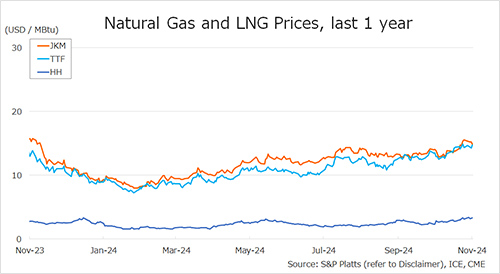

The Northeast Asian assessed spot LNG price JKM (January delivery) for last week (25 – 29 November) fell to high-USD 14s on 29 November from mid-USD 15s the previous weekend (22 November).

JKM rose significantly last week, but this week continued sluggish demand and high inventory led to a downward trend throughout the week. METI announced on 27 November that Japan’s LNG inventories for power generation as of 24 November stood at 2.06 million tonnes, down 0.22 million tonnes from the previous week.

The European gas price TTF for last week (25 – 29 November) rose to USD 14.8/MBtu (January delivery) on 29 November from USD 14.4/MBtu the previous weekend (December delivery, 22 November). The delivery month changed to January on 28 November.

TTF rose to USD 14.7/Mbtu on 25 November in response to forecasts of cooler temperatures, but then fell to USD 14.3/MBtu on 28 November due to strong fundamentals, including forecasts of warmer weather and stable gas supplies from the Norwegian continental shelf.

However, it rose to USD 14.8/MBtu on 29 November after the EC raised its target for the EU-wide underground gas storage across Europe. According to AGSI+, the EU-wide underground gas storage was 85.8% on 29 November, down from 88.3% at the end of the previous weekend.

The U.S. gas price HH for last week (25 – 29 November) rose to USD 3.4/MBtu on 29 November (January delivery) from USD 3.1/MBtu the previous weekend (December delivery, 22 November). The delivery month changed to January on 28 November.

The EIA Weekly Natural Gas Storage Report released on 27 November showed U.S. natural gas inventories as of 22 November at 3,967 Bcf, down 2 Bcf from the previous week, up 3.5% from the same period last year, and 7.2% increase over the five-year average.

Updated: December 2

Source: JOGMEC