As G&A has discussed throughout the week, LNG demand has maintained record highs in recent days and will enter the weekend at a seven-day average of 11.3 Bcf/d. Much of the late-year push in US exports has been fueled by the return of international demand and increased prices.

While chilly weather has been conspicuously absent from much of the United States, markets in Europe and Asia have both experienced bouts of below normal temperatures which have sparked early seasonal demand higher.

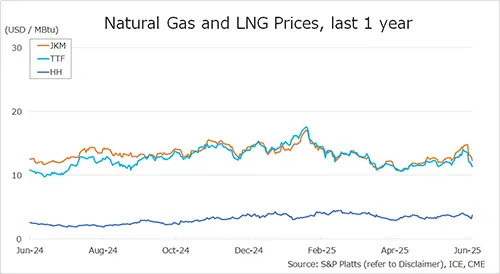

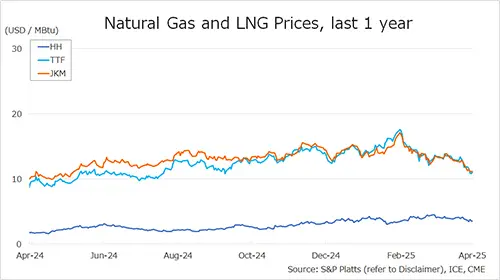

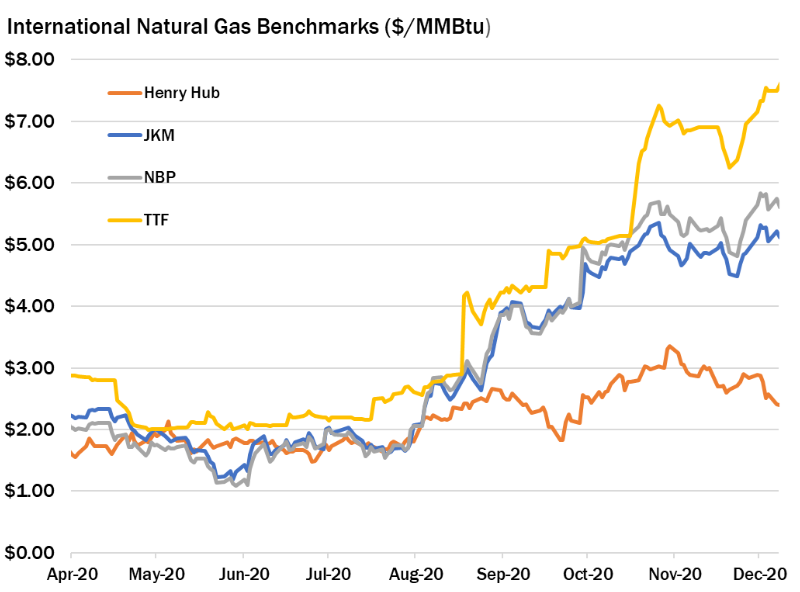

Important international price indicators, like the JKM (Japan-Korea Marker), TTF (Title Transfer Facility), and the NBP (National Balancing Point), have increased an average of $4.44/MMBtu since late June.

Most recently, JKM futures have registered nearly $8/MMBtu this week with reports of spot prices topping $9 in some markets (see the latest front month prices in the chart below).

Despite expectations of chillier conditions, South Korea has opted to begin seasonal coal plant shutdowns with Japan undergoing their own nuclear capacity shutdowns, increasing reliance on foreign gas in both markets.

Widening price spreads between Henry Hub and international benchmarks have been a shot in the arm for the US LNG industry and ensure continued export market tightness in coming months.

Source: Gelber & Associates

Follow on Twitter: [tfws username=”GelberCorp” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]