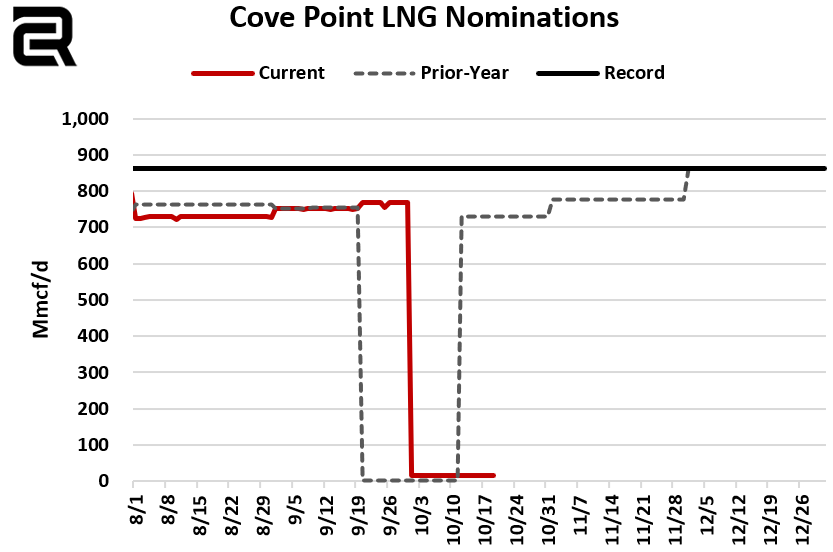

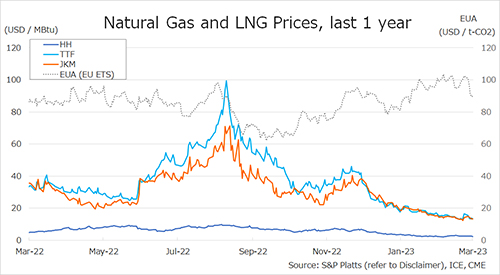

Global gas prices declined last week, with Asian LNG slipping back from the low-USD 12s, European TTF falling on easing weather before rebounding on storage drawdowns, and US Henry Hub tumbling sharply as the cold spell faded.

Asia – JKM (Northeast Asia)

The Northeast Asian spot LNG benchmark JKM (March delivery) fell to the high-USD 10s/MMBtu on 6 February, down from the low-USD 12s/MMBtu the previous weekend (30 January). At the start of the week, JKM dropped by more than USD 1 to the high-USD 10s/MMBtu as geopolitical tensions between the US and Iran eased.

Prices then softened further to the mid-USD 10s/MMBtu amid ample inventories in Northeast Asia. Toward the end of the week, JKM edged back up to the high-USD 10s/MMBtu as sellers became less active and some buyers engaged in inventory restocking. METI reported that Japan’s LNG inventories for power generation stood at 2.08 million tonnes as of 1 February — down 0.17 million tonnes week-on-week.

