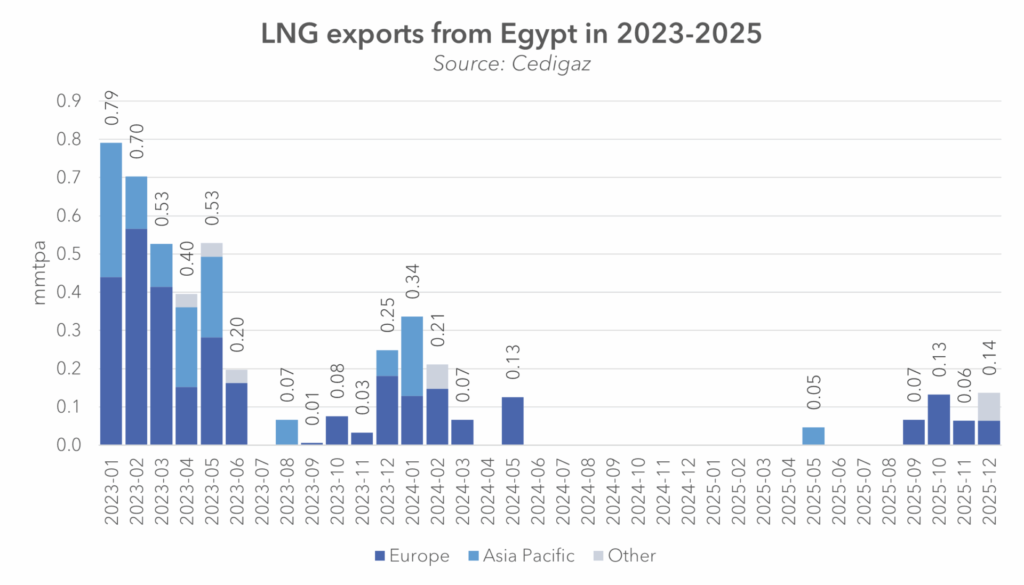

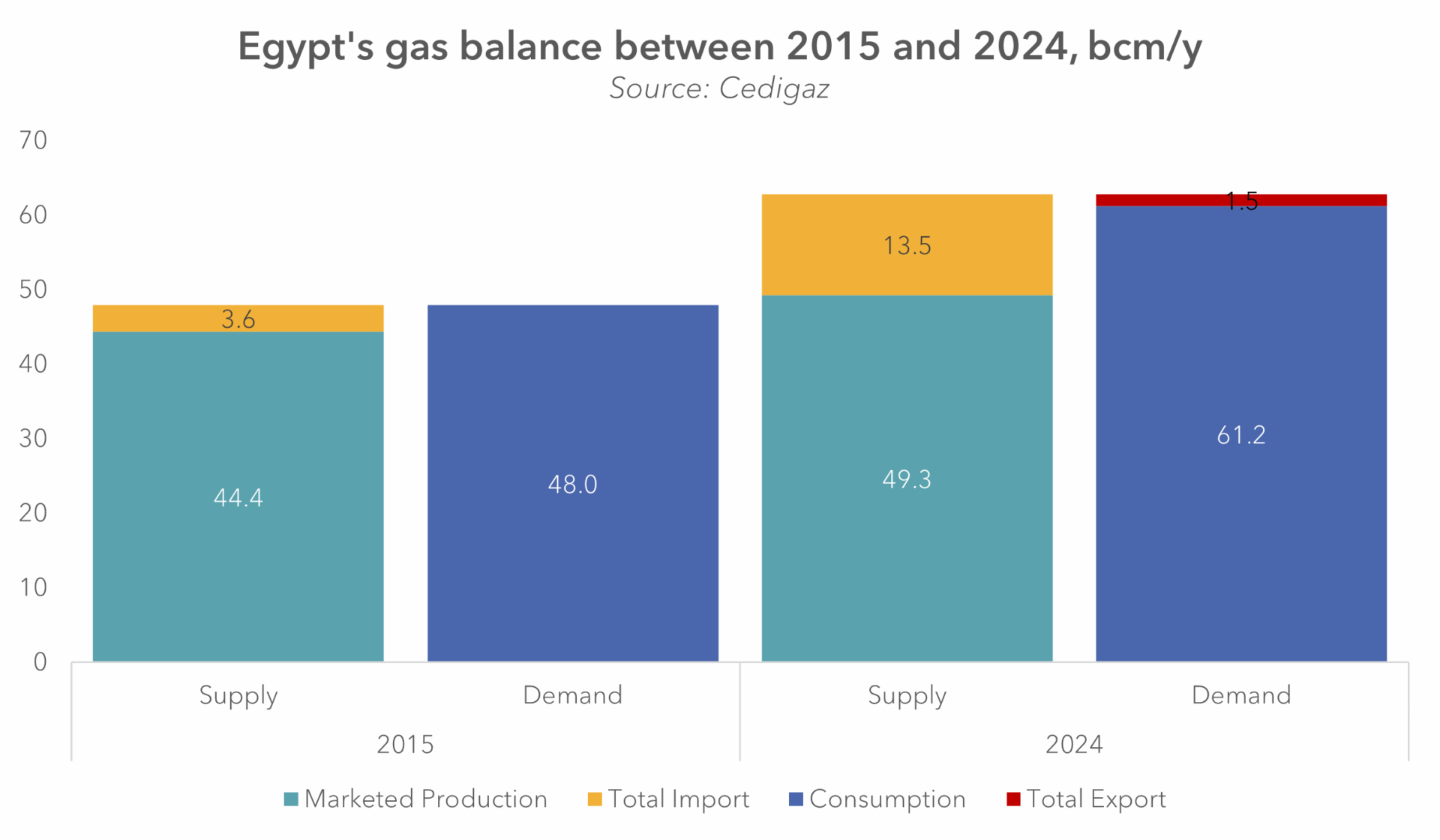

Egypt LNG supply is increasingly determined by the balance between domestic power demand and Israeli pipeline imports, according to new analysis by Cedigaz, as gas availability for liquefaction fluctuates with Egypt’s internal energy needs.

Israel’s transformation from energy importer to regional gas exporter is reshaping LNG dynamics in the Eastern Mediterranean. With production from major offshore fields now exceeding domestic needs, the country has developed a structural surplus that can be redirected between internal consumption and exports depending on market conditions and security considerations.

Much of this surplus flows to Egypt via pipeline, where it plays a critical role in stabilising a gas system under pressure from declining domestic output and rising electricity demand. In Egypt’s allocation hierarchy, gas supply to the power sector takes priority, leaving LNG liquefaction dependent on residual volumes.

As a result, LNG exports fluctuate in response to domestic demand swings rather than operating as a stable baseload supply source.

Pipeline imports from Israel have therefore become a key balancing mechanism for Egypt’s electricity system. While expanded infrastructure could significantly increase import capacity in the coming years, these flows primarily reduce domestic shortages and do not guarantee sustained LNG export availability.

The relationship is also asymmetrical. Israel can curtail exports without destabilising its own power system, whereas Egypt faces immediate economic and social risks if pipeline supplies are disrupted.

This dynamic reinforces Israeli gas as a regional stabiliser while making Egyptian LNG exports structurally interruptible.

For global LNG markets, the implication is clear: Egyptian cargoes represent flexible supply at the margin rather than reliable long-term volumes.

The case also challenges conventional assumptions about gas trade by demonstrating that pipeline exports can offer greater operational flexibility than LNG when domestic priorities and security considerations dominate allocation decisions.

Source: Cedigaz