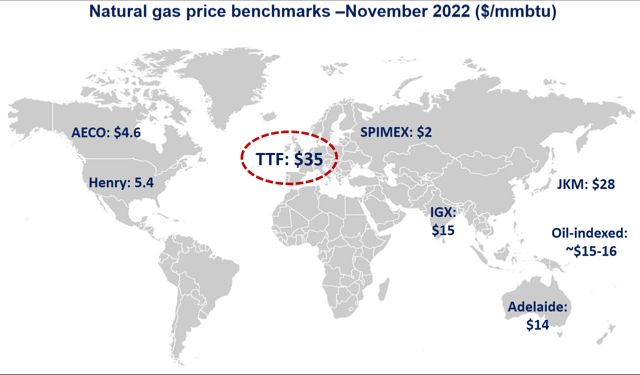

The Middle East crisis fuelled strong price volatility across Asia and European markets through June.

The fear premium drove-up TTF and JKM prices to a four-month high, before rapidly fading away.

In Europe, TTF prices rose by 14% yoy to an average of $12.4/mmbtu – their highest monthly level since January.

At the height of the Israel-Iran conflict, TTF surged to near $14/mmbtu, fuelled by fear that the crisis could escalate further and disrupt LNG flows via Hormuz.

Prices collapsed by 20% since the ceasefire and returned close to pre-crisis levels at just above $11/mmbtu.

This being said, lower Russia and Norwegian pipeline supplies together with stronger storage injections are keeping the market tight. and Europe’s LNG thirst is growing, with imports up by 40% yoy.

In Asia, JKM prices followed a similar pattern, rising by 6% to an average of $13/mmbtu, primarily supported by the Middle East crisis.

Demand remains weak, with both China (-6% yoy) and India (-16%) recording steep drops in their LNG imports.

In the US, Henry Hub prices were up by near 20% yoy to an average of $3/mmbtu.

Stronger storage injections together with higher exports are supporting prices at a balanced level -a well-needed recovery compared to the historically low prices of last year.

Domestic production remained strong, up by 4% yoy and staying close to record levels.

What is your view? How will gas prices evolve through the remainder of the summer? Are we up for more volatility?

Source: Greg MOLNAR