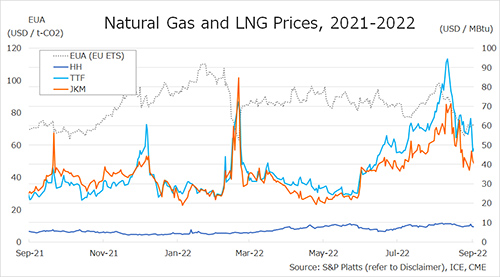

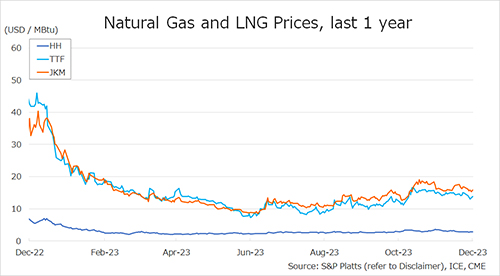

The Northeast Asian assessed spot LNG price JKM for the previous week (27 November – 1 December) fell to low USD 15s on 30 November due to continued weak demand caused by ample supply and high inventory levels from high USD 16s the previous week.

JKM then rose to high USD 15s on 1 December as the price declines stimulated buying interest. METI announced on 29 November that Japan’s LNG inventories for power generation as of 26 November stood at 2.33 million tons, up 0.08 million tonnes from the previous week, down 0.22 million tonnes from the end of the same month of last year and up 0.21 million tonnes from the average of the past five years.

The European gas price TTF fell to USD 13.0/MBtu on 29 November on the back of healthy inventory levels and a stable supply-demand balance from USD 14.9/MBtu the previous week.

TTF then rose to USD 13.9/MBtu on 1 December reflecting expectations of increased demand due to the cold weather.

According to AGSI+, the EU-wide underground gas storage rate declined to 94.8% as of 1 December from 97.9% the previous week.

The U.S. gas price HH fell slightly to USD 2.8/MBtu on 1 December due to reports that one-third of the U.S. could experience above-normal temperatures by mid-December, along with firm inventory levels from USD 2.9/MBtu the previous week.

The EIA Weekly Natural Gas Storage Report released on 30 November showed U.S. natural gas inventories as of 24 November at 3,836 Bcf, up 10 Bcf from the previous week and up 9.8% from the same period last year.

This was an 8.6% increase over the five-year average.

Updated: December 4

Source: JOGMEC