Premium LNG intelligence for market professionals

Curated reports, white papers, studies, and presentations from leading LNG commentators, research organisations, and industry experts.

Full access is available to premium subscribers.

Start with a FREE 30-day trial — cancel anytime.

Get instant access to our premium library of 1,700+ LNG reports, white papers, and slide decks, with new content added every week.

Subscribers use Global LNG Hub to stay informed, benchmark market views, and save hours of research time by having trusted material in one place.

Already a subscriber ? Log in

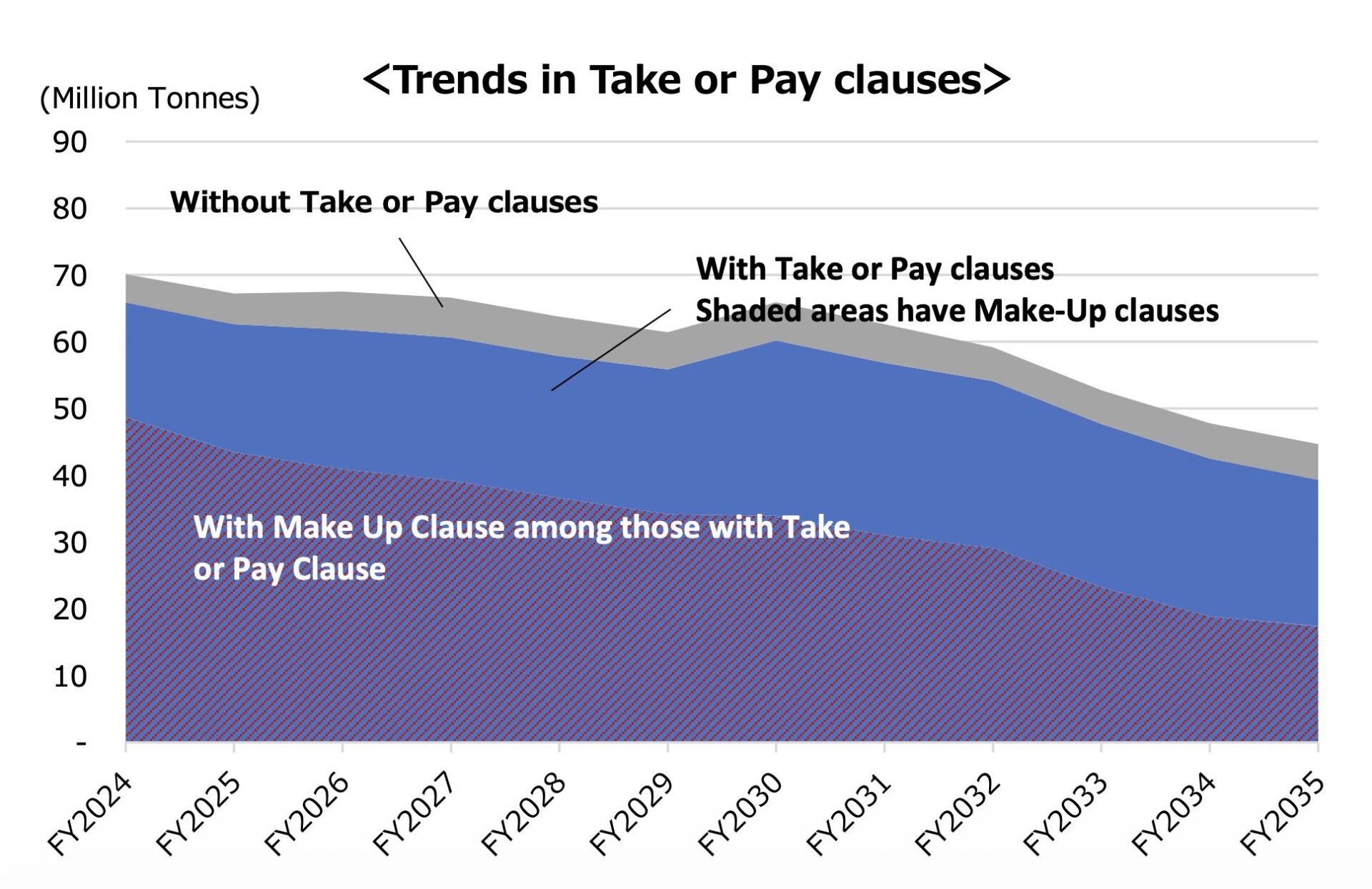

LNG destination clauses in Japanese LNG contracts are gradually declining as buyers seek greater flexibility in long term LNG sales and purchase agreements. LNG destination clauses still apply to about 40% of contracted LNG volumes in FY2024, compared with around 75% in 2016, but are expected to decline to roughly 30% by FY2035. The survey also highlights a shift in […]

