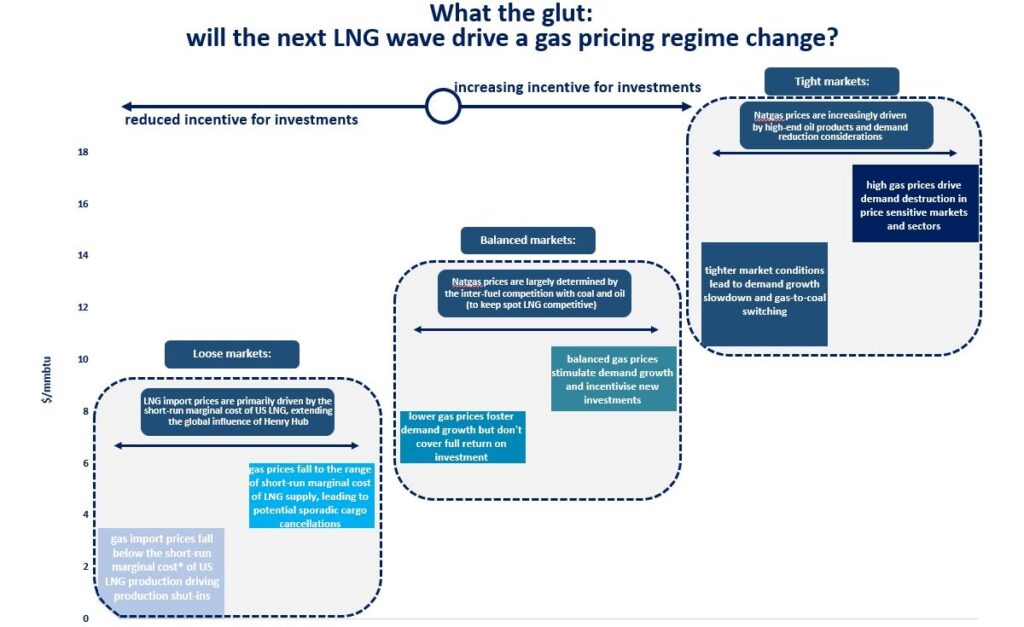

Global LNG supply is entering a new phase, with the next LNG wave likely to reshape gas pricing regimes and extend Henry Hub’s influence well beyond North America.

What the glut: The next LNG wave will not only drive down gas price levels, but ultimately could lead to a new gas pricing regime, with profound implications on gas price formation mechanims, hedging and risk management strategies.

The state of the global LNG market determines pricing regimes and the various price formation factors at play:

