in this article, the authors, Timera Energy look at how softening Asian demand is shaping LNG market evolution as Middle Eastern risk premiums recede sharply.

Last week we got to observe a market shock test in both the crude & LNG markets, as a result of the Iranian conflict. Prices in both markets shrugged off the shock within a week.

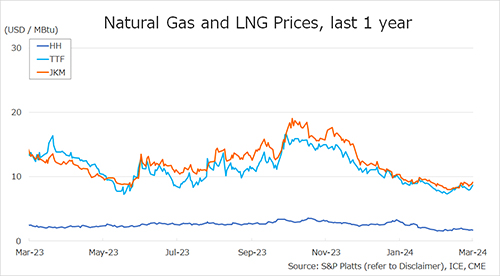

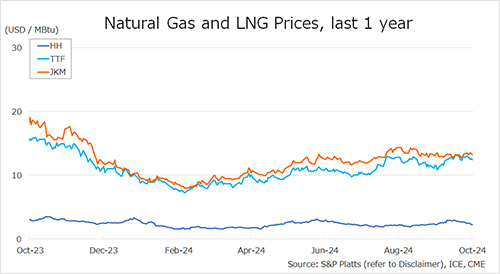

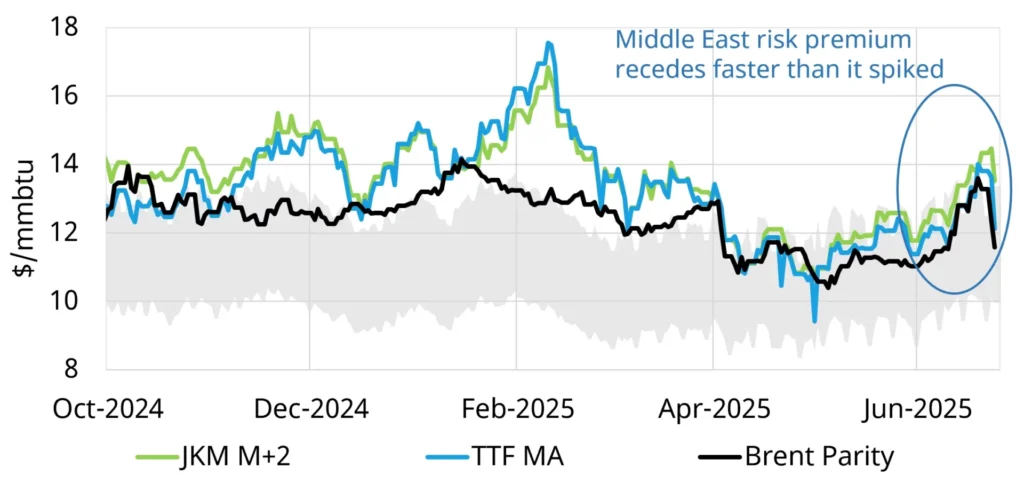

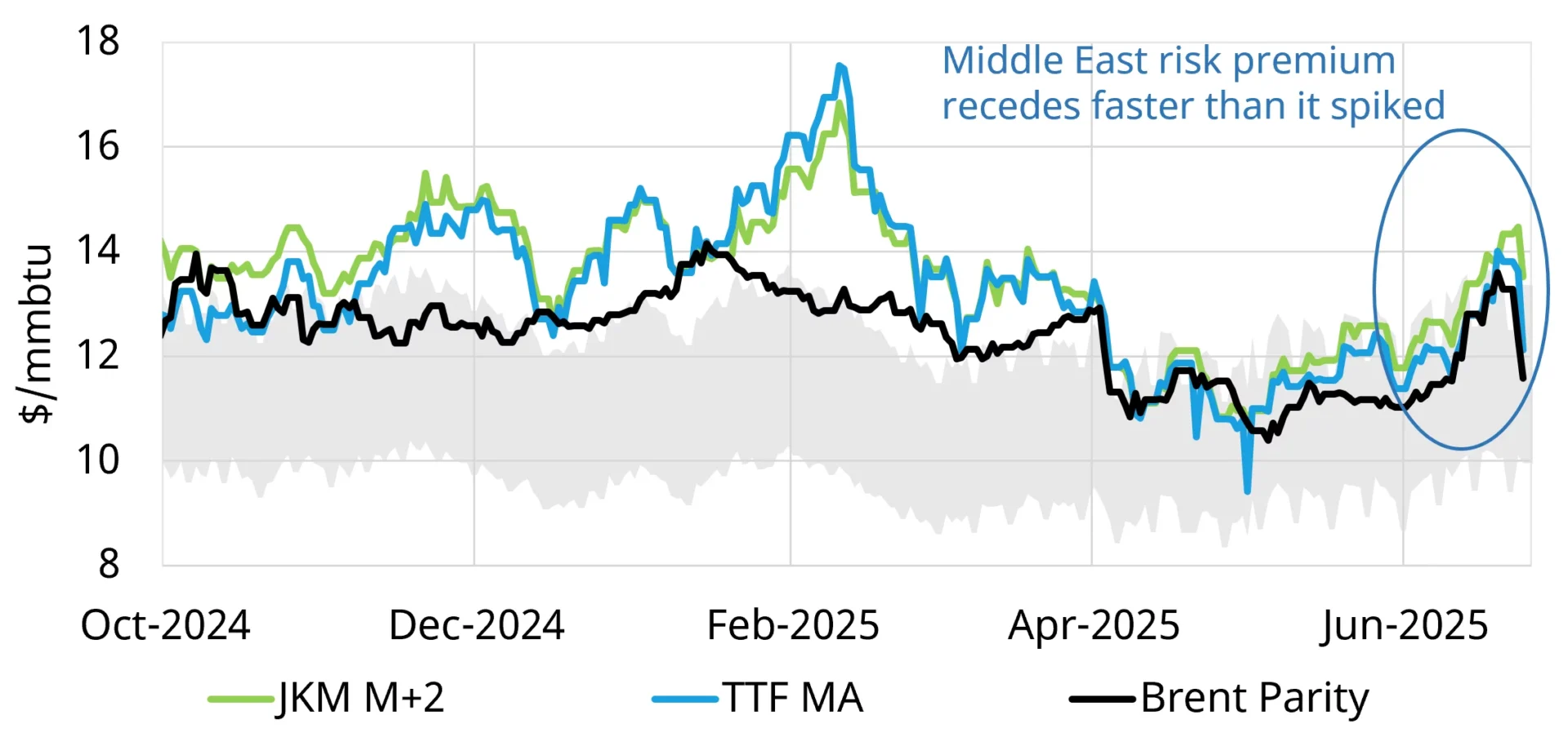

In an update of the chart we showed in last week’s article, Chart 1 shows key gas & oil price benchmarks falling faster than they rose as Middle Eastern risk premiums deflate and supply & demand balance comes firmly back into focus.

