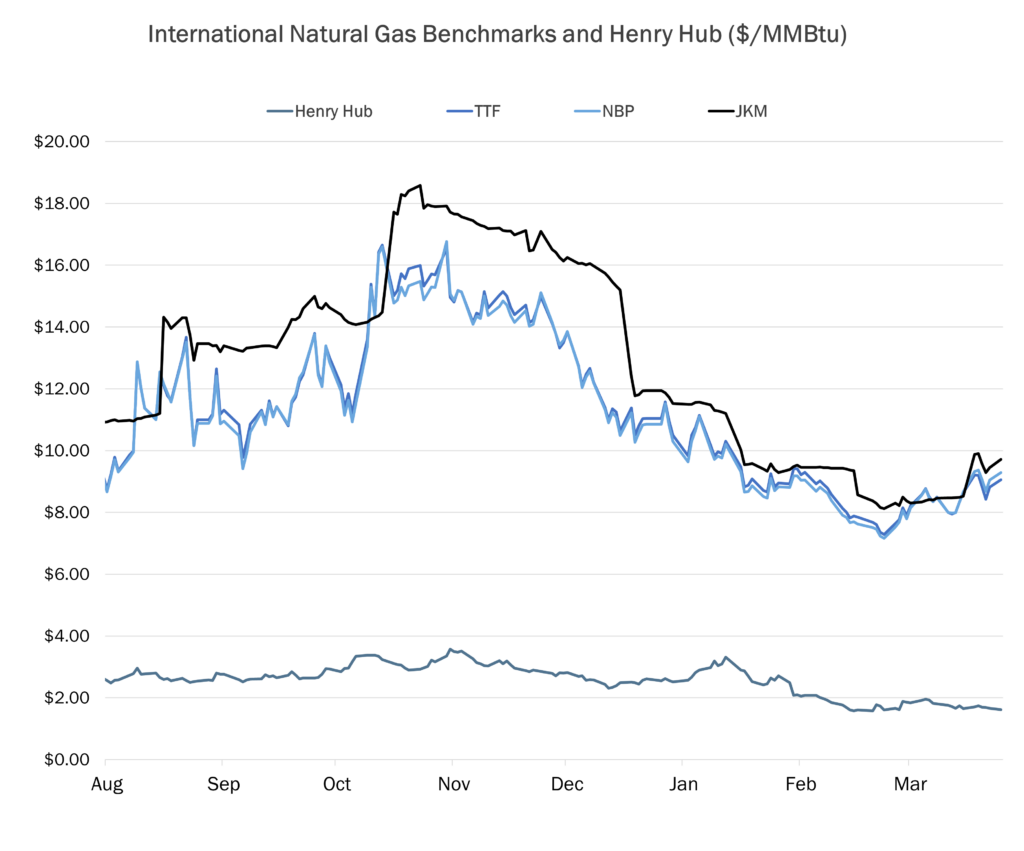

The arbitrage opportunity for shipping US LNG cargoes to Asia has become viable again due to a widening price gap between Europe and Asia, with Asian prices rising because of supply tightness and increased demand.

According to S&P Global Commodity Insights, the spot cargo price for May delivery in Japan/Korea was higher than in Northwest Europe and the Mediterranean, offering potential profits for rerouting cargoes to Asia despite longer voyage times and higher shipping costs.

Factors contributing to this situation include a demand surge in the Japan, Korea, Taiwan, and China trading hub, a cold snap in Japan, and potential supply disruptions from Australia due to Tropical Cyclone Megan.

This has led to increased buying in Asia and rerouting of cargoes from Europe, where tight discounts challenge profitability. However, shipping constraints, especially due to delays at major canals, are impacting the arbitrage economics, with many US LNG cargoes currently opting for the longer Cape of Good Hope route to Asia.

Source: Gelber & Associates