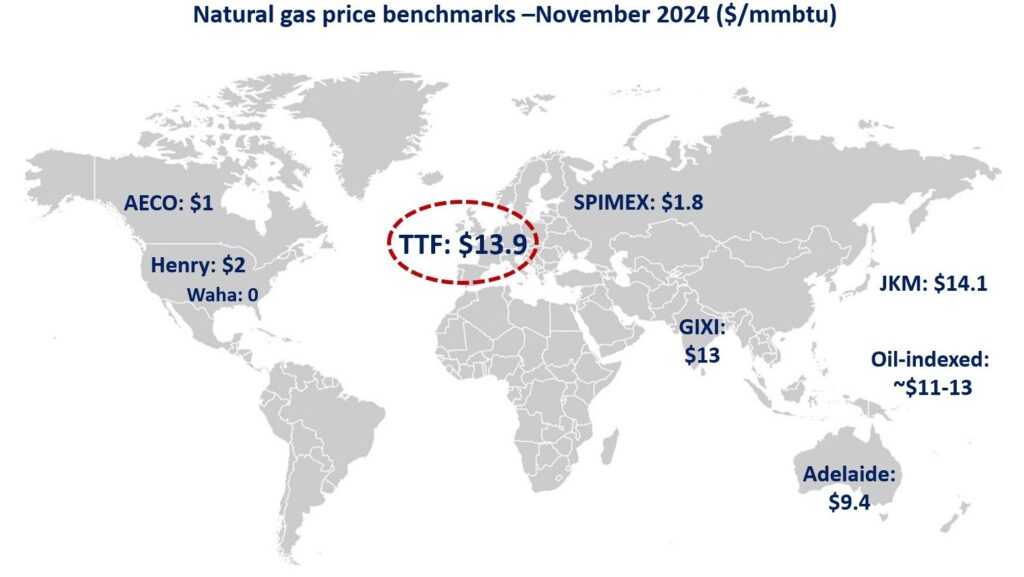

Asian and European gas prices rose to year-highs in November amid cold weather, low wind speeds and geopolitical tensions fuelling price volatility.

In Europe, TTF month-ahead prices rose by 8% month-on-month to an average of near $14/mmbtu. Gas demand surged by near 15% yoy on low wind power output, which boosted gas-fired powgen by a staggering 50% yoy.

Meanwhile colder weather increased the call on gas in the residential and commercial sectors. The demand surge was primarily met by higher storage draws which totalled at over 9 bcm through the month and brought down fill levels from 95% to 85%.

In Asia, JKM prices followed a similar trajectory and rose by 6% to $14.1/mmbtu amid the rising competition for flexible LNG cargos with Europe.

Spot LNG prices are now trading at a hefty premium of $1-2/mmbtu compared to oil-indexed LNG prices, meaning that buyers will reduce their spot procurements whenever they can. The collapse of the JKM-TTF spread also means that we might see LNG flows rerouted from Asia to Europe in Dec.

In the US, Henry Hub prices were all over the place, oscillating between $1.2 and $3/mmbtu. on average, Henry spot prices traded at just above $2/mmbtu – their lowest November level since 1995. mild weather together with strong associated gas production in the Permian kept Henry depressed.

Meanwhile, gas prices at the Waha hub, in the heart of the Permian, averaged at a comfortable 0 – difficult to compete with that.

What is your view? How will gas prices evolve this winter season? Could we see more volatility coming into play? What will be the impact of these higher gas prices on gas demand in Asia? Could we see a slowdown?

Source: Greg MOLNAR