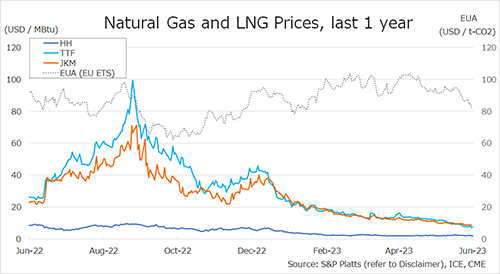

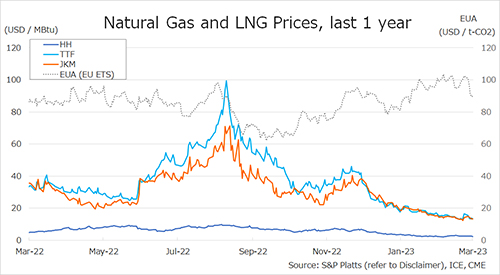

The Northeast Asian assessed spot LNG price JKM for the previous week (13 March – 17 March) rose to late USD 14/MBtu on 13 March from USD 14/MBtu the previous week on the heels of higher European gas prices.

The price then fell for three consecutive business days, dropping to USD 13/MBtu on 16 March, due to firm inventory levels, weak demand from Northeast Asian end-users, and a slowdown in competition for LNG cargoes in anticipation of weak demand in Europe.

On 17 March, JKM rose to mid-USD 13s on spot cargo procurement, especially from Taiwan. According to METI, Japan’s LNG inventories for power generation totaled 2.28 million tonnes as of 12 March, up 0.16 million tonnes from the previous week, up 0.75 million tonnes from the end of the same month last year and up 0.31 million tonnes from the average of the past five years.

The European gas price TTF fell to USD 13.3/MBtu by March 15 from USD 16.4/MBtu the previous week due to high gas inventories, mild weather, and strikes at French LNG terminals, but rose to USD 13.9/MBtu the following day on the back of reports of the Swiss National Bank loan to Credit Suisse Bank, which partially alleviated concerns of an economic downturn affecting gas demand.

On 17 March, the resumption of operations at French Dunkerque LNG eased the supply-demand crunch and the TTF fell to USD 13.3/MBtu. ACER published the 17 March spot LNG assessment price for delivery in the EU at EUR 41.55/MWh (equivalent to USD 12.94/MBtu).

According to AGSI+, the European underground gas storage rate as of 17 March was 55.7%, down from 56.9% the previous week.

The U.S. gas price HH rose to USD 2.6/MBtu on 13 March from USD 2.4/MBtu the previous week before falling for two consecutive business days to USD 2.4/MBtu on 15 March on increased supply and mild weather expectations.

HH rose to USD 2.5/MBtu the next day, but fell to USD 2.3/MBtu on 17 March following bullish sentiment on supply and an increase in renewable energy generation.

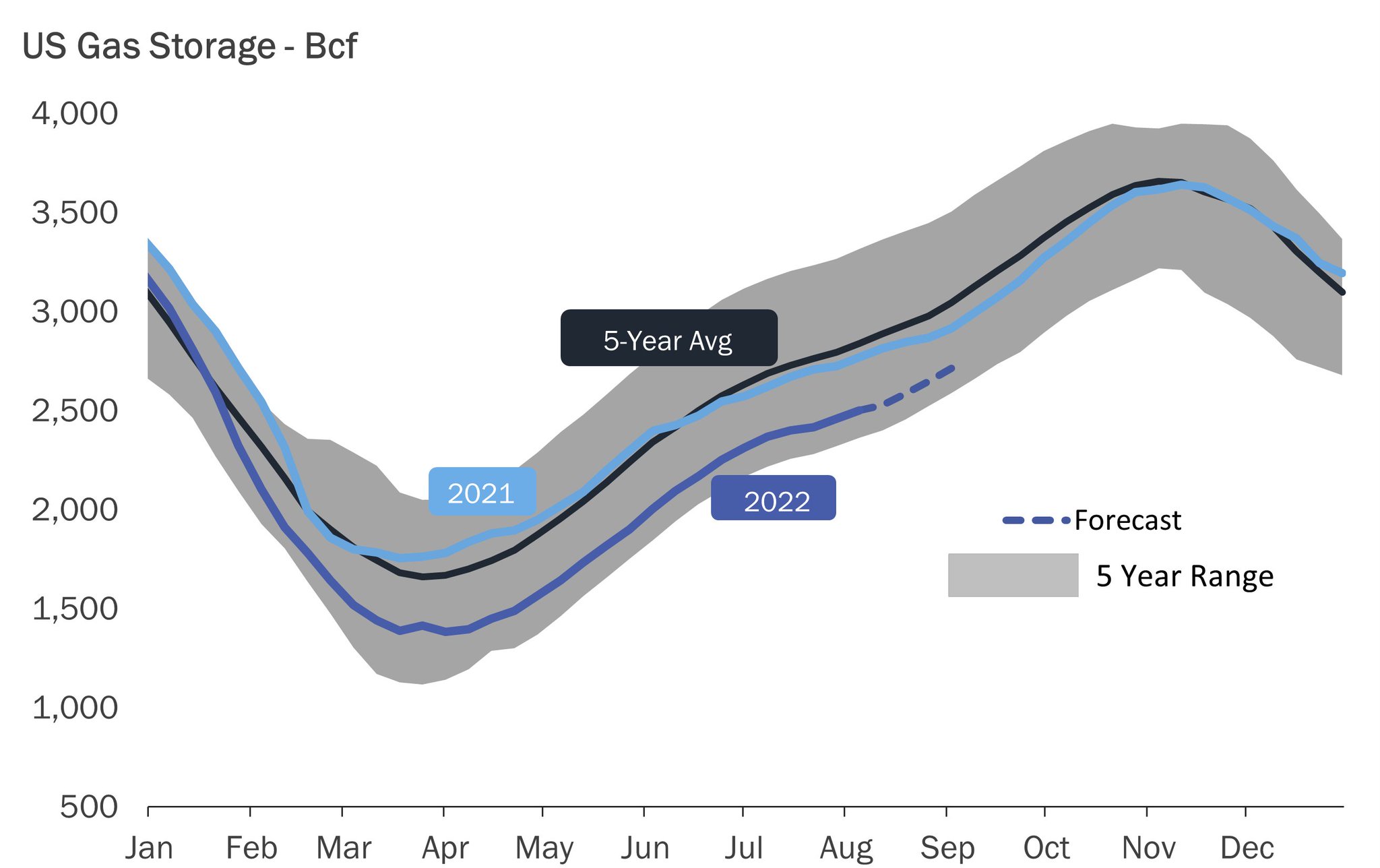

On 13 March, Venture Global announced the final investment decision for the second phase of Plaquemines LNG. According to the EIA Weekly Natural Gas Storage Report released on 16 March, the U.S. natural gas underground storage on 10 March was 1,972 Bcf, down 58 Bcf from the previous week, up 35.9% from the same period last year, and up 23.7% from the historical five-year average.

Updated 20 March 2023

Source: JOGMEC