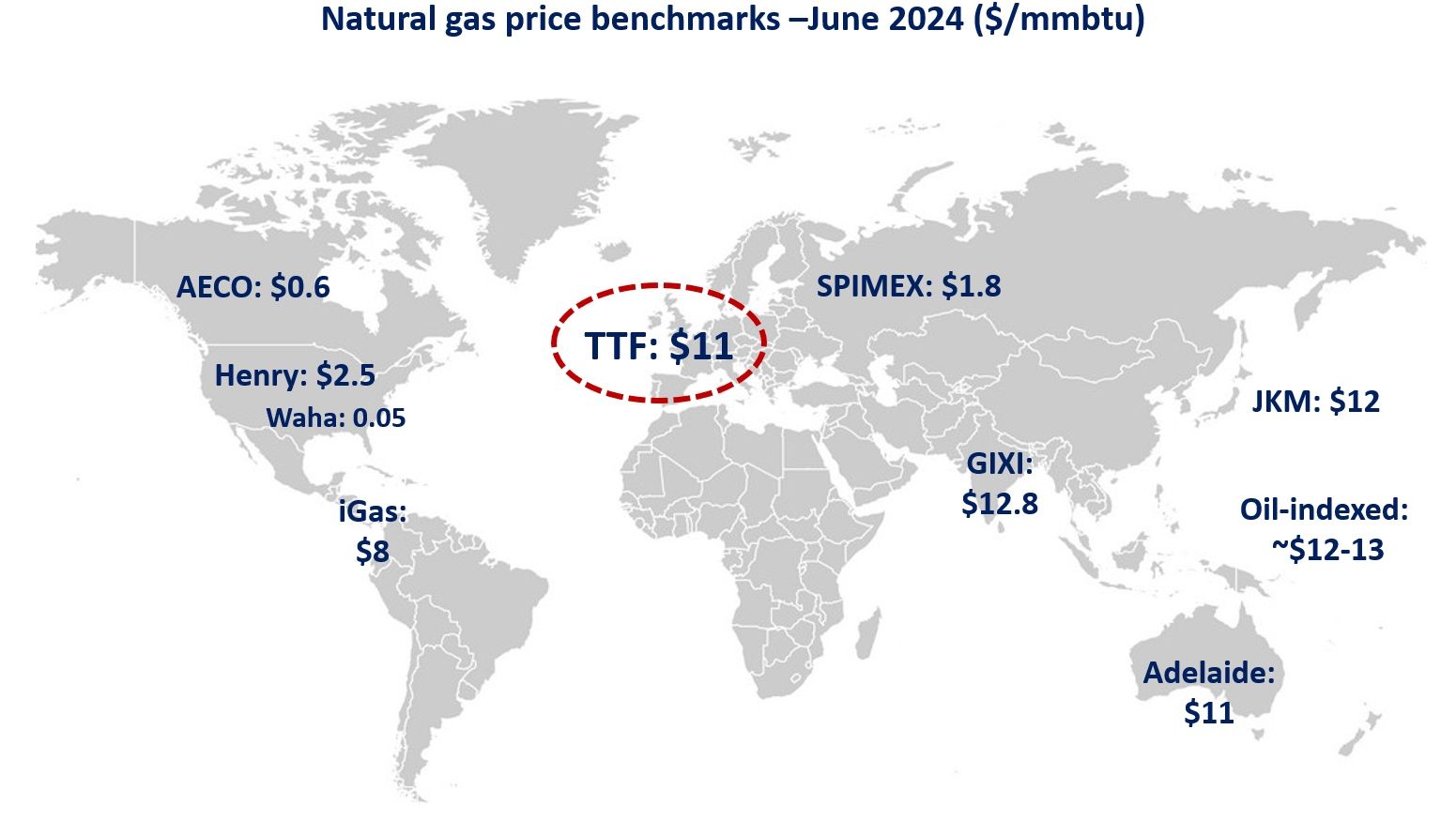

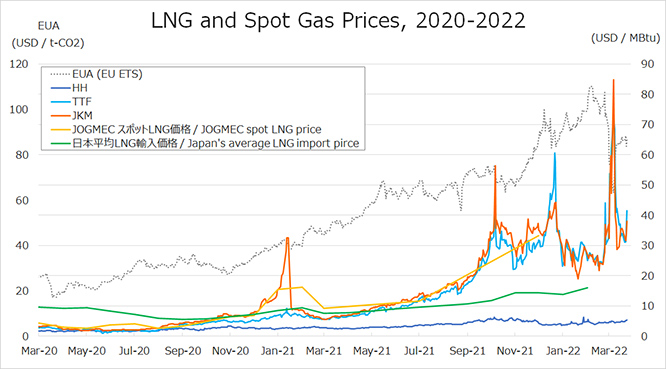

The assessed spot LNG price for near-month delivery to Northeast Asia, JKM hovered around the USD 30s per million Btu in early of March, then jumped to USD 84.8 on 7 March due to the spike in TTF Gas Futures price, but fell back, and remained in the USD 30s toward the end of the month.