FREE TRIAL

Already a subscriber ? Log in

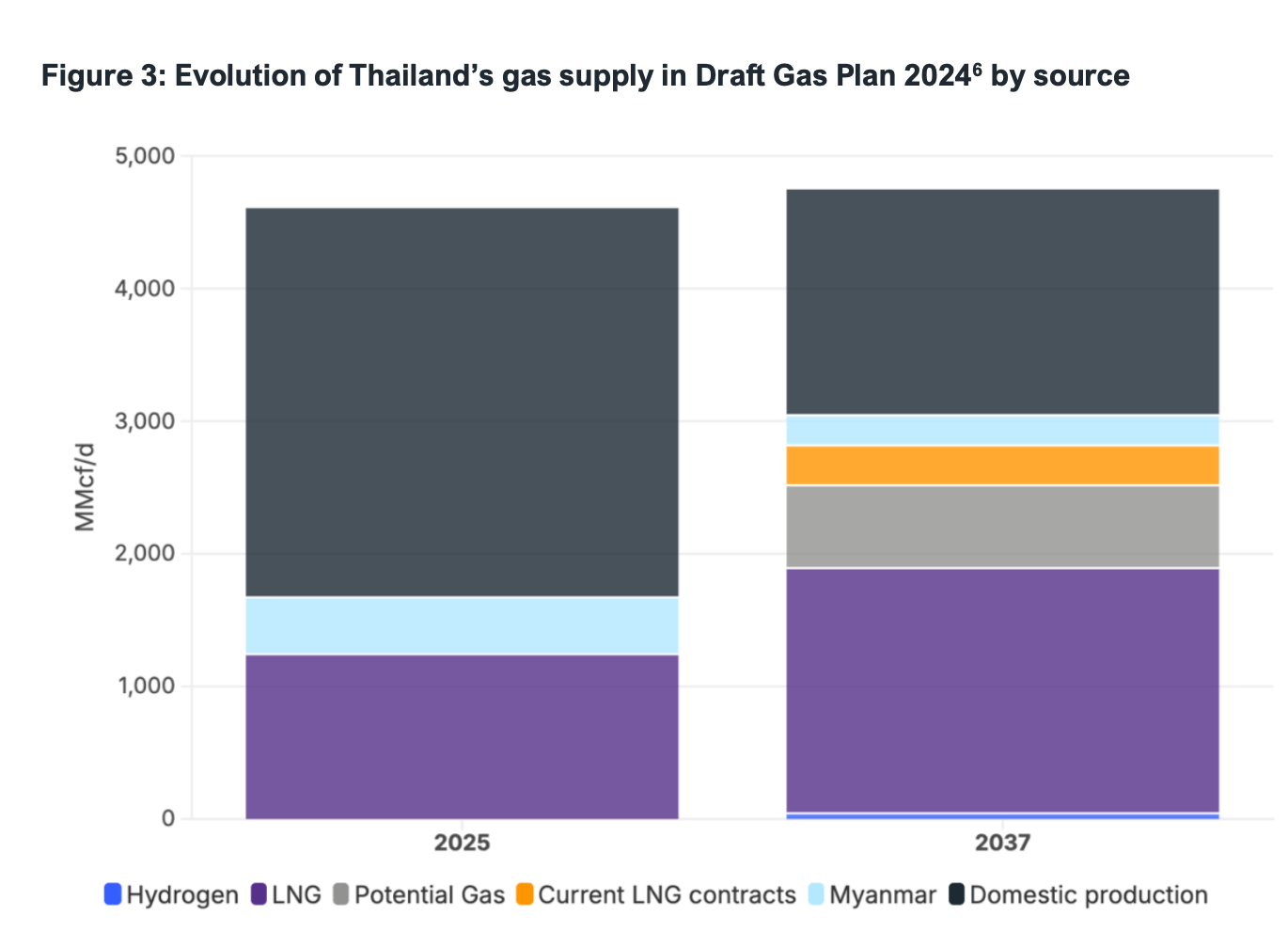

Thailand LNG imports could grow significantly over the coming decade as domestic gas production declines and the country becomes increasingly reliant on imported LNG to meet energy demand. Thailand LNG imports could grow by 73% by 2037 under current energy planning scenarios as declining domestic gas production and uncertain pipeline supplies reshape the country’s energy mix. LNG is expected to […]

FREE TRIAL

Already a subscriber ? Log in

The global energy market faces heightened volatility following large-scale military strikes on Iran and the risk of further escalation across the Middle East. The report examines how disruptions to regional energy infrastructure and shipping routes could destabilise the global energy market. The latest analysis from the Institute of Energy Economics Japan examines the growing risks facing the global energy market […]

FREE TRIAL

Already a subscriber ? Log in

The global LNG market saw continued expansion in infrastructure, supply agreements and export capacity developments across Asia, North America and the Middle East during February 2026. Across the global LNG market, several infrastructure and supply developments took place during February 2026. In Asia, LNG-to-power projects and receiving terminals progressed in countries including Vietnam, India and Cambodia, while China’s gas production […]

