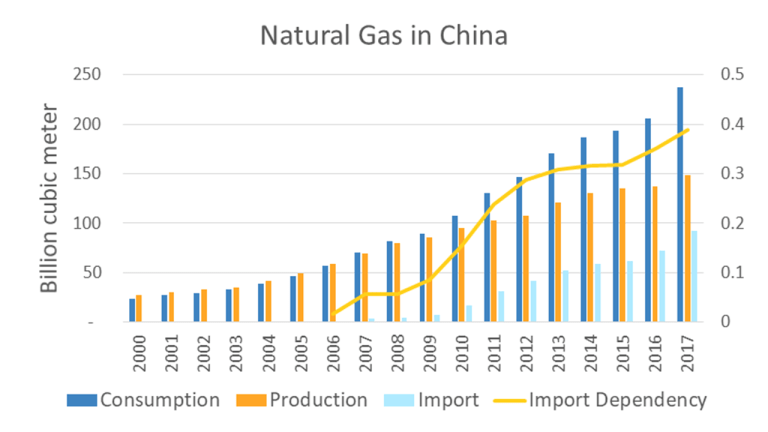

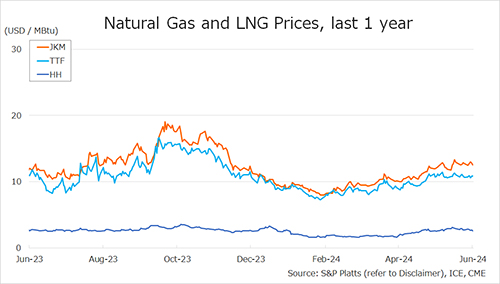

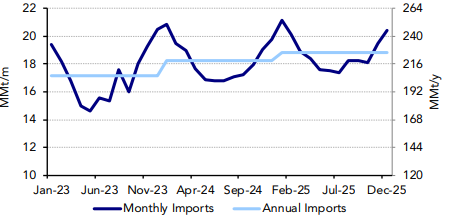

While LNG imports for China have rebounded in 2023 on 5% growth in gas demand, LNG imports for Northeast Asia are forecast to see only 0.3% growth with LNG imports forecast at 206.4 MMt in 2023 due to falling demand for natural gas in Japan, South Korea and Taiwan offsetting growth from China.

However, LNG imports are forecast to increase to 218.7 MMt in 2024 and 225.8 MMt in 2025. Nuclear reactor restarts and higher renewable energy output has cut into natural gas consumption in the power and industrial sectors this year.

Natural gas demand is forecast to increase in 2024 and 2025 on economic growth in the region, which will lift demand for LNG imports.

Northeast Asia LNG Import Forecast

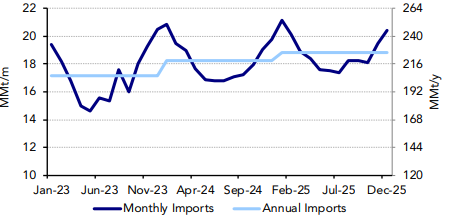

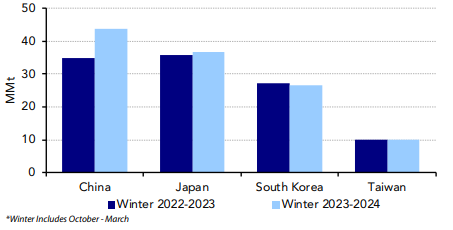

Looking at this upcoming winter, LNG import growth is forecast to primarily come from China where LNG imports will increase from 34.8 MMt last winter to 43.7 MMt this winter. Imports for Japan are forecast to increase by 1.1 MMt from 35.7 MMt last winter to 36.8 MMt this winter. Elsewhere, imports are declining, winter over winter in South Korea.

Chinese LNG imports are estimated to average 7.3 MMt/m from October 2023 to March 2024, a marked increase from 5.7 MMt/m thus far in 2023. Conversely, other sources of energy pose a downside risk to the winter LNG import forecast for China.

China is well supplied with coal this year with higher domestic output and an increase in coal imports this year.

