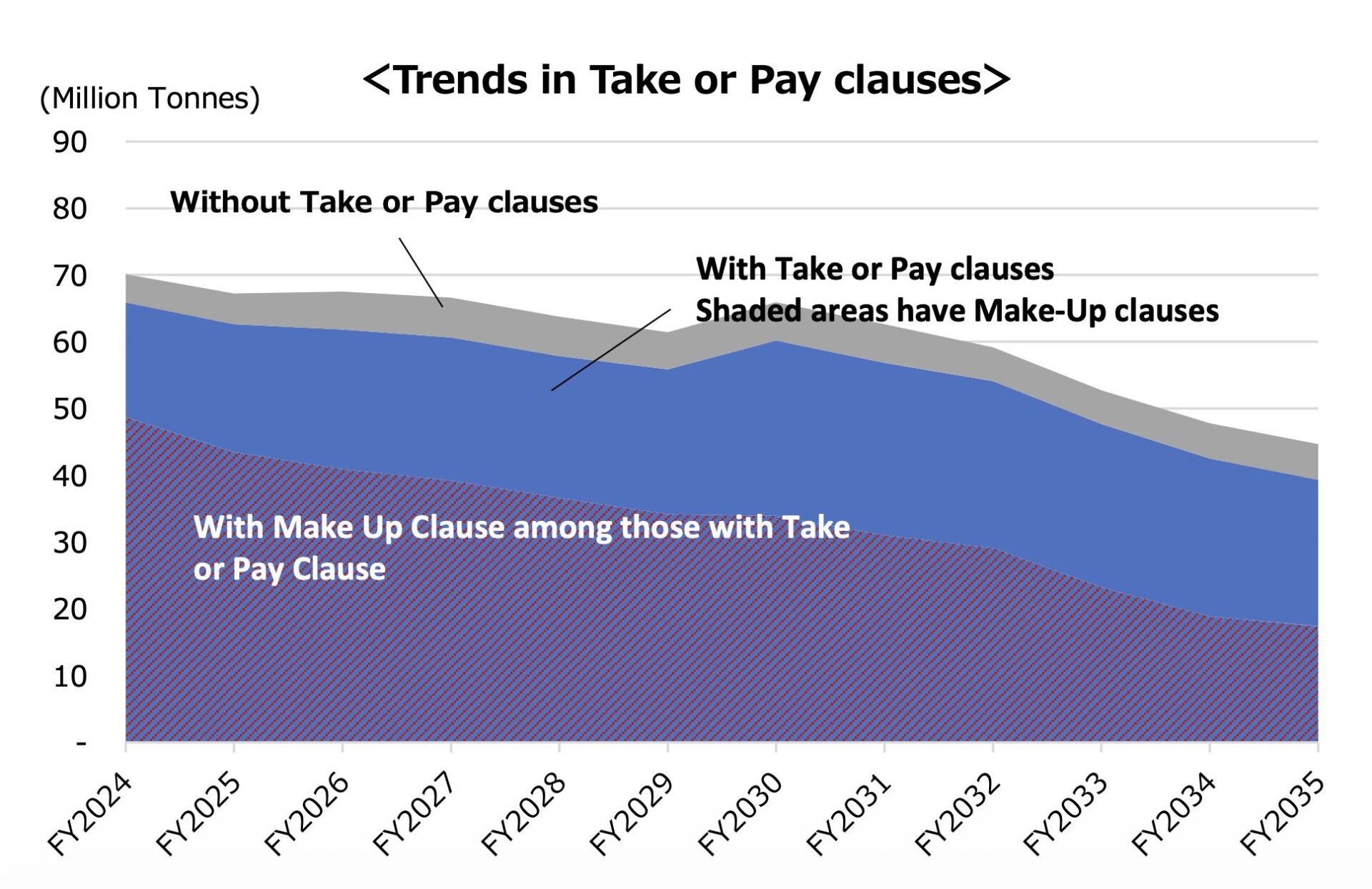

Destination clauses ease in Japanese LNG contracts

LNG destination clauses in Japanese LNG contracts are gradually declining as buyers seek greater flexibility in long term LNG sales and purchase agreements. LNG destination clauses still apply to about 40% of contracted LNG volumes in FY2024, compared with around 75% in 2016, but are expected to decline to roughly 30% by FY2035. The survey also highlights a shift in […]