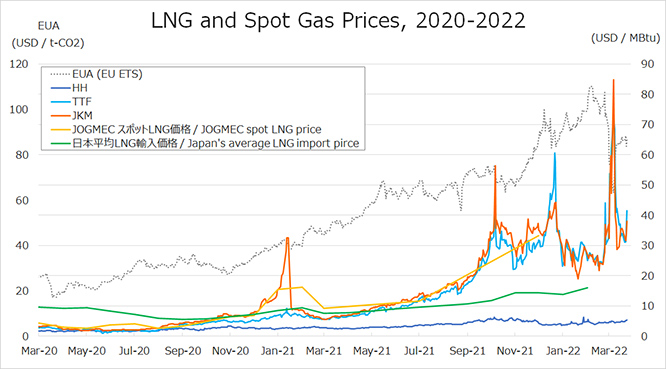

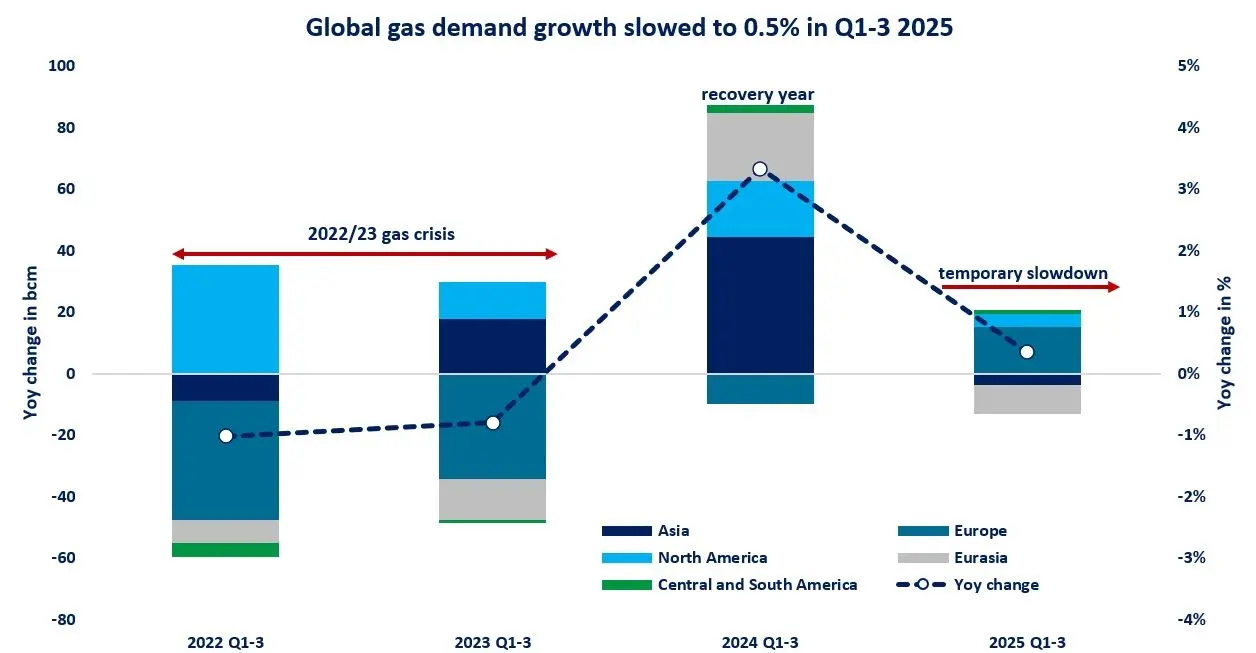

(1) Extreme tightness: Gas prices are increasingly determined by the cost of not consuming gas. For instance, industrial consumers are switching to oil-based products and/or are tendering out part of their contracted demand. This was the case through the 2022/23 gas supply crisis;

(2) Standard tightness: Spot LNG prices find their floor above oil-indexed gas contracts, maximising volume nominations under LTCs and hence limiting spot-based procurements. This is also accompanied by gas-to-coal switching dynamics in the power sector. This was the case for instance in 2024 or through the post-Fukushima period in Asia (2011-14);

(3) Balanced markets: LNG import prices oscillate between the short- and long-run marginal cost of US LNG and are still sufficiently high to support investments into gas/LNG infrastructure. Gas prices are increasingly determined by the inter-fuel competition with coal, while oil-indexed prices typically serve as a ceiling. Balanced markets are fairly rare in real world, although 2024 was pretty close to it: Prices supported both healthy demand growth and continued investments along the gas/LNG value chain;

(4) Loose markets: LNG import prices fall within the range of the short-run marginal cost of US LNG. This does not results in production shut-ins, but could lead to sporadic cargo cancellations. Lower price levels foster additional demand growth, including via coal-to-gas switching dynamics in the power and industrial sectors. In this context, LNG import prices are becoming increasing sensitive to the variable costs of US LNG supply, extending the global influence of Henry Hub. A good example of a loose market would be 2019;

(5) Excessive oversupply: LNG import prices fall for a prolonged period below the short-run marginal cost of US LNG. This has happened over the summer of 2020 and led to substantial cargo cancellations, primarily from the US. 2020 was very particular as the covid-induced lockdowns practically locked any potential demand response to lower gas prices.

As the next LNG wave is unfolding, the global gas market is moving towards more loose conditions. Starting from 2027, Asian and European LNG prices could start to gradually converge towards the short-run cost of US LNG supply.

And this is likely to extend the influence of Henry Hub both on Asian and European hub price dynamics. In this evolving constellation, global LNG market players will become increasingly incentivised to hedge their positions on Henry Hub.

What is your view? How will the next LNG wave transform global gas markets? What will be the impact on pricing regimes? And on regional hub correlation?

Source: Greg Molnar