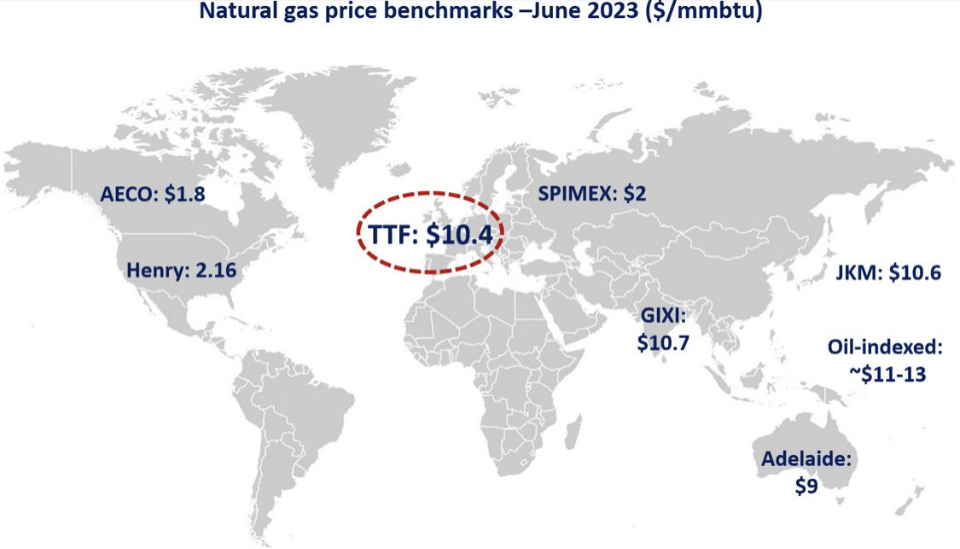

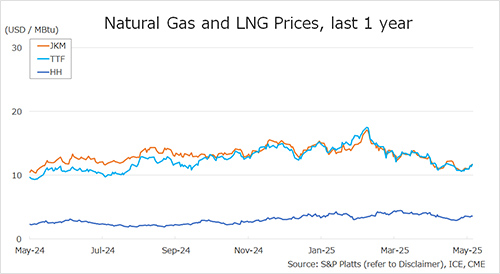

The Northeast Asian assessed spot LNG price JKM for last week (5 May – 9 May, June delivery) rose to high-USD 11s/MBtu on 9 May from low-USD 11s/MBtu the previous weekend (2 May).

JKM rose throughout the week as competition for procurement intensified ahead of the summer season, particularly between Europe and Asia, although end-user demand in Asia remained weak.

The European gas price TTF for last week (5 May – 9 May, June delivery) rose to USD 11.4/MBtu on 9 May from USD 11.0/MBtu the previous weekend (2 May). TTF rose due to the EU’s target to reduce Russian gas imports to zero by 2027 and expectations of the economic recovery by easing trade friction between U.S. and China.

According to AGSI+, the EU-wide underground gas storage was 42.2% on 9 May, up from 40.3% the previous weekend, down 34.5% from the same period last year, and down 19.0% over the five-year average.

The U.S. gas price HH for last week (5 May – 9 May, June delivery) rose to USD 3.8/MBtu on 9 May from USD 3.6/MBtu the previous weekend (2 May). HH fell in the first half of the week due to decrease in feed gas demand caused by maintenances at several U.S. LNG liquefaction terminals, but it turned upward over the weekend due to the outlook for increased electricity demand by forecasts of rising temperatures.

The EIA Weekly Natural Gas Storage Report released on 8 May showed U.S. natural gas inventories as of 2 May at 2,145 Bcf, up 104 Bcf from the previous week, down 16.1% from the same period last year, and 1.4% increase over the five-year average.

Updated: May 12

Source: JOGMEC