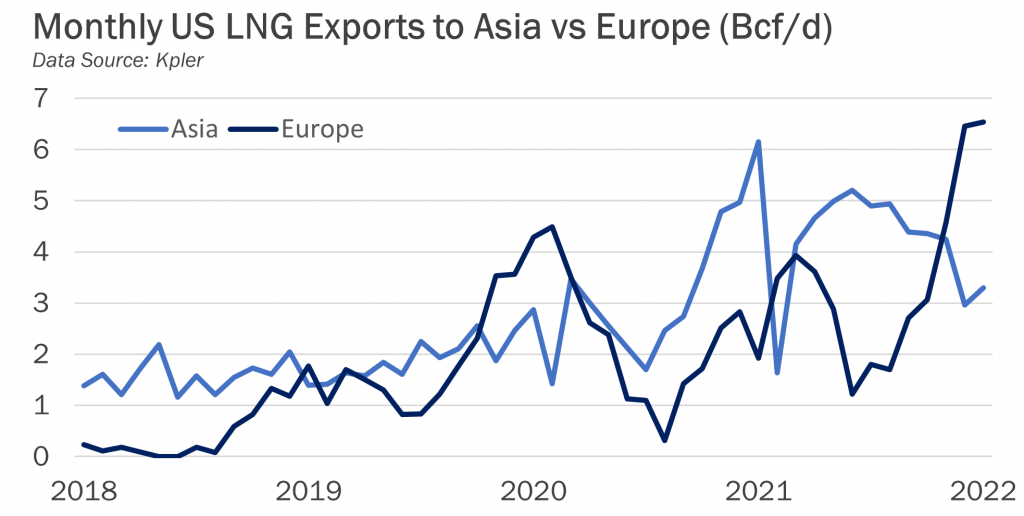

It is a well-known story that high European price premiums have been redirecting LNG exports from Asia to Europe – the data shown in the graph below does well to depict this short-term trend.

While, globally, the number of Asian LNG imports still surpasses that of Europe by a wide margin (as Asia is a larger LNG-dependent demand zone), focusing on one country like the U.S., which is geographically located in a way that it can supply both Europe and Asia, indirectly reveals the higher price European arbitrage opportunity.

Nearly 6.5 Bcf/D of gas is heading towards European ports from the US, nearly 3 Bcf/d above that to Asia.

This widespread is mirrored in real-time shipping statistics, which indicate that at the moment, nearly 32 ships are in transit between U.S. and European destinations while only 19 U.S. LNG ships have Asia marked as their final destination.

International market dynamics continue to favor Europe over Asia, and with the threat of war looming over Eastern Europe, Europe will continue to depend upon LNG to hold storage declines in the withdrawal season as Russian pipeline gas becomes more of a not only unreliable source, but also an unfavorable one.

Source: Gelber and Associates