The natural gas market is surging out of the gate yesterday morning while climbing demand pressures both spot and future prices higher early this week.

Weather forecasts continue to double-down on a burst of below-normal temperatures that will increase heating demand in the near-term, culminating with freezing temps and a winter storm in the Northeast by the middle of this week.

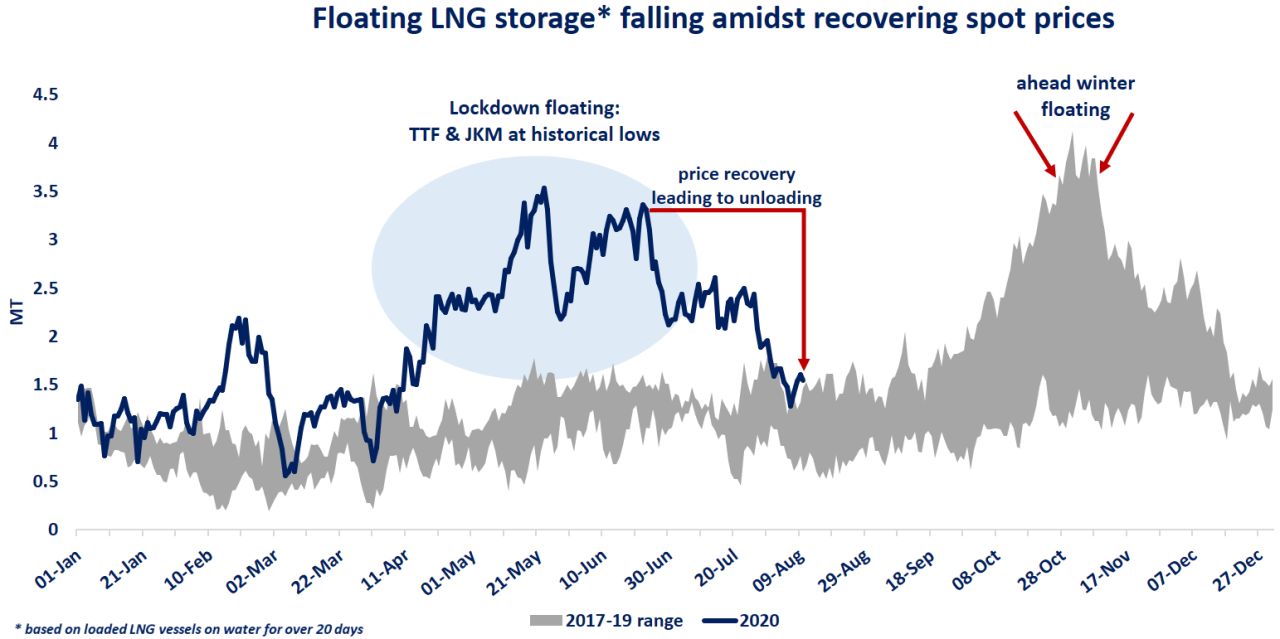

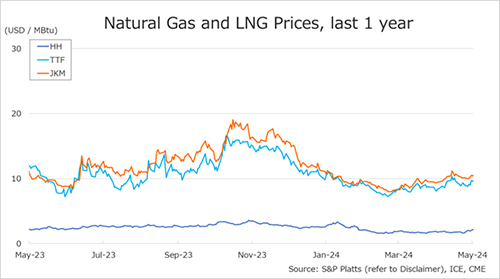

Beyond the current period, the market will still struggle to sustain stronger than normal demand but has gained a little support in 11-15 day forecasts today. On the fundamentals side, production is holding a seven-day average just below 90 Bcf/d while LNG terminals extend their run of impressive utilization rates, with feedgas demand averaging 11.5 Bcf/d over the past week.

Rig Count Rundown

According to data from Baker Hughes, the gas rig count jumped by four last week, regaining losses from the previous week and climbing to 79, its highest level since May. Meanwhile, twelve oil rigs were added across the country to bring the total rig count to 338, a 39% increase from the low back in August.

The Marcellus and Utica shale regions each added two gas rigs, while the Eagle Ford and Permian drove increases in the oil rig count. The pick-up in rigs over the last few months has been driven mostly by the oil/liquids side as WTI prices currently maintaining $46.50/bbl and Brent crude above $50 support additional drilling late this year.

Source: Gelber & Associates

Follow on Twitter:

[tfws username=”GelberCorp” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]