FREE TRIAL

Already a subscriber ? Log in

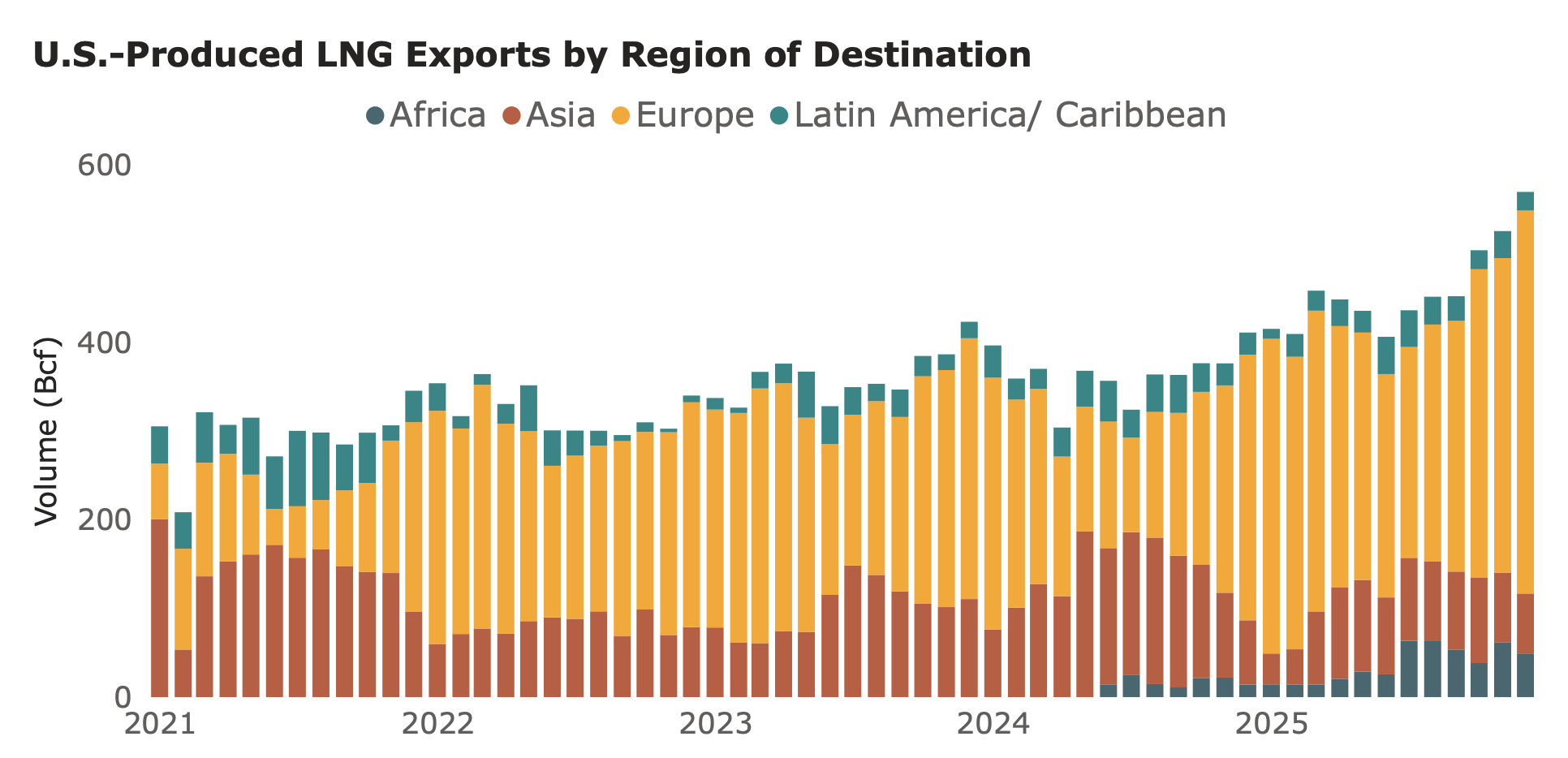

US LNG exports rose to 569 Bcf in December 2025, with Europe absorbing the majority of cargoes as the United States strengthened its position as a key supplier to global LNG markets. US LNG exports reached 569.3 Bcf in December 2025, representing around 64% of total US natural gas exports and marking an increase compared with the previous month. Europe […]

