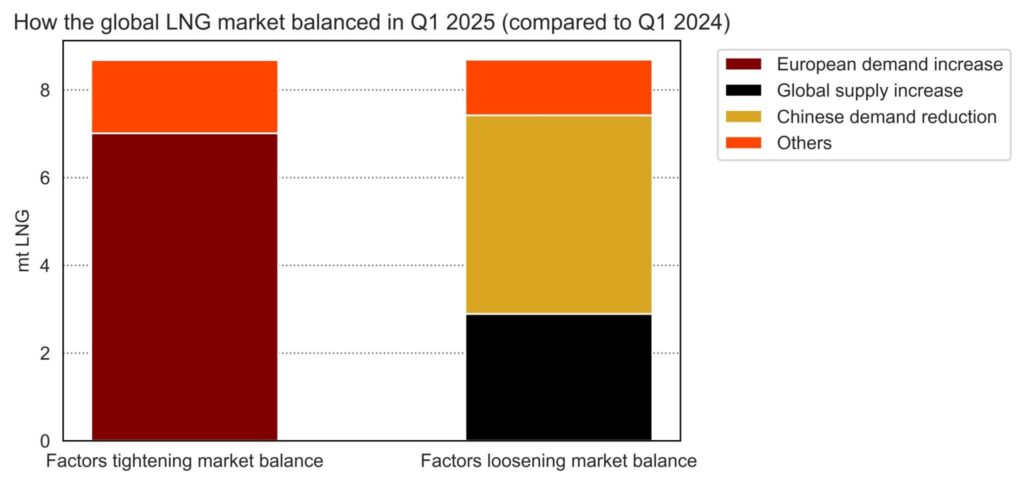

What enabled Europe to increase LNG imports in Q1 compared to 2024? Vortexa data clearly shows that, while slightly higher supply has helped, the significant decline in Chinese imports as been by far the most significant factor in helping to balance the global market in the face of higher European demand.

Other more price-sensitive markets have seen roughly constant imports, signalling that spot market prices have been at a level that has constrained any potential for growth, but they have not yet been sufficiently high to actually lower demand.

In this context, what would the threat of a global economic downturn mean for LNG market balances in 2025?

In short, more of what we have seen in Q1, except at lower prices.

This is because of the likely further decline in Asian imports (potentially extending to countries other than China).

Also, the bulk of the increase in supply expected this year will mostly be felt in the second half of the year, potentially further tipping the scale towards a looser market.

A lot of uncertainty still remains, as US import tariffs remain far from set in stone and global markets have yet to fully digest their impact.

The bottom line however is that Europe is increasingly likely to attract the to 20-30 mt of higher LNG imports it needs this year at a lower price than previously expected and the task of refilling storage in the summer may just turn out to be much easier than feared a few weeks ago.

Source: Giovanni Bettinelli