US earnings calls were broadly dominated by two key topics in Q1: (1) the forthcoming LNG wave and need for feedgas; (2) the gas demand surge stemming from data centers/AI and a bit of crypto mining on the margin.

Data centers and AI are now expected to drive a more rapid electricity demand growth than previously foreseen, and this additional electricity supply needs to be stable and hence could provide some additional upside for gas burn in the power sector.

The key question is how much additional gas demand?

While for incremental LNG feedgas the maths are pretty straightforward, forecasting the potential demand from data centers and AI is much more tricky…

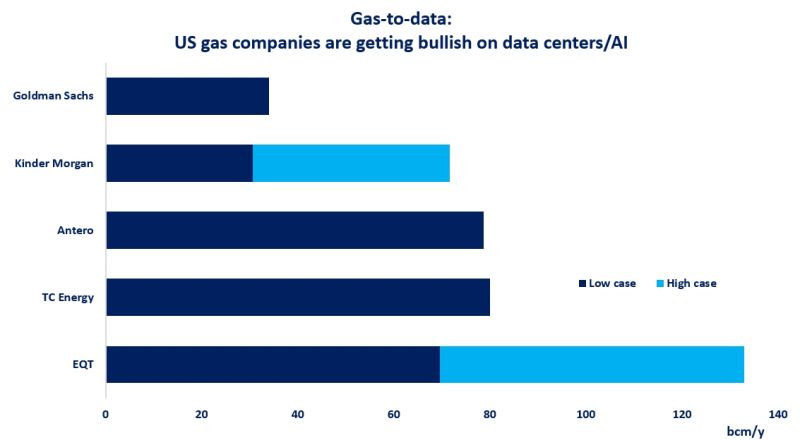

And this is well-reflected by the uncertainty ranges posted by North American gas companies: while the more conservative projections shows 30 bcm/y additional demand by 2030, the more brave ones bet on over 130 bcm/y of gas demand from data centres/AI by the end of the decade.

One thing to note: this is only North America. data centers/AI and crypto is likely to have implications on other gas-rich markets. and to be fair it already has: Iran is regularly facing grid stability issues due to high crypto mining, which was a key driver behind the country’s growing electricity demand in recent years. in Russia, GazpromNeft used a stranded gas well to run an onsite cryptomine a few years ago, etc.

Source: Greg Molnar