FREE TRIAL

Already a subscriber ? Log in

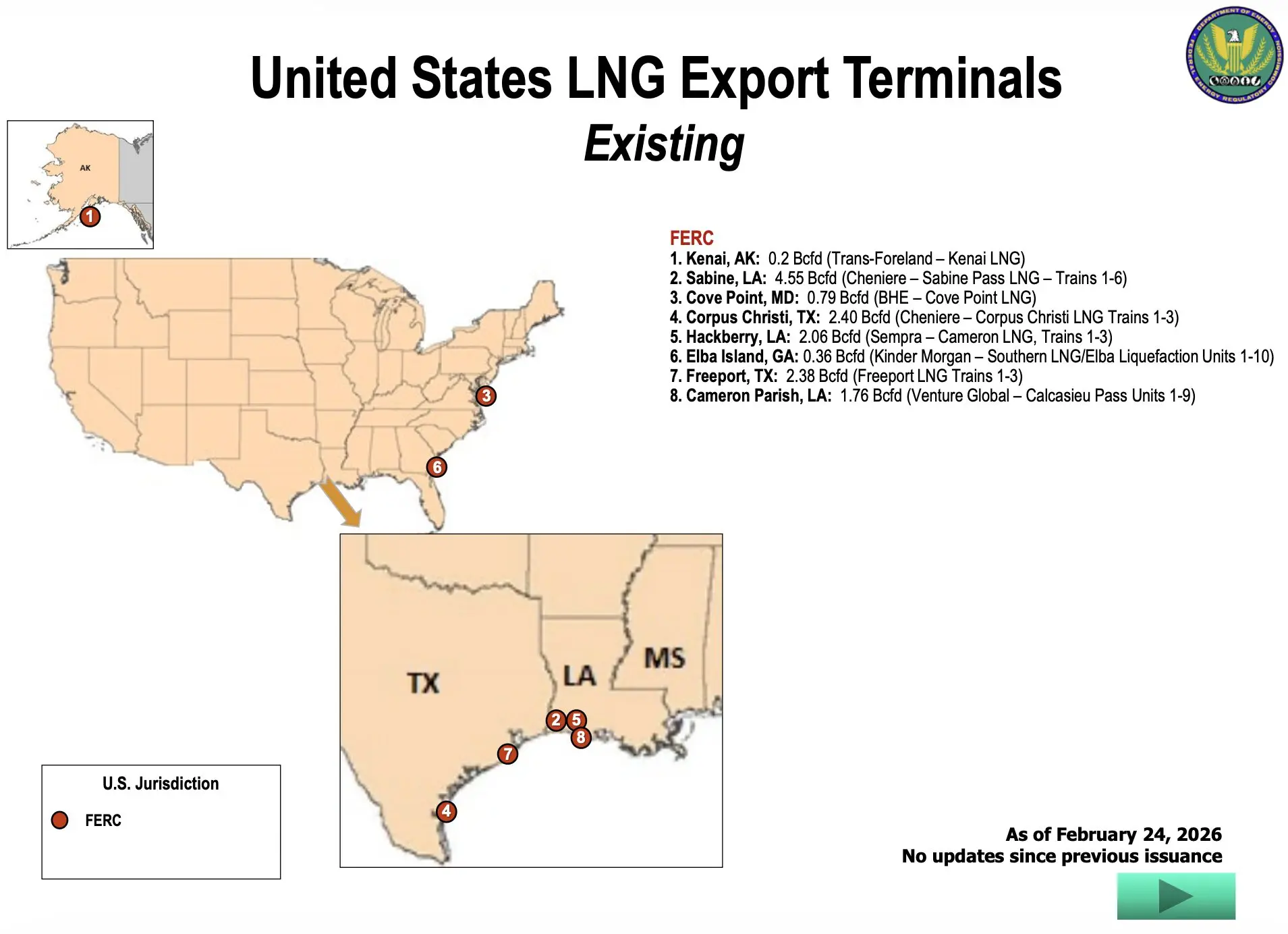

US LNG export terminals maps show existing, under-construction and proposed capacity across the U.S. Gulf Coast and Alaska, highlighting the scale of future LNG supply growth. These maps of United States LNG export terminals provide a comprehensive overview of existing facilities, projects under construction and proposed developments across the country. The visual breakdown highlights the concentration of capacity along the […]

