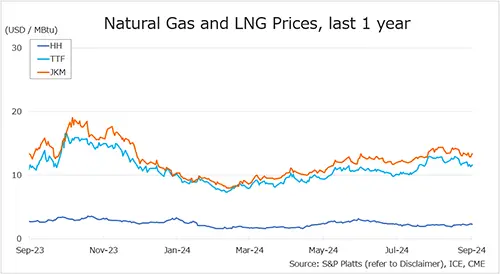

(June 23) The Northeast Asian assessed spot LNG price JKM for last week (16 June – 20 June) rose to high-USD 14s/MBtu on 20 June (August delivery) from mid-USD 13s/MBtu the previous weekend (13 June, July delivery).

JKM had been rising for six consecutive business days due to rising geopolitical tensions in the Middle East, and although it temporarily declined on 19 June, it rebounded on 20 June amid recurrence of supply concerns.

Despite record-setting heat across Japan, end-user‘s demand remained relatively stable, and spot procurement activity continued to be limited. METI announced on 18 June that Japan’s LNG inventories for power generation as of 15 June stood at 2.14 million tonnes, down 0.20 million tonnes from the previous week.

The European gas price TTF (July delivery) for last week (16 June – 20 June) rose to USD 13.8/MBtu on 20 June from USD 12.8/MBtu the previous weekend (13 June). TTF rose in the first half of the week due to heightened geopolitical tensions in the Middle East but showed some downward movement later in the week as a result of continued stable supply from Norway and increasing storage levels across Europe.

Although a heatwave is expected to drive up cooling demand, fundamentals remain weak, with geopolitical risks continuing to support prices. According to AGSI+, the EU-wide underground gas storage was 55.4% on 20 June, up from the previous weekend, down 25.7% from the same period last year, and down 14.7% over the five-year average.

The U.S. gas price HH (July delivery) for last week (16 June – 20 June) rose to USD 3.9/MBtu on 20 June from USD 3.6/MBtu the previous weekend (13 June). HH remained firm throughout the week, supported by increased cooling demand due to rising temperatures in the Eastern U.S. and growing LNG supply risks derived from Middle East tensions, although the price softened slightly towards the end of the week.

The EIA Weekly Natural Gas Storage Report released on 18 June showed U.S. natural gas inventories as of 13 June at 2,802 Bcf, up 95 Bcf from the previous week, down 7.7% from the same period last year, and 6.1% above the five-year average.

Source: JOGMEC