LNG markets are showing signs of life on both the supply and demand side of the balance.

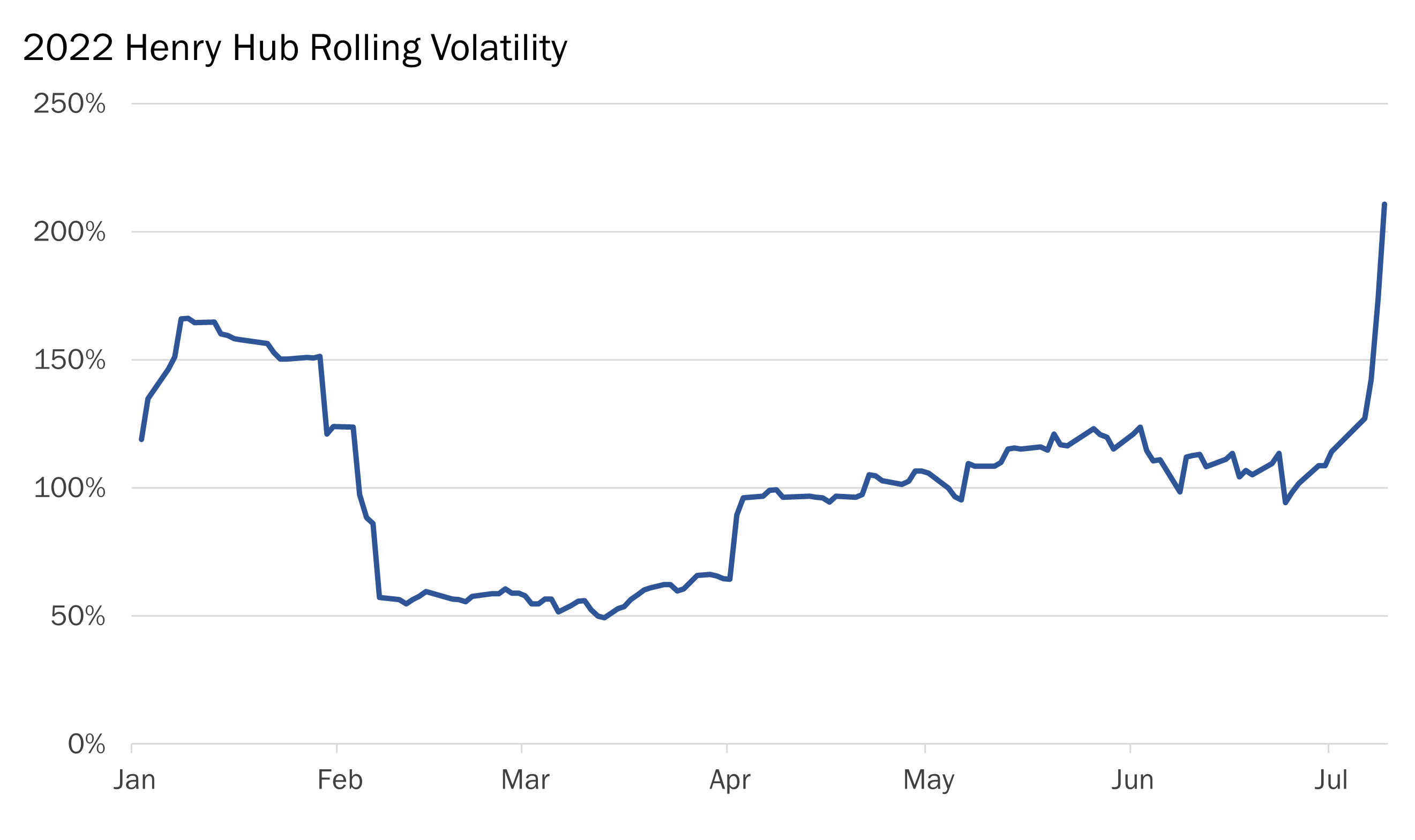

Gas prices in the US have been elevated in recent months, flirting with $3/MMBTU on a monthly basis at Henry Hub for the first time since March 2019. One factor propping up gas prices in the US has been increased demand from LNG facilities for exports, both in the form of new startups and increased utilization at existing plants.

United States LNG exports (mt)

As recently as 2019, US LNG exports made up just 10 percent of global trade. So far this year the US represents 17.5 percent of global exports, just 3 percentage points behind Australia for the top source of LNG globally.

These LNG export facilities have been able to run harder thanks to favorable export economics due to elevated delivered prices in Asia. Since the beginning of March delivered LNG prices in Asia are up an astounding 82 percent and currently sit near $10/MMBTU. With the temporary exception of the price rally this January, LNG prices in Asia have not been at current levels since November 2018.

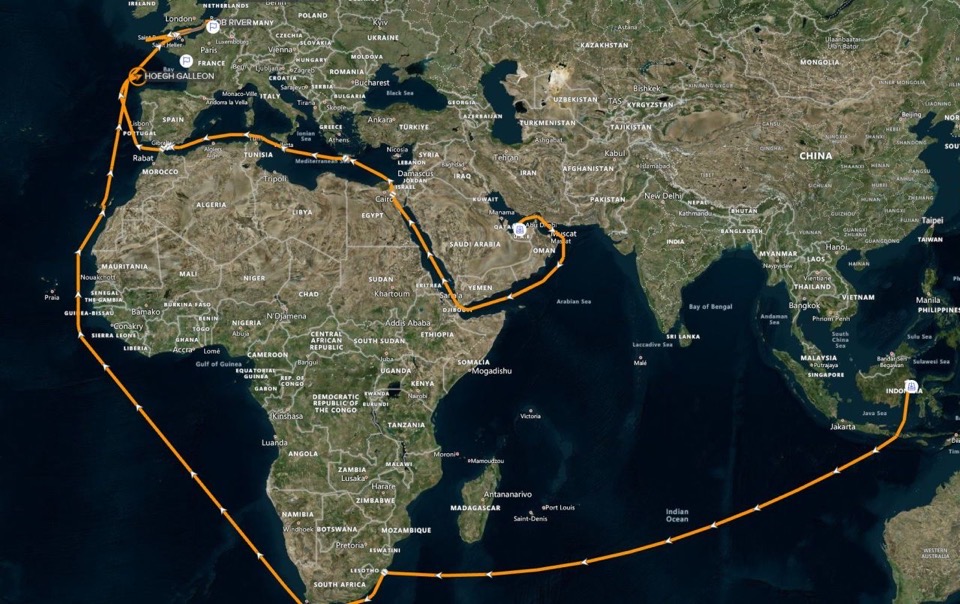

On the demand side of the market, Asia is not the only bright spot in LNG. Deliveries of LNG to Europe have also surged in the last two months, with March and April LNG imports returning to pre-Corona highs. These elevated deliveries are arriving into still seasonally low storage, so there is good room for continued flows in the coming months.

European LNG arrivals (mt)

Solid supply and demand-side activity as reflected in seaborne LNG flows, as well as healthy price dynamics may well serve as testimony to an overall recovering world economy, in spite of Corona-related setbacks here and there.

Source: VORTEXA

Check out the VORTEXA website