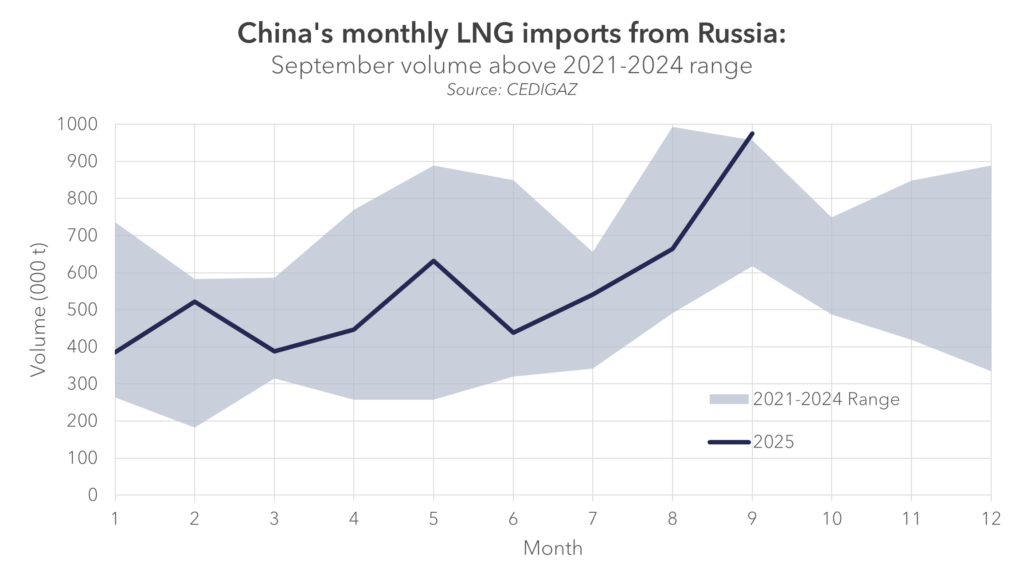

Russian LNG flows into China showed strong seasonal momentum in 2025, with September imports rising above the entire 2021–2024 range. While China’s LNG demand has remained comparatively soft this year, Russian cargoes have continued to gain ground, supported by flexible spot availability and Russia’s increasing reliance on China as a key outlet for its seaborne LNG.

Data from CEDIGAZ shows that LNG continues to play a balancing role in China’s overall gas supply structure. Domestic production and pipeline imports (most notably from Central Asia and Russia) form the backbone of Chinese supply, while LNG volumes flex up or down depending on seasonal demand and price arbitrage opportunities.

In the first nine months of 2025, Russia ranked as China’s third-largest LNG supplier, after Australia and Qatar — a notable shift compared with previous years.

However, beneath this seasonal strength lie several structural risks. Total Russian LNG deliveries to China over the first nine months of 2025 are still down year-on-year, with pipeline flows via Power of Siberia increasingly dominating the Russia–China gas relationship. China is also actively diversifying its LNG supply portfolio, adding volumes from the United States, Qatar, and Southeast Asia, which could limit Russia’s future share of the Chinese LNG market.

CEDIGAZ also highlights an important external variable: U.S. LNG policy and export dynamics. Any sustained rise in U.S. Gulf Coast LNG output or shifts in U.S.–China trade relations could reshape regional supply competition, exerting pressure on Russia’s ability to maintain — or expand — its LNG position in China. With pipeline gas gaining structural weight and global LNG trade flows in flux, Russia’s long-term LNG role in China remains exposed to both market and geopolitical uncertainty.

In the near term, seasonal demand, pricing dynamics, and the availability of flexible spot cargoes will continue to shape Russian LNG flows. But the broader trend is clear: while Russia has strengthened its LNG footprint in China in 2025, its strategic position is far less secure than the headline growth suggests.

Source: Irina Mironova for CEDIGAZ