FREE TRIAL

Already a subscriber ? Log in

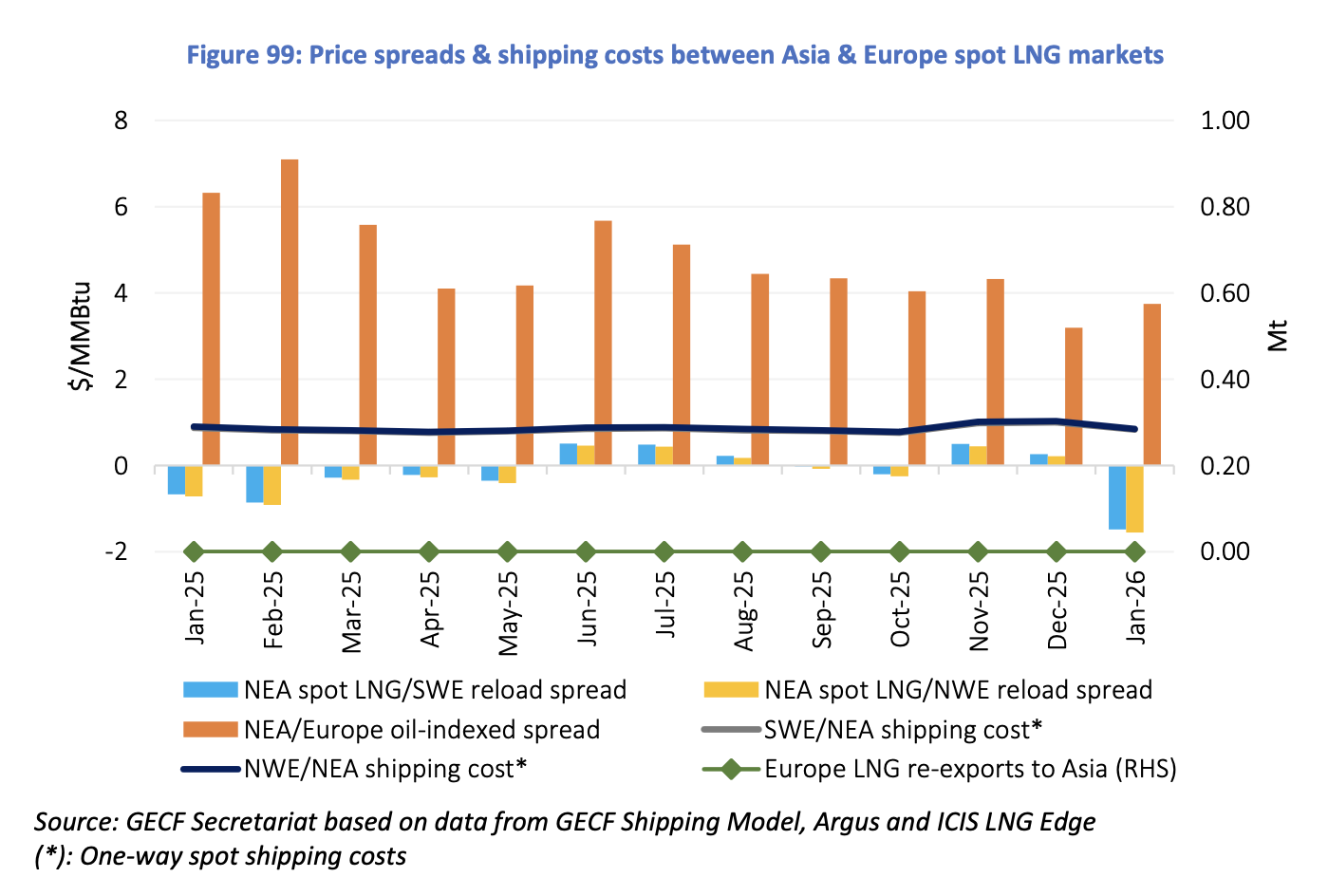

The global gas market tightened sharply in January 2026 as extreme winter conditions drove a surge in LNG demand and intensified competition between importing regions. Record LNG imports at the start of 2026 highlight a market increasingly driven by weather shocks and shifting regional demand. Strong heating needs across the Northern Hemisphere pulled cargoes toward Asia, which posted the largest […]

