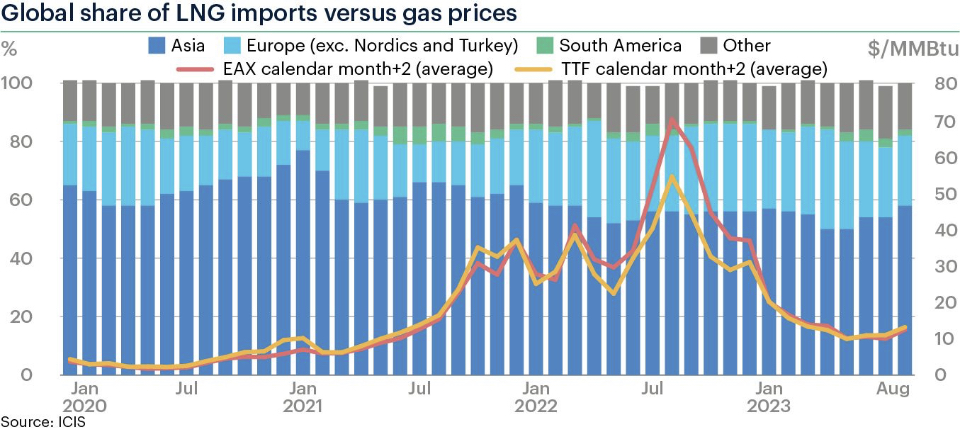

JKM’s premium over TTF rose yesterday to its highest level year-to-date at $2.7/mmbtu, indicating that Asia is set to dominate the LNG market ahead of winter.

The spread between JKM and TTF rose gradually through the year, from an average of just $0.5/mmbtu in Q1 to an average of over $1.5/mmbtu in Q3.

There are several factors driving this wider spread:

(1) robust Asian demand: both China and India are back with full strength, displaying near double-digit growth rates. higher domestic demand is set to drive their LNG imports to new record highs this year;

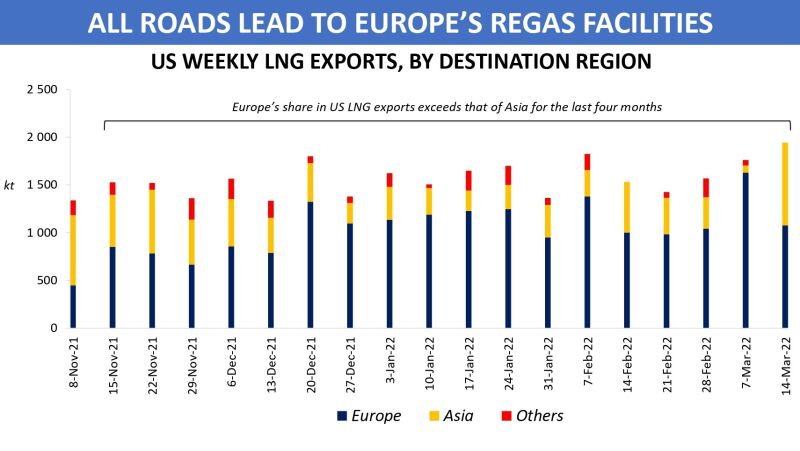

(2) weak European fundamentals: in contrast with Asia, Europe’s natural gas demand remained depressed through 2024, primarily due to lower gas burn in the power sector amid the rapid expansion of renewables;

(3) storage: while Europe’s storage sites are now nearly full, Asia has limited storage capabilities. moreover, Japan’s LNG stocks are now standing 6% below their 5y average.

This means that northeast Asian markets rely more on LNG for seasonal demand balancing, which in turns supports JKM’s premium over TTF ahead of the winter season.

(4) Ukraine transit: yesterday’s rumours on a potential Azerbaijan-Ukraine gas transit deal drove down TTF by 6%, while Asian markets did not have time yet to react.

What is your view? How will the JKM-TTF spread evolve over the winter time? Are we back in the good old days when TTF was structurally lower than JKM?

Source: Greg MOLNAR