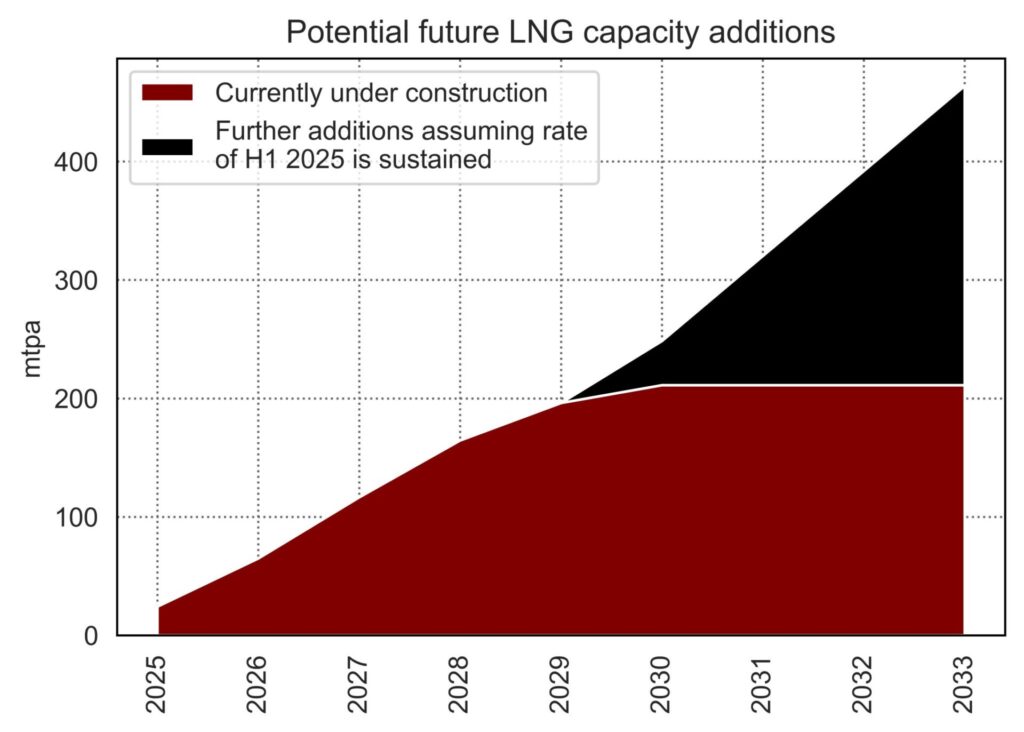

The first half of 2025 has seen a significant acceleration in offtake commitments with pre-FID LNG projects, especially in the US, with three projects also formally taking FID.

The rate of commitment to new capacity has now reached such a level that, if it was sustained and if all firm commitments were to be turned to actual capacity additions, it would translate to more than 65 mtpa of capacity additions per year.

This would be enough to double the already enormous wave of new supply under construction in only three years.

The market is clearly continuing to bet on an unprecedented rate of demand growth in the next ten years: with a large amount of this new supply capacity yet to have a clear commitment to end users, this bet appears very risky at the moment.

What’s sure is that the likelihood that prices will remain well below the capital cost of new capacity additions into the early 2030s continues to increase.

Note that the data in the figure only include binding SPAs: non-binding HOAs have been excluded from this analysis; capacity under construction is taken from the IEA global LNG capacity tracker

Source : Giovanni Bettinelli