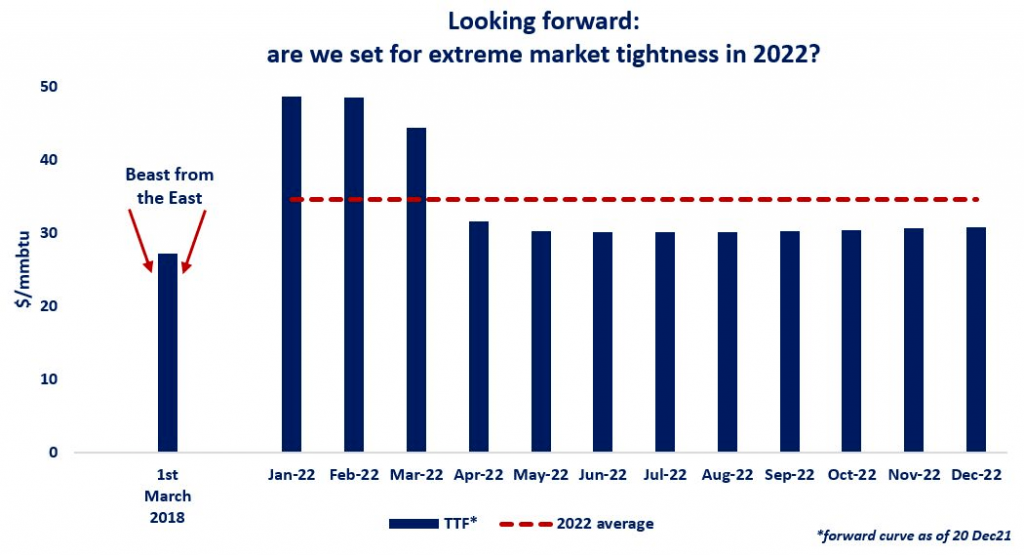

Looking forward: TTF set a new record at $48/mmbtu yesterday, but what about 2022?

If we look at the current forward curve, it suggests that gas prices will average well over $30/mmbtu in 2022. in comparison, Europe’s pre-2021 price record was $27/mmbtu during the Beast of the East episode, when a late cold spell caught by surprise northwest Europe back in March 2018.

Forward curves, as well as price forecasts should be taken with a pinch of salt (or two). forward curve movements are largely influenced by the spot and month-ahead contracts, which they carefully follow albeit at a lower degree of volatility.

But are we going to face extreme market tightness in 2022 as the forward curve suggests? a few points to consider:

(1) Europe’s net injection needs during the 2022 summer are likely to be 15-20 bcm above their 5y average, driving up import requirements;

(2) LNG liquefaction capacity additions will be just ~15 bcm in 2022 (vs 30 bcm/y LNG trade growth between 2015-19);

(3) Nuclear and coal phase-outs will reduce in the short-term of the flex of the European power system with gas increasingly called upon to fill in the thermal gap;

(4) Supplier’s behaviour, especially those with spare capacity and flex

options will remain the key uncertainty both for the European and the global market.

Of course, there could be bears in the bush: we could have a milder Q1 2021, higher hydro in the summer of 2022, economic growth could slow down and so on…

What is your view? how will 2022 play out? are we set for extreme market tightness?

Source: Greg MOLNAR (LinkedIn)