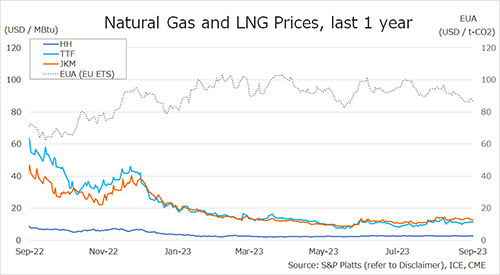

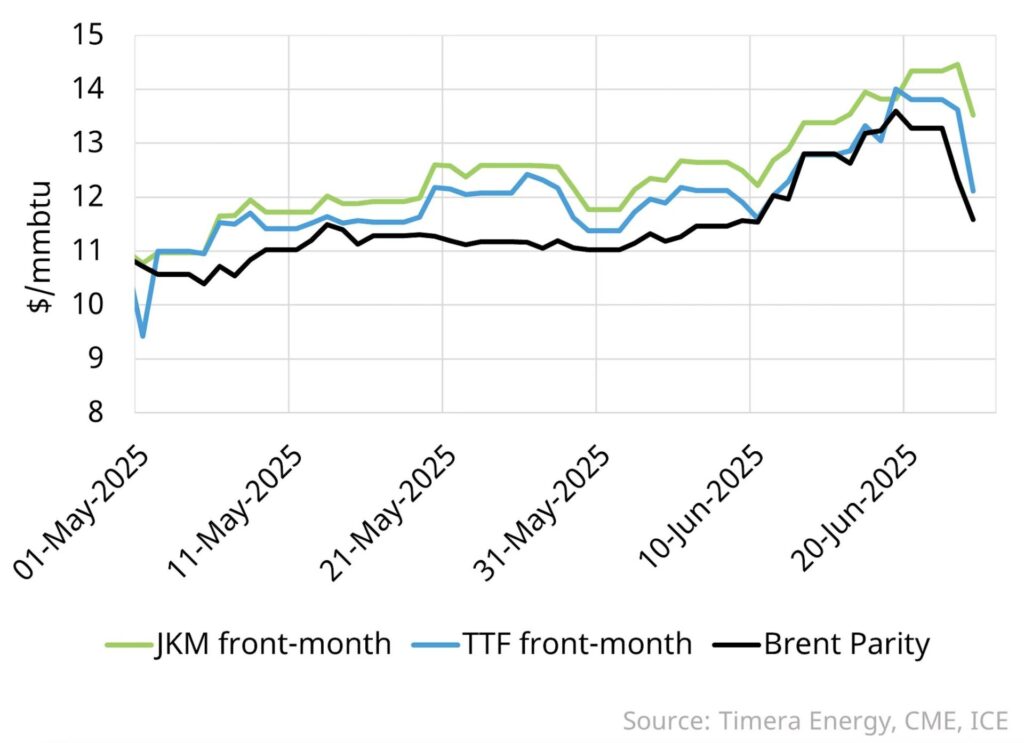

In June, global gas markets experienced heightened volatility, driven by escalating tensions in the Middle East.

TTF and JKM front-month futures surged by a peak of 23% and 22% respectively since the start of June, fuelled by concerns over potential disruptions to exports through the Strait of Hormuz – a critical chokepoint for Qatari LNG & Gulf states oil exports.

Additional upward pressure came from the loss of Israeli pied gas deliveries to Egypt.

Prompt Brent prices have been particularly volatile, climbing from approximately 64 $/bbl on the 10th June to a peak of near 80 $/bbl.

Despite markets pricing in a geopolitical risk premium, no actual disruptions to flows through the Strait of Hormuz have occurred.

As signs of de-escalation emerged, the risk premium in gas & oil prices unwound rapidly.

Nonetheless, the price movements over the last few weeks has evidenced the potential upside risk to global gas prices from supply-side disruptions in the current regime where supply is inelastic at the margin.

Source: Timera Energy