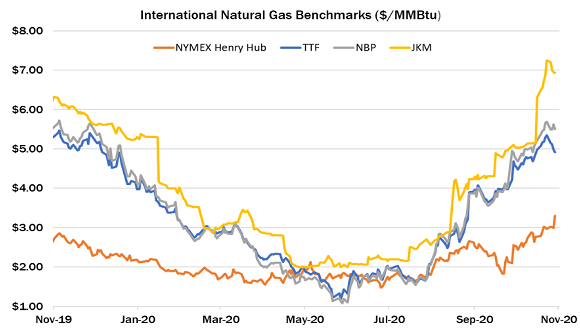

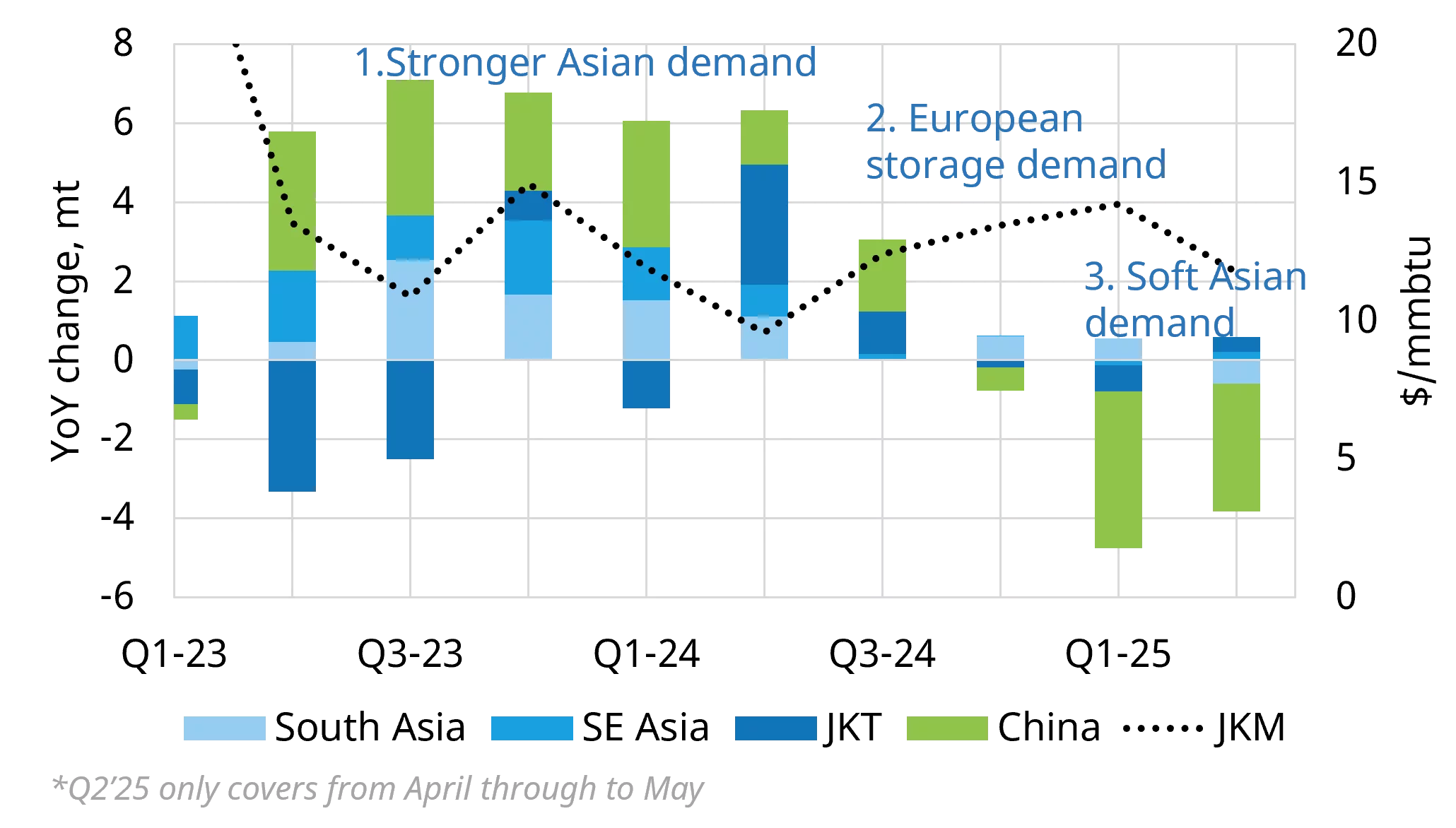

In 2024, a recovery in Asian LNG demand was a key driver of tightening LNG & European gas markets and higher gas prices.

TTF & JKM prices remained supported across Winter 2024-25 by colder weather and the requirement to replenish rapidly depleting European underground storage stocks.

However LNG demand has softened into 2025. Asian LNG demand, the engine room of global demand growth, has not been firing on all cylinders in 2025 as shown in Chart 2. Soft Chinese LNG demand is the main driver.

The dynamics of Asian LNG demand from here to 2030 is the most important variable in determining how the LNG market will absorb more than 200 mtpa of new supply.

Source: Timera Energy