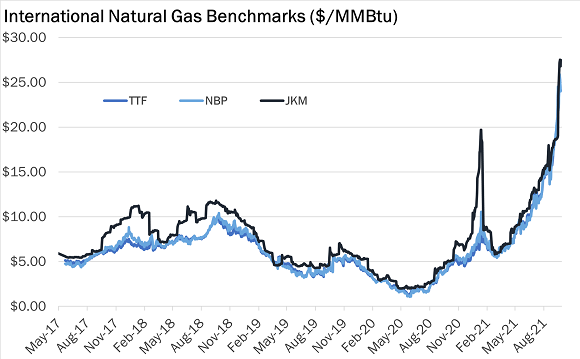

The Northeast Asian assessed spot LNG price JKM for the previous week (7 November-11 November) fell to USD 24/MBtu on 7 November due to high inventory levels in the region from USD 28/MBtu the previous week. JKM then rose to USD 26/MBtu on 8 November but fell to USD 24/MBtu on 10 November due to declining demand in Asia and concerns about “tank tops” at LNG receiving terminals in India and China.

On 11 November, JKM fell further to USD 22/MBtu. According to METI, LNG inventories for power generation were 2.52 million tonnes as of 6 November, up 0.36 million tonnes from the end of the same month last year, and up 0.57 million tonnes from the average of the past five years, which remains a high level.

The European gas price TTF fell to USD 32.1/MBtu on 7 November from USD 33.2/MBtu the previous week due to warm weather and near full European underground gas storage. On 8 November, TTF rebounded to USD 34.6/MBtu, after 9 November, the market trend turned downward amid a high European underground gas storage rate and low market liquidity and fell to USD 29.6/MBtu on 11 November.

According to AGSI, European underground gas storage reached 95.44% on the same day.

The U.S. gas price HH rose to USD 6.9/MBtu on 7 November from USD 6.4/MBtu the previous week. It then fell for two consecutive days, hitting USD 5.9/MBtu on 9 November. It rose to USD 6.2/MBtu on the following day but fell to USD 5.9/MBtu on 11 November.

According to the EIA Weekly Natural Gas Storage Report, natural gas underground storage on 4 November was 3,580 Bcf, an increase of 79 Bcf from the previous week, but remains low, down 1.0% from the same period last year and 2.1% from the average of the past five years.

Updated 16 November 2022

Source: JOGMEC