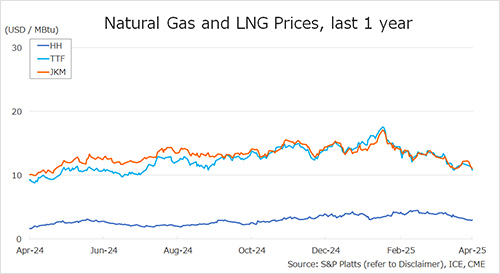

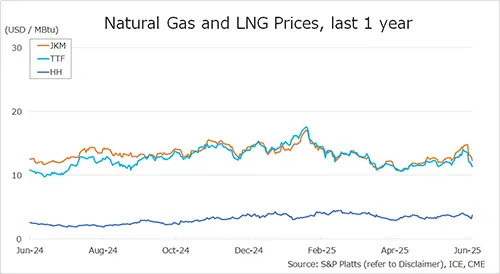

The Northeast Asian assessed spot LNG price JKM (August delivery) for last week (23 June – 27 June) fell to mid-USD 12s/MBtu on 27 June from high-USD 14s/MBtu the previous weekend (20 June).

JKM rose to high-USD 14s/MBtu on 23 June due to tensions in the Middle East, but subsequently continued to fall to mid-USD 12s/MBtu as geopolitical tensions subsided with the announcement of an Israeli-Iranian ceasefire, and demand in Asia remained sluggish. METI announced on 25 June that Japan’s LNG inventories for power generation as of 22 June stood at 2.25 million tonnes, up 0.11 million tonnes from the previous week.

The European gas price TTF (July delivery) for last week (23 June – 27 June) fell to USD 11.3/MBtu on 27 June from USD 13.8/MBtu the previous weekend (20 June). TTF fell throughout the week due to easing geopolitical tensions in the Middle East, increased supply from Norway and warm weather information, and was more than USD 2/MBtu lower than the previous weekend.

According to AGSI+, the EU-wide underground gas storage was 57.8% on 27 June, up from the previous weekend, down 24.5% from the same period last year, and down 13.7% over the five-year average.

The U.S. gas price HH for last week (23 June – 27 June) fell to USD 3.7/Mbtu (August delivery) on 27 June from USD 3.9/MBtu the previous weekend (20 June, July delivery). HH switched to the August delivery on 27 June. HH fell to USD 3.2/MBtu by 26 June due to easing geopolitical tensions in the Middle East, but rose to USD 3.7/MBtu on 27 June on a rebound from the continued decline and increased demand due to a heat wave in the eastern U.S.

The EIA Weekly Natural Gas Storage Report released on 26 June showed U.S. natural gas inventories as of 20 June at 2,898 Bcf, up 96 Bcf from the previous week, down 6.3% from the same period last year, and 6.6% above the five-year average.

Updated: June 30

Source: JOGMEC