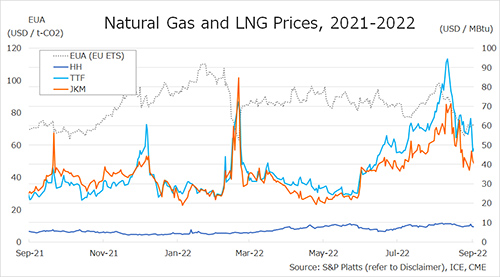

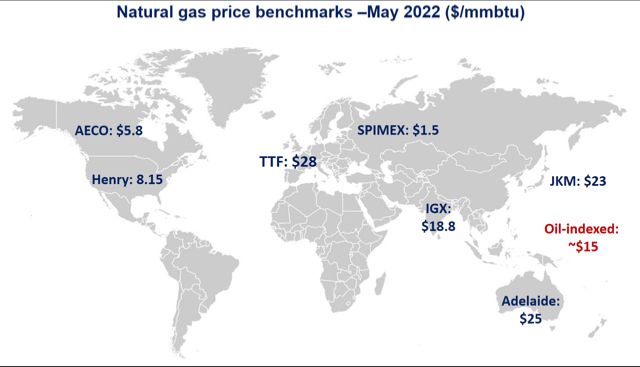

How much is the gas? Gas prices remain at historic highs in Europe, at pre-shale records in the US, and hit all-time highs in Australia.

In the US, Henry Hub prices average at $8.15/mmbtu, the second highest May prices since Henry Hub started to trade on Nymex.

Only in 2008 we had higher May prices. Demand was up by 3%, largely driven by gas-fired generation which surged by 11% yoy.

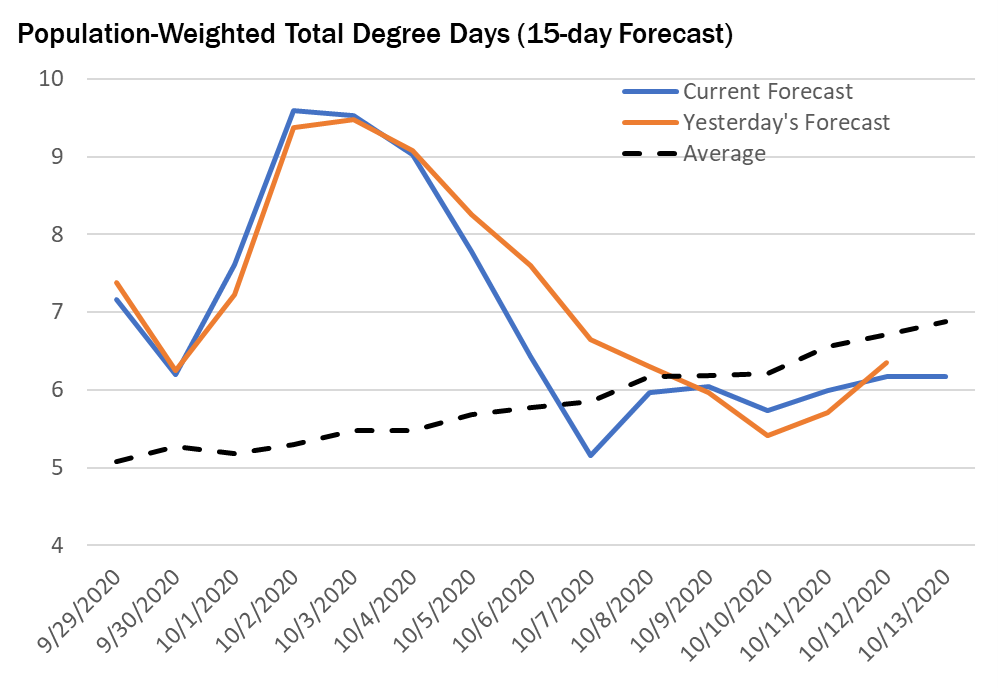

Strong cooling demand, together with high regional coal prices supported gas burn in the power sector.

Together with the strong growth in LNG exports, total US demand growth outpaced production increase (+3%) supporting high gas prices and further deteriorating the US gas storage deficit (now 9.5 bcm below 5y average).

In Europe, TTF prices fell 14% compared to April, averaging at $28/mmbtu. strong LNG inflow (up by 45%) together with plummeting demand (-18% yoy) provided some downward pressure on prices.

Meanwhile storage injections remained strong, with the EU’s storage deficit now standing just 3 bcm below its 5y average.

In Asia, JKM prices witnessed a more pronounced drop, falling by over 20% to $23/mmbtu. this reflects plummeting LNG imports to China (-27% yoy), driven by lockdowns and slower economic growth.

In Australia, cold wintry weather drove gas prices on the East Coast to record levels, averaging at $25/mmbtu in Adelaide. AEMO imposed temporary price caps at AUD 40/GJ.

What is your view? How will the summer gas market play out? What are the down and upside risks in the months ahead?

Source: Greg Molnar