FREE TRIAL

Already a subscriber ? Log in

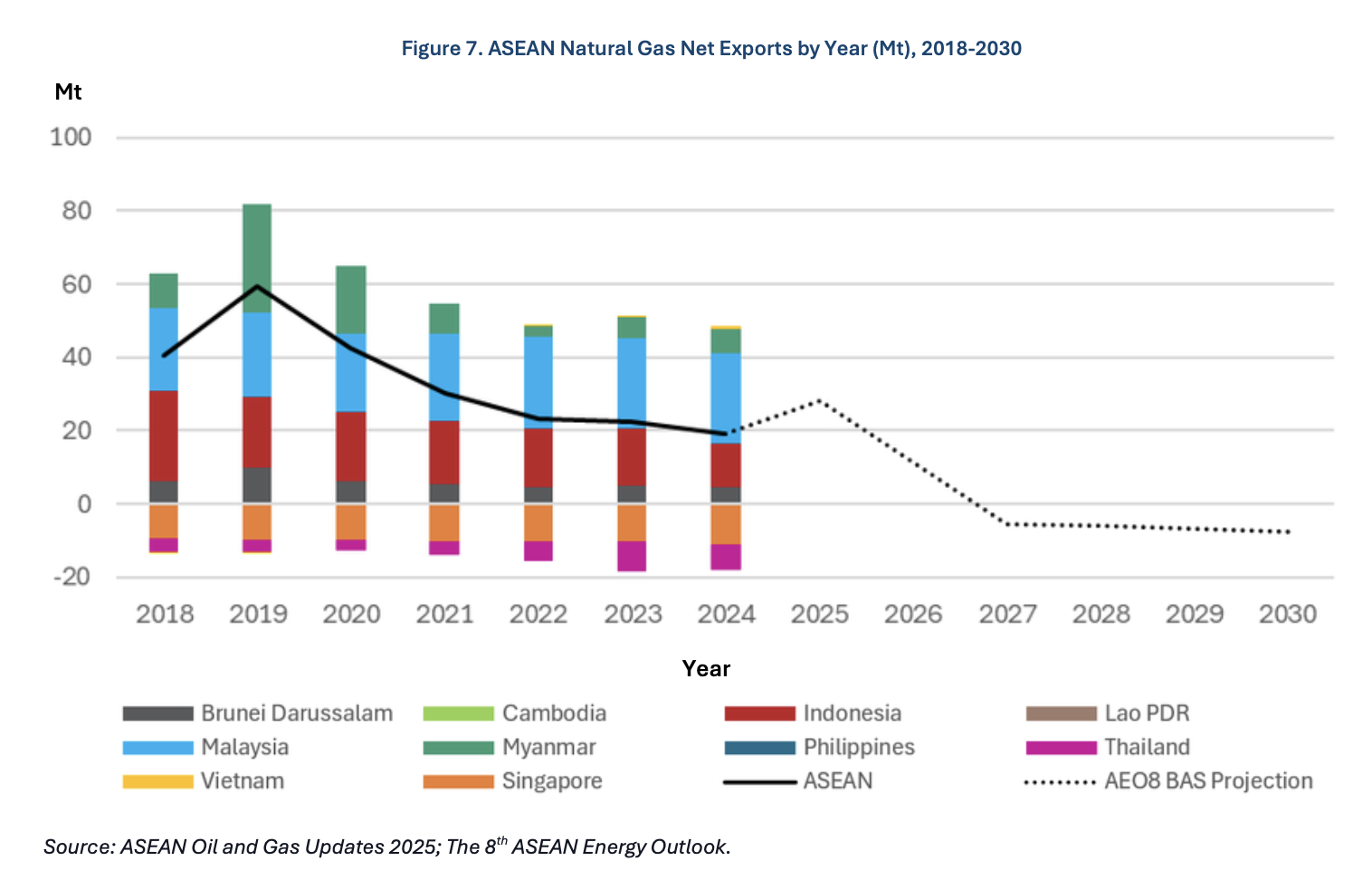

Southeast Asia LNG demand is set to grow strongly as declining domestic production, ageing gas fields and limited new discoveries tighten regional supply while energy consumption continues to rise. The shift is pushing the region toward structural import dependence, increasing its exposure to global LNG price volatility and intensifying competition with other Asian buyers for available cargoes. Southeast Asia is […]

