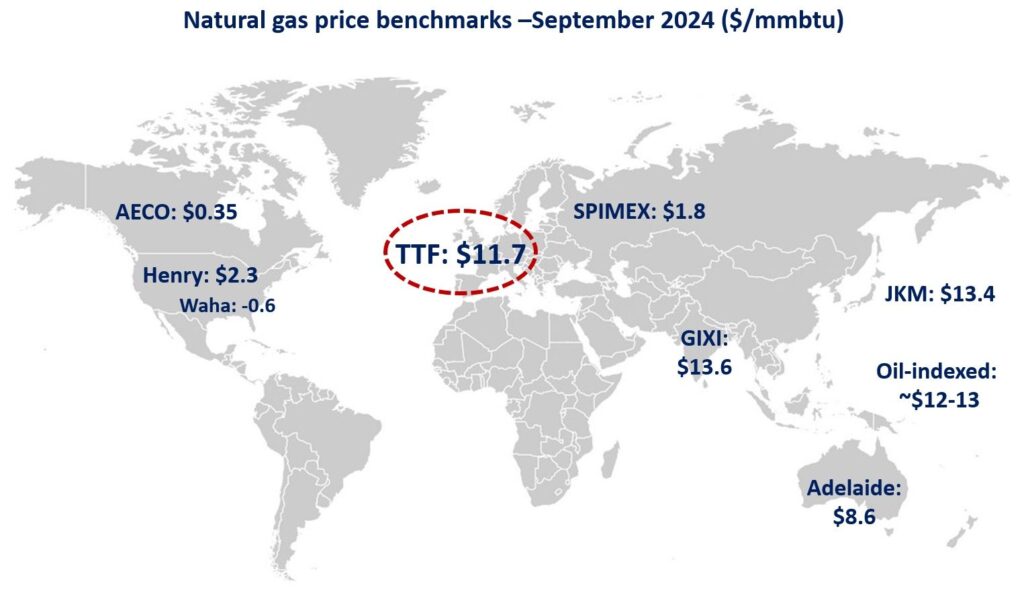

Gas prices displayed volatile patterns in September as we are nearing the heating season and players are optimising their short-term positions.

In Europe, TTF month-ahead prices moderated down compared to August and averaged at just over $11.5/mmbtu. high storage levels (near 95% fill levels) and relatively weak demand fundamentals put downward pressure on gas prices. geopolitics are set to remain the most important price driver in the coming months, with all eyes remain on the fate of the Ukrainian transit.

In Asia, JKM prices strengthened marginally compared to August to an average of $13.4/mmbtu. China’s strong LNG appetite (up by 25% yoy) continued to provide upward support to gas prices. hence, Asian spot prices now sit comfortably above oil-indexed LNG contracts. this could in turn incentivise buyers to use more the upside flexibility mechanisms embedded in long-term LNG contracts.

In the US, Henry Hub is finally showing some signs of recovery after a tough summer. the US benchmark rose by 13% compared to August to an average of $2.25/mmbtu. lower gas production, slower storage build-up and variable weather patterns provided some much needed support to Henry Hub prices. meanwhile in Texas, Waha remained in negative territory averaging at -$0.6/mmbtu.

Source: Greg Molnar (LinkedIn)