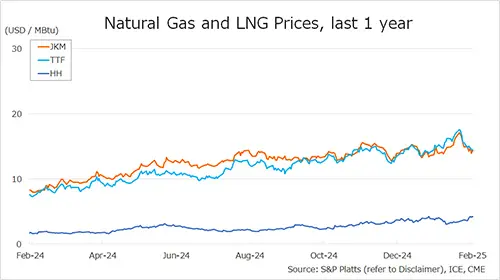

The Northeast Asian assessed spot LNG price JKM for last week (17 – 21 February) fell to mid-USD 14s on 21 February (April Delivery) from high-USD 14s the previous weekend (14 February, March delivery). JKM was on a downtrend, falling below USD 14 on 20 February due to falling European gas prices and weak demand in Northeast Asia.

Then, the price rebounded to mid-USD 14s, mainly due to buying orders from Taiwan and Thailand. METI announced on 19 February that Japan’s LNG inventories for power generation as of 16 February stood at 2.01 million tonnes, down 0.14 million tonnes from the previous week.

The European gas price TTF (March delivery) for last week (17 – 21 February) fell to USD 14.5/MBtu on 21 February from USD 15.6/MBtu the previous weekend (14 February).

TTF fell sharply at the beginning of the week to USD 14.7 from USD 15.6 at the end of last week, due to lower geopolitical risks from the start of Russian-Ukrainian peace talks, discussions on easing European underground gas storage requirements, and forecasts of rising temperatures, particularly in northwest Europe.

It then briefly rose to USD 15.3 due to less optimism about the peace talks, but fell to USD 14.5 over the weekend, partly due to warmer weather and higher renewable energy output.

According to AGSI+, the EU-wide underground gas storage was 41.0% on 21 February, down from 45.2% at the end of the previous weekend, down 35.8% from the same period last year, and down 19.8% over the five-year average.

The U.S. gas price HH (March delivery) for last week (17 – 21 February) rose to USD 4.2/MBtu on 21 February from USD 3.7/MBtu the previous weekend (14 February).

HH rose above USD 4 on 18 February due to a major cold front descending on the central U.S. and increased demand for heating, as well as strong feedstock gas supplies to LNG export terminals.

The EIA Weekly Natural Gas Storage Report released on 20 February showed U.S. natural gas inventories as of 14 February at 2,101 Bcf, down 196 Bcf from the previous week, down 15.5% from the same period last year, and 5.3% decrease over the five-year average.

Updated: February 25

Source: JOGMEC