FREE TRIAL

Already a subscriber ? Log in

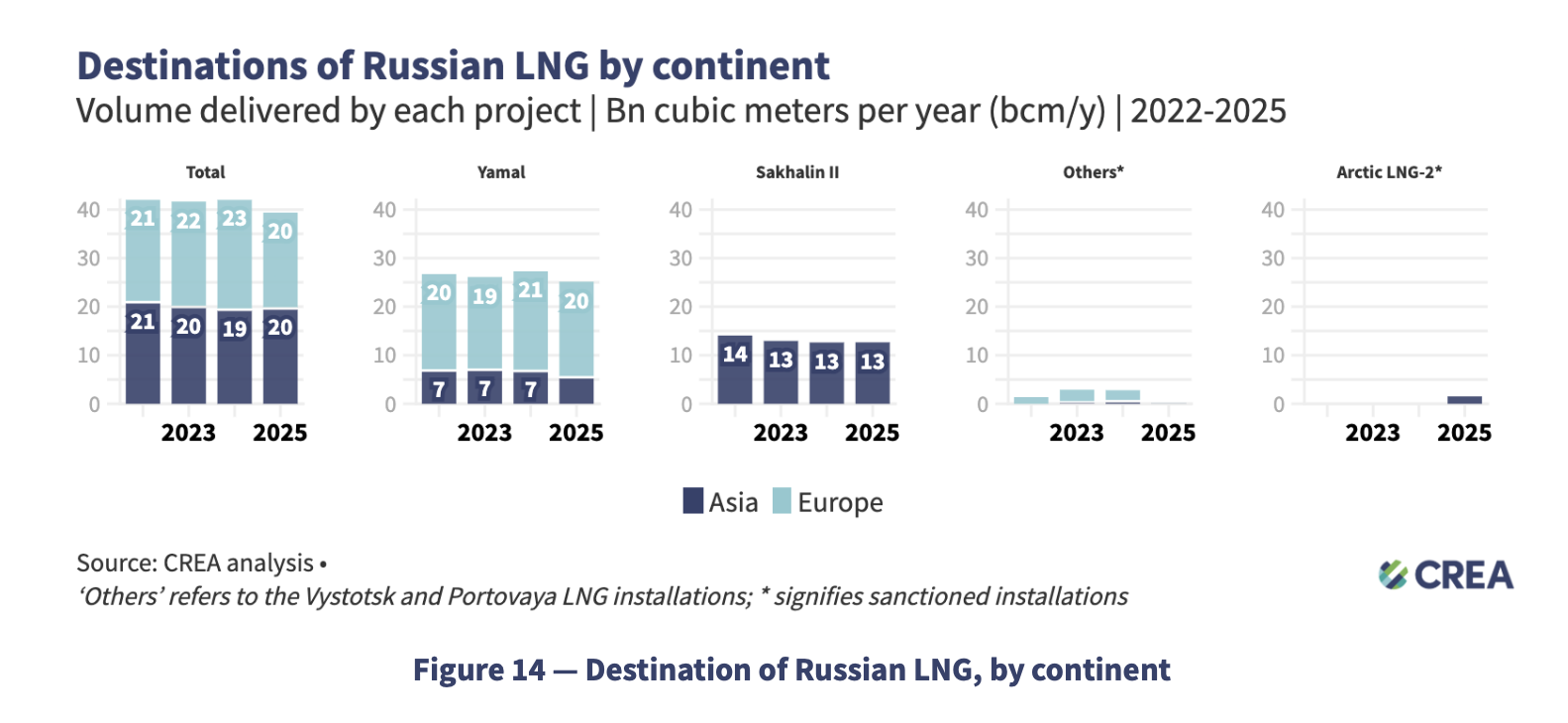

Russian LNG exports continue to rely heavily on European buyers even as pipeline flows decline and geopolitical tensions push Moscow to seek alternative markets. Structural constraints on shipping, infrastructure and new capacity limit Russia’s ability to redirect volumes quickly toward Asia, leaving Europe central to its LNG trade in the near term. A broader analysis of Russian fossil fuel trade […]

FREE TRIAL

Already a subscriber ? Log in