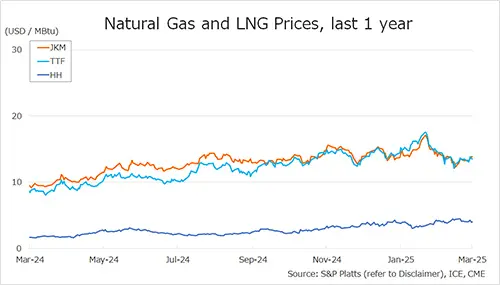

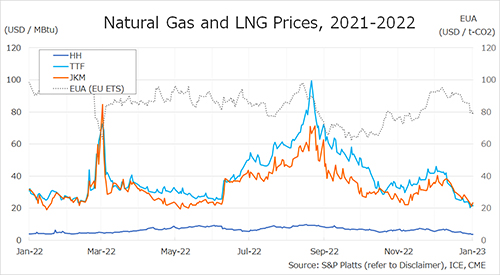

The Northeast Asian assessed spot LNG price JKM for the previous week (2 January – 6 January) fell for the third consecutive business day to USD 21/MBtu on 5 January from USD 28/MBtu on 30 December, as weak demand and some end-users in the region turned to sell to hold off on spot purchases. On 6 January, JKM rebounded to USD 23/MBtu.

According to METI, Japan’s LNG inventories for power generation totaled 2.41 million tonnes as of 25 December, down 0.03 million tonnes from the previous week, but up 0.07 million tonnes from the end of the same month last year and up 0.57 million tonnes from the average of the past five years, indicating a steady inventory.

The European gas price TTF rose slightly to USD 24.0/MBtu on 2 January from USD 23.8/MBtu on 30 December. It then fell for the second consecutive day to USD 20.2/MBtu on 4 January due to reports of cargoes arriving at a new LNG terminal in Wilhelmshaven, Germany, warm weather boosting European gas inventories, and strong wind power generation in the UK.

On 5 January, the price rebounded to USD 22.5/MBtu due to reduced supply due to scheduled maintenance to several Norwegian gas fields, reduced gas supply to Italy due to unplanned maintenance to a Libyan gas facility, and uncertainty about the restart of Freeport LNG in the US. On 6 January, TTF fell slightly to USD 21.4/MBtu. According to AGSI+, EU average underground gas storage was 83.16% as of 6 January, down 0.11% from the previous week.

The U.S. gas price HH fell to USD 4.0/MBtu on 3 January from USD 4.5/MBtu on 30 December. It then rose to USD 4.2/MBtu on 4 January on the expectation of higher LNG exports in the next two weeks, but fell to USD 3.7/MBtu on 5 January, remained almost flat on the following day.

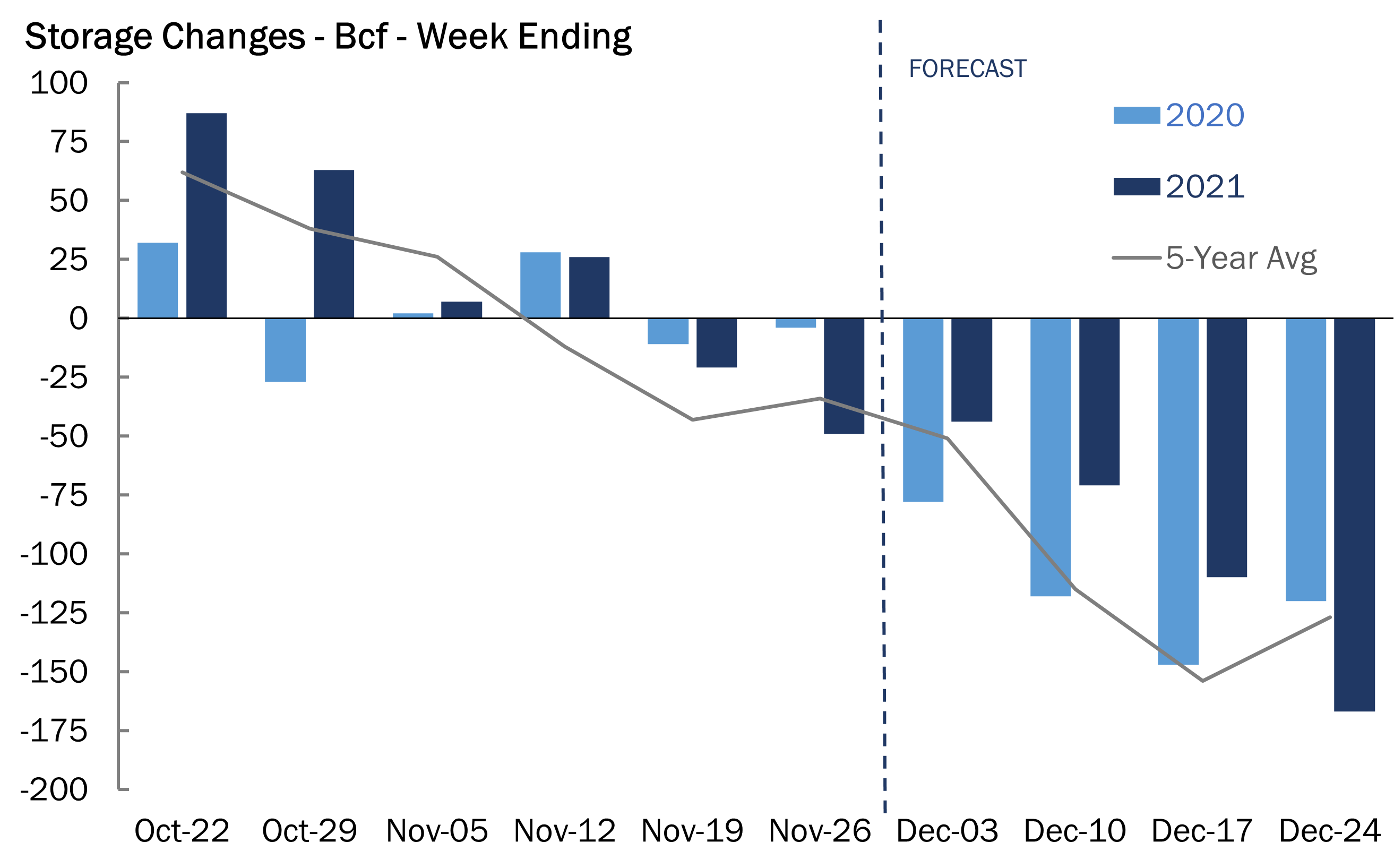

According to the EIA Weekly Natural Gas Storage Report released on 5 January, the U.S. natural gas underground storage on 30 December was 2,891 Bcf, down 221 Bcf from the previous week, down 9.6% from the same period last year, and down 6.7% from the historical five-year average.

Updated 11 January 2023

Source: JOGMEC