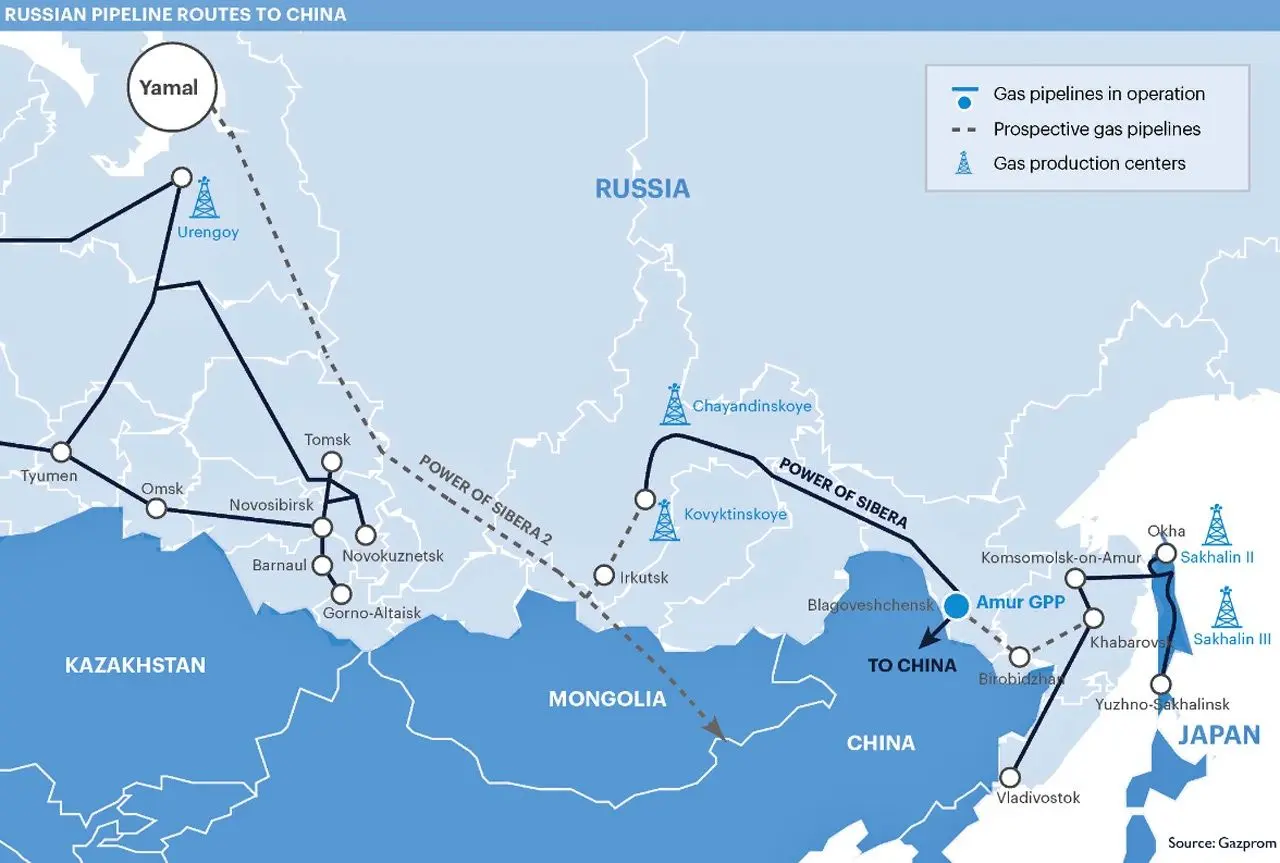

Russia has plans to increase pipeline exports to China in 2024 by 8 Bcm/y, totaling 30 Bcm/y, in addition to rising domestic natural gas production.

Northeast Asia Winter LNG Import Forecast

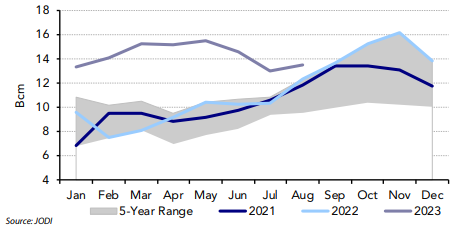

From October 2022 to March 2023, European inventories fell slowly by 38 Bcm from 93.4 Bcm to 55.6 Bcm due to relatively mild winter temperatures. From October 2023 to March 2024, inventory levels are forecast to fall by roughly 53 Bcm from 974 Bcm to 44.5 Bcm.

This steep decline will lead to higher LNG import requirements in 2024 and 2025 in conjunction with higher demand in Asia that will limit Europe’s ability to import the LNG needed to fill storage levels as quickly.

Lower electricity consumption across Northern Europe and the Mediterranean has led to a reduction in natural gas demand from the power sector in addition to reductions caused by renewables expansion. Gas demand is forecast to fall from 466 Bcm in 2022 to 442 Bcm in 2023. Demand is forecast to increase in 2024 and 2025 by 2% and 1% to 454 Bcm and 457 Bcm, respectively.

Japan, Korea, Taiwan Combined Natural Gas Storage

Source: Poten & Partners