Global gas demand more than quadrupled since the early 1970s, and the outlook for the blue fuel looks more exciting than ever.

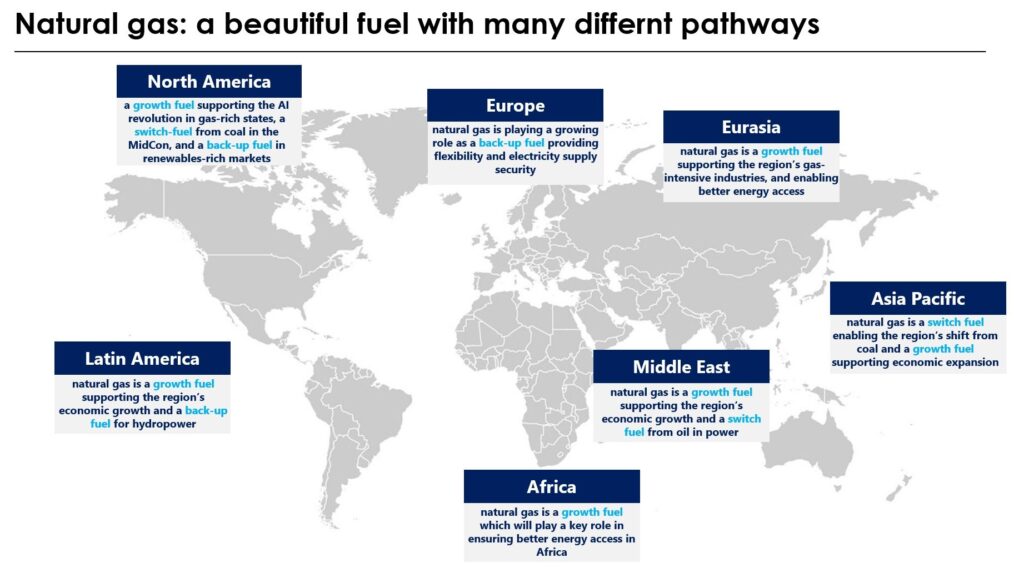

In many markets, natural gas will play a key role as a “growth fuel” in improving energy access and support economic expansion through the medium-term.

This would be particularly the case of Africa, blessed with vast gas reserves and still hundred of millions lacking access to modern energy and electricity.

But gas will also support the AI revolution, especially in the gas-rich states of the US, the Middle East and will enable the expansion of gas-intensive industries (such as fertilisers) in many markets, including Eurasia.

In other markets, natural gas will act as a “switch fuel”. This is the case of the large Asian economies, which still heavily rely on coal, accounting for almost half of the region’s total energy demand.

Think about it: Asia’s coal demand equates to almost 7 times the current global LNG trade. Outside of Asia, there is still important coal-to-gas switching potential left in the US MidContinent as well as Central and Eastern Europe.

And in the Middle East, natural gas will enable the switching from oil in the region’s power sector, with Saudi Arabia leading the way.

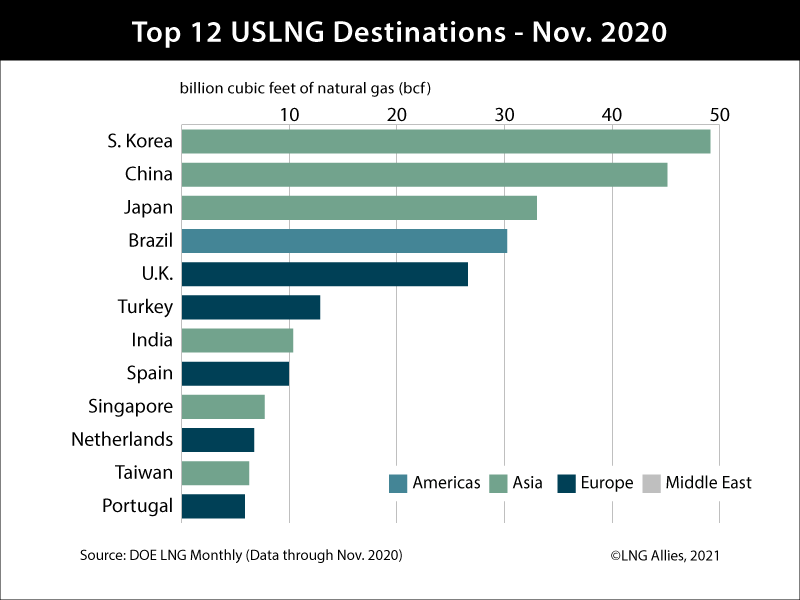

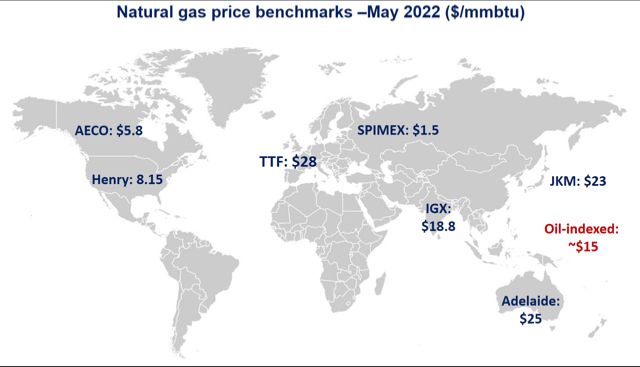

The next wave of LNG will support the role of natural gas as a “switch fuel”, especially in the large, import-reliant Asian markets.

More competitive gas prices will effectively support policies in these countries to reduce their reliance on coal and oil and hence lower emissions and improve air quality

And even in markets where the rapid expansion of renewables is weighing on natural gas consumption, natural gas is set to play a growing role as a “back-up fuel”, providing flexibility to power systems increasingly dominated by weather-dependent renewables.

This is the case of Europe, where gas is backing-up wind, or South America where gas is there when hydro is low.

All in all, natural gas will face different demand trajectories and varying roles across regions. And its role in the global energy system won’t peak any time soon.

And the commoditisation of LNG will certainly underpin this process and make gas markets more exciting than ever…

What is your view? What will be the future of natural gas? How will gas markets evolve? And what does it mean for investments?

Source: Greg MOLNAR