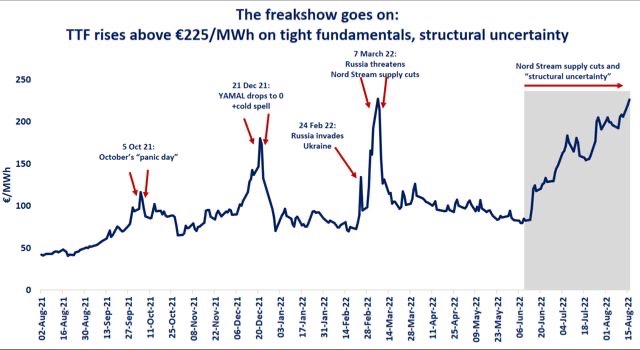

The freakshow goes on: TTF gas prices surged to above €225/MWh yesterday, close to their record levels of 7 March, when Russia threatened to cut en bloc Nord Stream flows.

The difference, is that the current price levels are not the result of a spike, or knee-jerk, but rather reflect a trend as Europe’s gas crisis deepens.

Four main factors are driving the price surge of the last few days:

1. Tight fundamentals: persisting low Russian supply; Troll maintenance in Norway; Transmed maintenance; heatwave driving up aircon demand, while weighing on hydro, nuclear and even coal-fired power output (due to Rhine levels);

2. Germany’s gas levy might prompted some midstreamers to move on the market and buy additional gas;

3. Rough is back: UK’s largest storage is set to return to service, potentially creating over 3 bcm of injection demand;

4. Low liquidity: high gas prices increases margining costs, which weighs on liquidity, which in turn drives up volatility and price swings.

Media reports on the potential extension of Germany’s remaining 6 GW nuclear capacity weighed on yesterday’s afternoon session.

The German government since then denied plans on the nuclear extension… another bull run for today?

What is your view? Are gas prices above €200/MWh here to stay?

Freakshow is a Britney song from her Blackout album… does not sound too promising!

Source: Greg Molnar (LinkedIn)