The LNG market outlook is shifting toward a buyer’s market, according to Timera Energy’s takeaways from the LNG 2026 conference in Doha.

Industry discussions at LNG 2026 in Doha highlighted a changing balance in global gas markets, with participants pointing to a transition toward a buyer’s market after several years dominated by supply scarcity.

Momentum behind new US LNG export projects appears to be weakening despite a surge of final investment decisions in 2025. Market participants noted growing caution around additional capacity commitments, reflecting concerns about future price cycles and contracting risks.

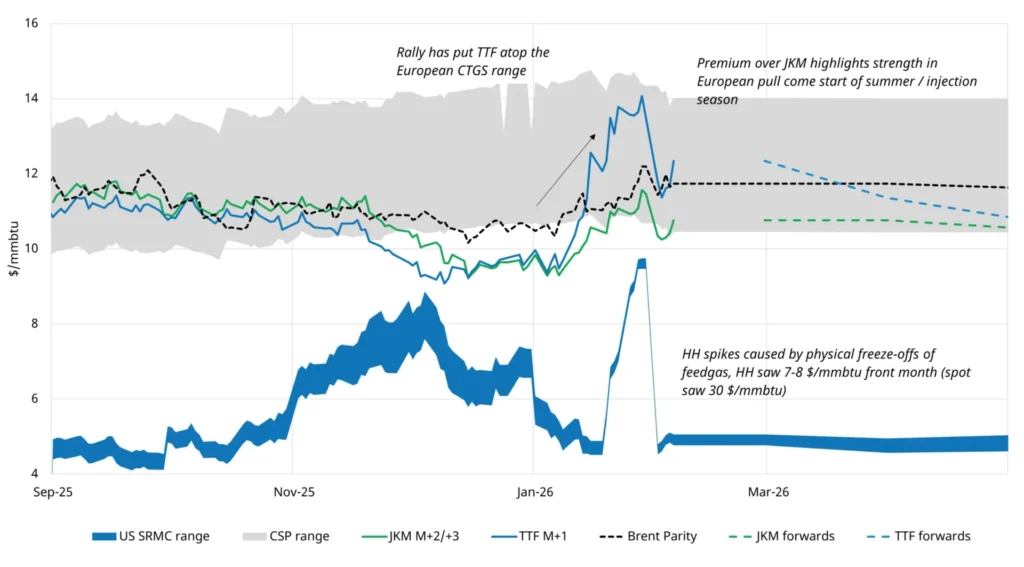

Price volatility — particularly linked to Henry Hub — has become a central concern for portfolio players. Fluctuations in US gas prices are directly affecting export margins and risk management strategies, prompting traders to reassess exposure to US-linked supply.

At the same time, appetite for LNG portfolio expansion remains strong, with companies exploring equity positions and secondary market opportunities amid expectations of increased supply pressure in coming years.

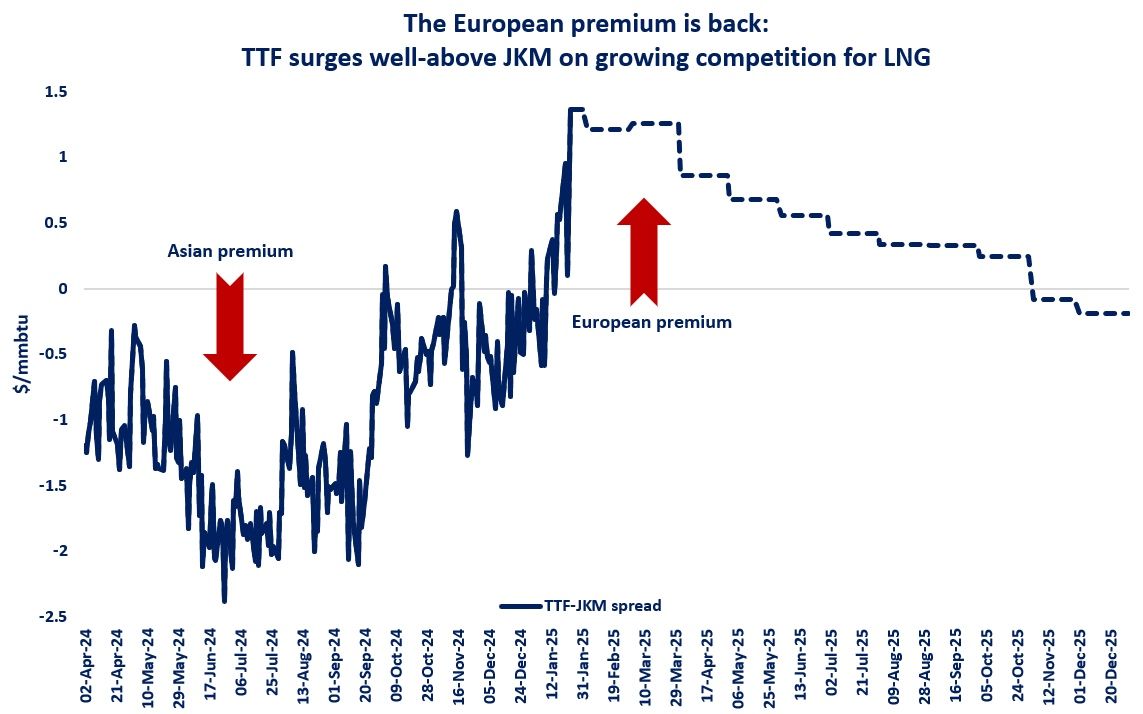

Regulatory uncertainty in Europe is also influencing contracting decisions, while Asian demand is widely expected to determine the clearing price for global LNG markets as new supply enters the system.

Price-sensitive buyers in Asia are waiting for lower prices before committing to long-term purchases, reinforcing the shift toward buyer leverage.

Together, these trends suggest a market entering a more complex phase in which flexibility, optionality and portfolio management strategies will play a greater role than sheer supply growth.

Source: Timera Energy