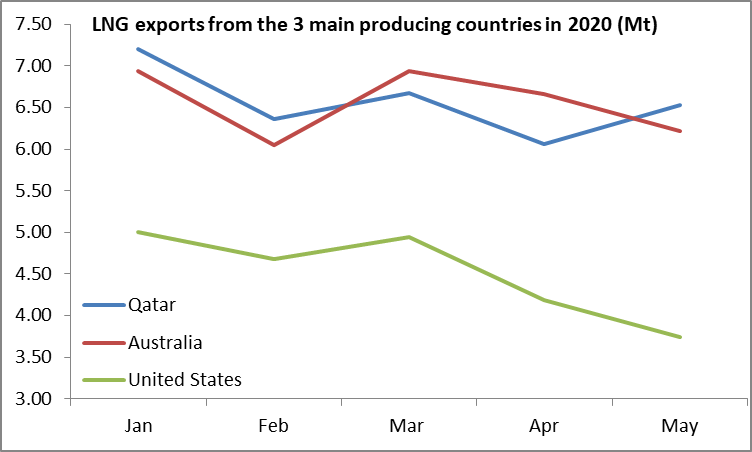

Australian LNG exports slipped again in 2025, with year-to-date shipments down 2.8% compared with the same period last year, according to LSEG seaborne LNG data. The slowdown leaves Australia further behind the US and Qatar, which have expanded output and strengthened their positions in the global LNG market.

Global LNG trade grew 5.2% y/y in the first ten months of 2025, but Australian LNG volumes fell to 65.8 Mt, down from 67.7 Mt last year — highlighting Australia’s continuing supply stagnation.

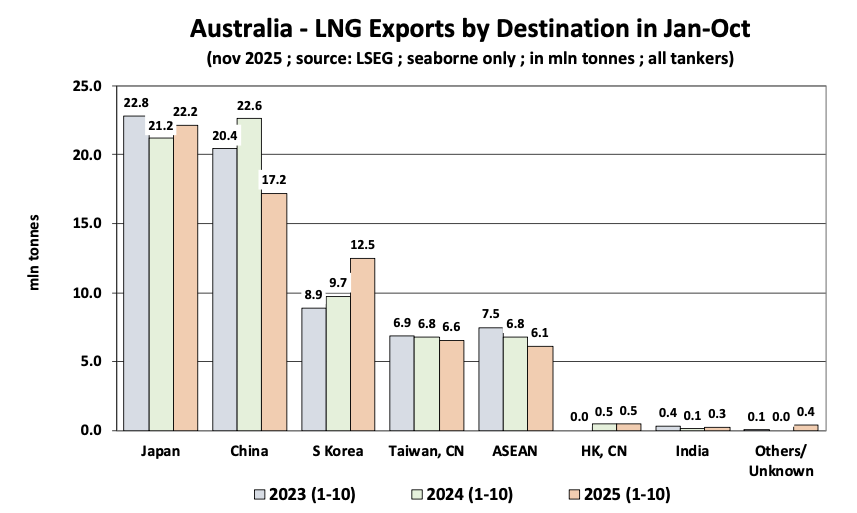

A clear shift in Asian demand is emerging:

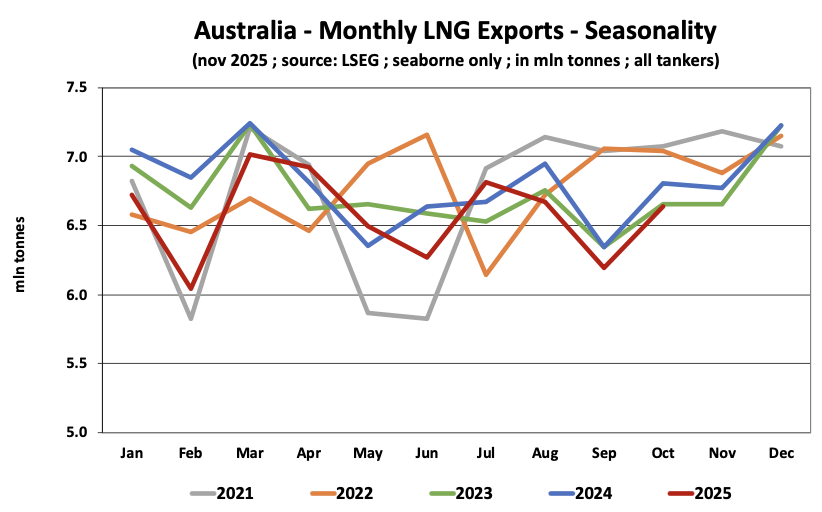

Monthly seasonality also shows Australian LNG output locked in a narrow range around 6.2–7.2 Mt/month, with little structural growth despite robust Asian demand.

With US LNG capacity surging, Qatar expanding long-term supply, and China reducing Australian purchases, Australian LNG risks losing further global market share in 2026 unless new investment or upstream improvements materialise.

KEY TAKEAWAY:

Australian LNG remains a vital supplier to Japan and Korea, but declining Chinese demand and intensifying global competition are weighing on Australia’s position in the LNG market.

Source: Bancosta Research