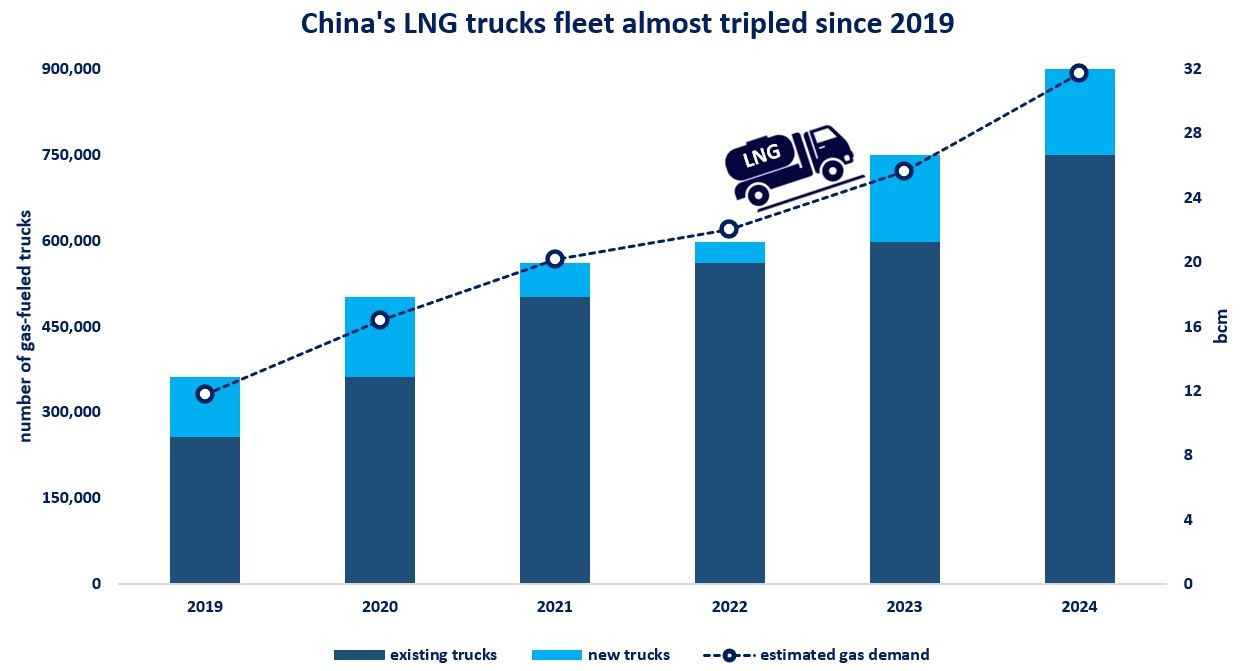

China’s LNG imports have dropped to their lowest level in 2025, with the 14-day moving average falling to just 174.67 Mcm/d. Terminal utilization remains muted at 43.96%, while domestic LNG prices edged up to ¥4,525/ton, reflecting cautious support in a demand-weak environment.

Mild weather is weighing on gas consumption in both Beijing and Shanghai, with limited heating demand ahead.

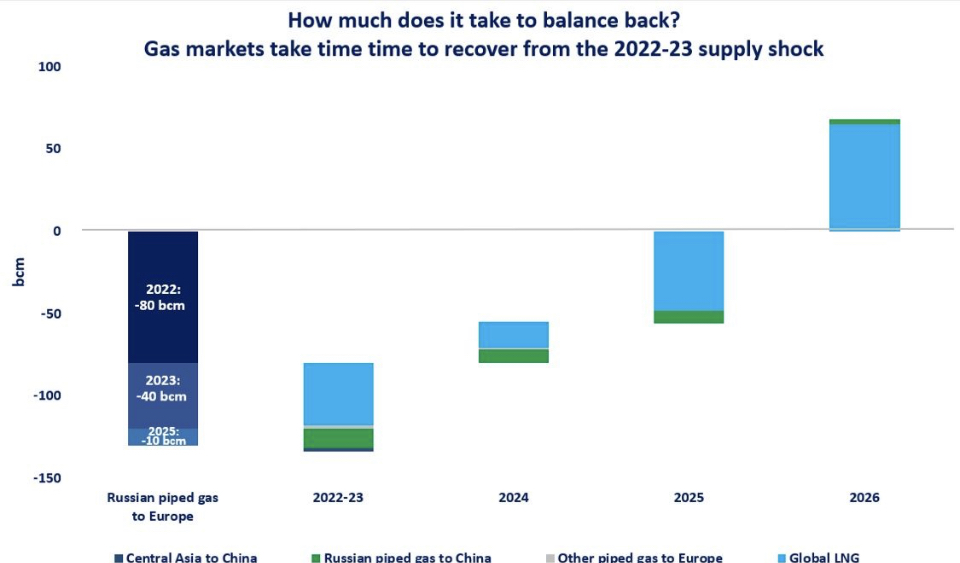

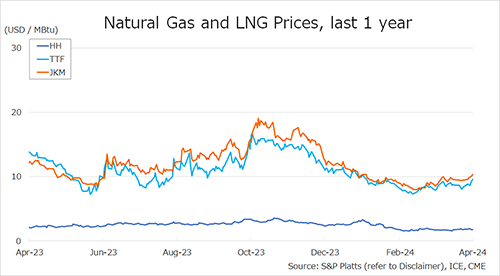

A notable geopolitical shift is reshaping flows: tariffs on U.S. LNG are forcing Chinese buyers to reroute cargoes, while pipeline imports from Russia have overtaken LNG volumes for the first time on record (Feb 2025: 5.01 vs. 4.54 billion kg).

What it means: The LNG market in China is facing a double bind – seasonal weakness in demand, and a structural shift in supply strategy. The rise of pipeline gas is reducing LNG’s share in the mix, with implications for seaborne trade flows and terminal infrastructure.

As this realignment unfolds, China’s role in the global LNG market may become less dominant, especially in the spot space, with long term consequences for exporters, traders, and infrastructure developers.

Source: EklipX Research