Weather forecasts declined once again, erasing ~19 Bcf of potential natural gas demand over the two-week forecast period.

Similar to yesterday, the natural gas front month moved in a direction contrary to the demand change; as of the morning, the March contract is trading at $4.66, 16 cents higher than its noted close yesterday.

While the front month’s move is strong, additional buying is occurring down the curve; it can be noted that the daily percentage gains of the summer months outpace those of the front-month as expiration approaches and the traded volume of the March contract continues to slowly diminish.

There are a multitude of factors in the market contributing to the market’s bullish move, including but not limited to the escalation of Russia-Ukraine tensions, the pricing in of sub-average storage expectations, and higher gas to coal fuel switching in the coming summer months. For today, G&A will focus on the expectations surrounding tomorrow’s storage report.

March contract up 4%, trading at $4.66

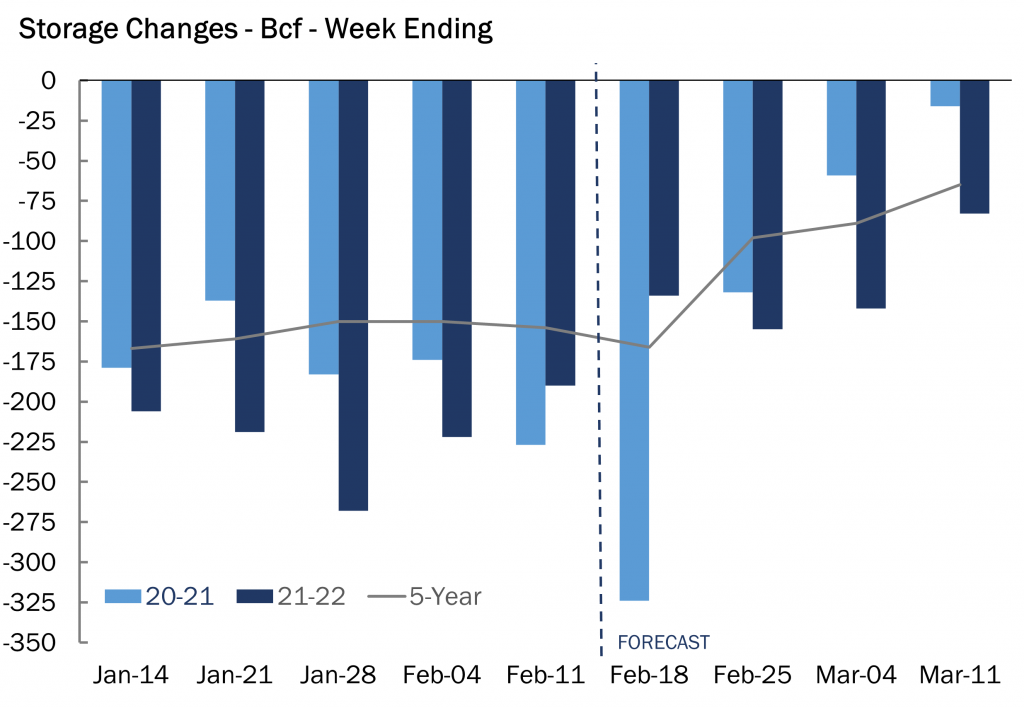

G&A expects a withdrawal of 134 Bcf to be reported tomorrow; this is around 30 Bcf below the five-year average for this time of year.

In fact, tomorrow’s storage report will be the first of the year where the realized withdrawal value falls under that of the five-year average – this in of itself is a testament to the strength of the sustained cold period observed through January and early February.

During the week of storage, robust weather demand drove G&A’s storage model predictions well above 100 Bcf; however, increased week-over-week production (3.8 Bcf/D) outpaced overall week-over-week demand growth (0.4 Bcf/D), somewhat unraveling the trend of a tightening market over the last month.

Increased fuel switching away from gas would also contribute to further weakening over the week of storage as gas and coal generation both declined heavily in the face of a strong showing from wind generators across the country.

This week’s storage report falls in line with the one impacted by Storm Uri last year – this explains the large magnitude of last year’s withdrawal for this time of year at 300+ Bcf as well as the reason why the five-year average is higher than the weeks preceding 2/18.

While last year, nearly all of the cold occurred in one blast, the cold has been strong, but better distributed over a longer range this year.

Similar to last year, weather forecasts project declining withdrawals past late February as the end of the winter season approaches.

Source: Gelber and Associates