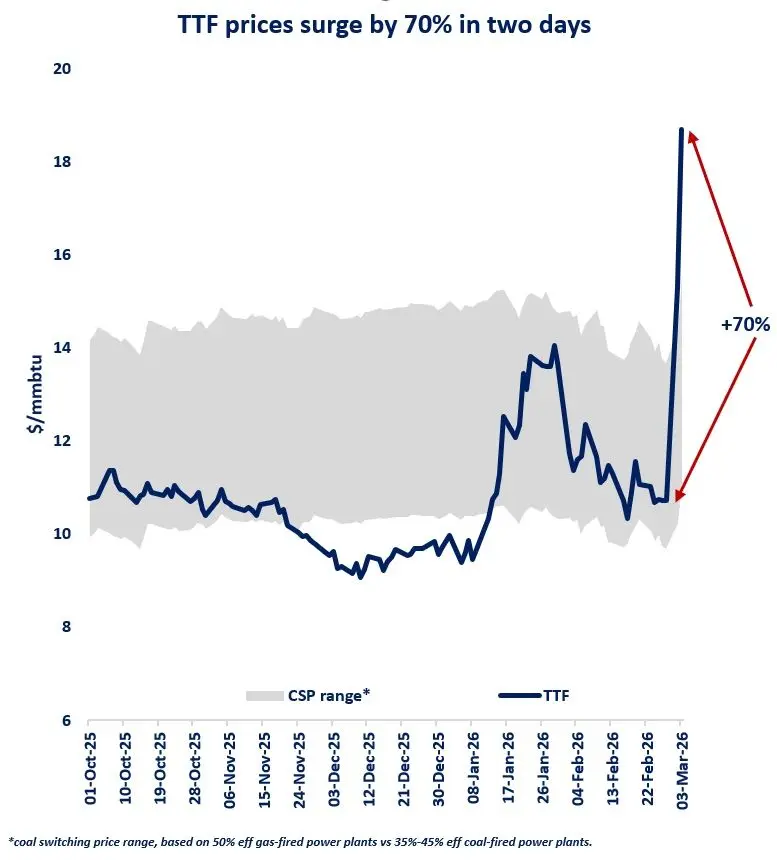

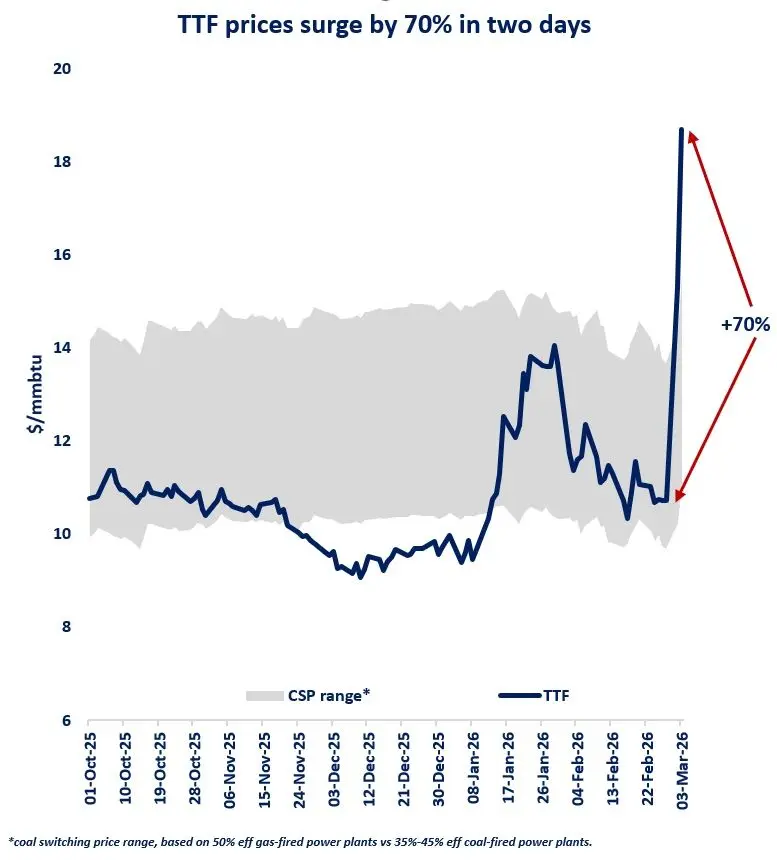

Europe – TTF

European TTF prices (March delivery) fell to USD 12.3/MMBtu on 6 February from USD 13.7/MMBtu the previous weekend (30 January). Prices initially dropped to USD 11.8/MMBtu at the beginning of the week as tensions eased following the start of US-Iran dialogue. TTF declined further to USD 11.4/MMBtu on 3 February amid forecasts that the European cold spell would ease. From mid-week onward, however, prices reversed higher as storage withdrawals accelerated and wind power output weakened, reaching USD 12.3/MMBtu on 6 February. According to AGSI+, EU-wide gas storage stood at 37.4% on 6 February — down from 41.5% the previous weekend, 25.5% below last year, and 30.4% below the five-year average.

United States – Henry Hub

US Henry Hub prices (March delivery) fell sharply to USD 3.4/MMBtu on 6 February from USD 4.4/MMBtu the previous weekend (30 January). At the start of the week, prices slid to USD 3.2/MMBtu as forecasts pointed to a rapid easing of the cold spell. Henry Hub then recovered slightly into the mid-USD 3s/MMBtu as some traders stepped in after the steep sell-off. On 5 February, the EIA reported a large withdrawal from storage, but the impact on prices was limited.

The EIA Weekly Natural Gas Storage Report showed US inventories at 2,463 Bcf as of 30 January — down 360 Bcf week-on-week, 1.7% above last year, and 1.1% below the five-year average.

Source: JOGMEC