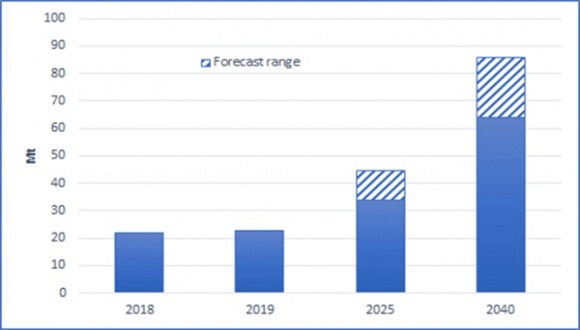

India aims to raise the share of natural gas in the energy mix from 6.5% currently to 15% in 2030. This would lead to a huge growth in LNG imports.

But India is one of the most sensitive price markets and needs infrastructure development for natural gas to fulfil its development potential.

COVID-19 has introduced an additional uncertainty to natural gas demand growth but the Indian gas market fundamentals remain robust.

The Indian Government is actively promoting natural gas to diversify its energy mix towards cleaner fuels, reduce oil dependency and tackle air pollution in big cities.

The aim is to move towards a gas-based economy and raise the share of natural gas in the energy mix to 15% by 2030 from around 6.5% now.

Over the past two years, there has been growing attention on rapidly building out gas infrastructure, including inter – and intra-state pipelines, LNG import terminals, city gas distribution networks to cover over 70% of the population, and CNG/LNG stations across the country.

Domestic and foreign investments in the natural sector are likely to amount to $60 billion over the next five years.

But the Indian gas market does not come without challenges. India is one of the most sensitive price markets and affordability of LNG supplies remains a key issue, triggering renegotiations of existing LNG contracts.

The changing global LNG market environment also pushes LNG buyers to seek better contract terms. Despite the rapid build out of LNG terminals in India over the past two years and a new wave of investments in LNG import capacity, one key restricting factor to increased LNG supplies is the lack of connectivity of the terminals with downstream buyers.

Source: Cedigaz

See full article by Cedigaz HERE.