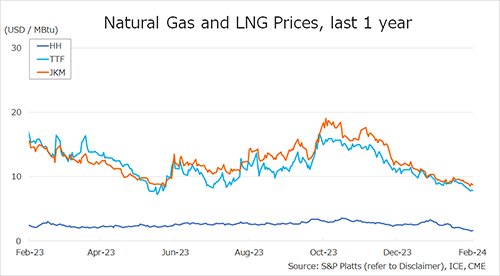

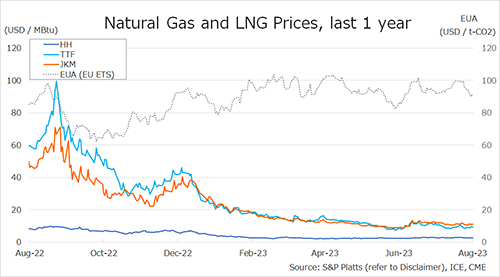

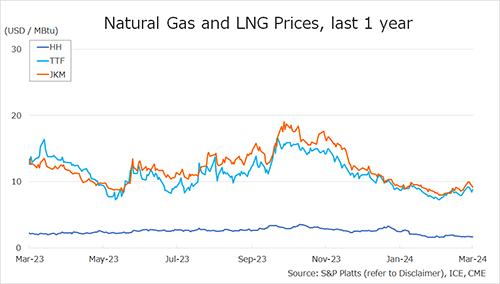

The Northeast Asian assessed spot LNG price JKM for the previous week (18 March – 22 March) rose to nearly USD 10 on 18 March from USD 9 the previous week due to a cyclone in Australia and trouble at a liquefaction facility in the U.S. However, it dropped to USD 9 on 22 March amid sluggish demands and declined buying interests due to price hikes since then. METI announced on 21 March that Japan’s LNG inventories for power generation as of 17 March stood at 1.60 million tonnes, down 0.11 million tonnes from the previous week.

The European gas price TTF rose to USD 9.2 on 18 March from USD 8.6 the previous week due to a trouble at an U.S. liquefaction facility, but dropped to USD 8.4 on 21 March due to firm underground gas storage and weak demand. The following day, TTF recovered from the previous day’s drop to USD 8.8. According to AGSI+, the EU-wide underground gas storage declined to 59.2% as of 22 March from 59.7% the previous week.

The U.S. gas price HH moved from USD 1.7 the previous week to USD 1.7 on 22 March, after price movements reflecting feed gas supplies to U.S. export facilities and gas inventory movements. U.S. gas inventories showed an increase for the first time in 2024. The EIA Weekly Natural Gas Storage Report released on 21 March showed U.S. natural gas inventories as of 15 March at 2,332 Bcf, up 7 Bcf from the previous week, up 21.4% from the same period last year, and 41.0% increase over the five-year average.

Updated: 25 March 2024

Source: JOGMEC