Global LNG liquefaction capacity is expected to increase by a staggering 300 bcm/y by 2030, based on projects which reached FID or are under construction.

This is by far the largest LNG wave in history, equating to just over half of current LNG trade and to around 90% of the EU’s annual gas demand.

Despite all the uncertainties, already this year more than 50 bcm/y of new LNG liquefaction capacity reached FID or started construction, including the CP2 project, Louisiana LNG and Corpus Christi T8&9, which reached FID just yesterday.

And most recently, TotalEnergies confirmed that Mozambique LNG could start operations in 2029.

The single most important question now, how strong will be the demand response?

To make out the most of the next LNG wave, producers will need to adopt a more proactive approach:

(1) scale-up trading operations: while long-term contracts remain the basis of the LNG industry, trading desks will grow in importance by catching short-term profit-making opportunities and bringing more flexibility to the market;

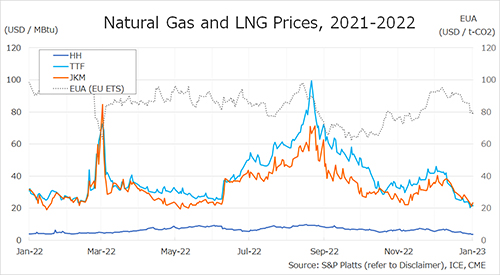

(2) market-based pricing: LNG will need to fiercely compete with alternative fuels in the coming years, making necessary that it reflects market-based prices. Hub-indexed LTCs, together with price corridors, can reduce price volatility while guarantee competitive prices;

(3) downstream engagement: producers could increase their direct engagement with end-users by booking regas/pipeline capacity and engage in downstream marketing. This could be particularly important in new, emerging markets which are still developing their downstream gas infrastructure.

The next LNG wave will be transformative for the global gas market and will bring in an even more exciting and more liquid trading environment.

And while 300 bcm is immense, it still accounts for less than 10% of Asia’s thermal coal demand, so in a way a drop in the ocean…

What is your view? How will the next LNG wave change the global gas market? How strong will be the demand response? How should producers adapt their strategies?

Source: Greg Molnar