JKM has been moving in line with European gas prices. On the supply and demand side, LNG production disruptions continue in Malaysia and Australia, and spot cargos demand in the Northeast Asia is increasing in the near term. In particular, geopolitical tension with regard to gas supplies to Europe is a factor driving prices higher.

JOGMEC announced in its monthly report of spot LNG prices for delivery to Japan that the average price of spot LNG cargoes for delivery to Japan contracted in February 2022 and scheduled to be delivered from the month onward (contract-based price) was USD 26.4. The average price of spot LNG cargoes that were contracted and delivered in Japan within the month (arrival-based price) was not disclosed as only one or less company submitted the report for the month.

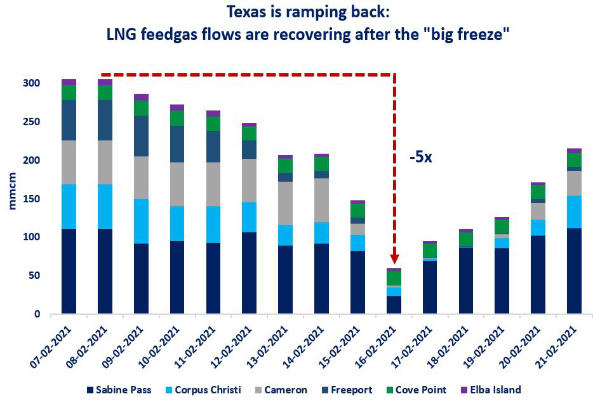

The Henry Hub Natural Gas Futures price temporarily rose to the USD 5 at the beginning of March and fell to middle of USD 4 and rising to the low USD 5s toward the end of the month. According to the U.S. Energy Information Administration (EIA), the price outlook is expected to average USD 3.83 for the second quarter of 2022, average USD 3.95 for all of 2022, and average USD 3.59 for the year 2023. U.S. LNG exports were estimated to be about 6.4 million tonnes in February 2022 was lower than the previous month, many LNG cargoes have been delivered to Europe, where there are concerns about Ukraine-related gas supply concerns. EIA expects the U.S. LNG export capacity will contribute to LNG exports rising to about 86 million tonnes in 2022, up 16% from the previous year.

The Dutch TTF Gas Futures price surged to USD 72 on 7 March due to fears of Russian pipeline gas supply disruptions, then fell to the low USD 30s by mid-month and remained in the middle of USD 30s toward the end of the month. European underground gas storage level is approaching to its five-year average due to a number of additional LNG receipts, mainly from the United States, and a warm winter. However, European gas prices have been volatile amid the geopolitical tensions.

Based on the preliminary figures from Japan’s customs statistics of the Ministry of Finance, the country’s average LNG import price was USD 15.98 in February 2022. The average landed prices of LNG in Japan from the United States, the ASEAN region, the Middle East, and Russia in the month were USD 21.26, USD 13.38, USD 15.58, and USD 16.04, respectively. Elsewhere in Asian, average import prices in February were USD 13.01 in China, USD 16.27 in Korea, USD 14.69 in Chinese Taipei.

The Japan’s average landed crude oil import price (JCC: Japan crude cocktail) was USD 86.69 in February 2022, the highest since November 2014. Japan’s average LNG import price, which accounts for 70%-80% of long-term contracts linked to JCC prices, is expected to continue rise to the current rise in crude oil prices.

Japan imported 7.11 million tonnes of LNG in February 2022, 12% lower than the same month of 2021. The total import volume during the first two months of 2022 was 13.89 million tonnes, a decrease of 14% from the same period of 2021. China imported 4.86 million tonnes of LNG in February 2022, 12% less than the same month of 2021. China’s total LNG import volume during the first two months of 2022 was 12.68 million tonnes, a decrease of 9% from the same period of the previous year.

While Korea imported 3.48 million tonnes in February 2022, a decrease of 33% from the same month of 2021, Chinese Taipei imported 1.59 million tonnes, 21% higher than one year earlier. LNG import volume from these four markets was 38.08 million tonnes during the first two months of 2022, a 10% decrease year-on-year.

Source: JOGMEC