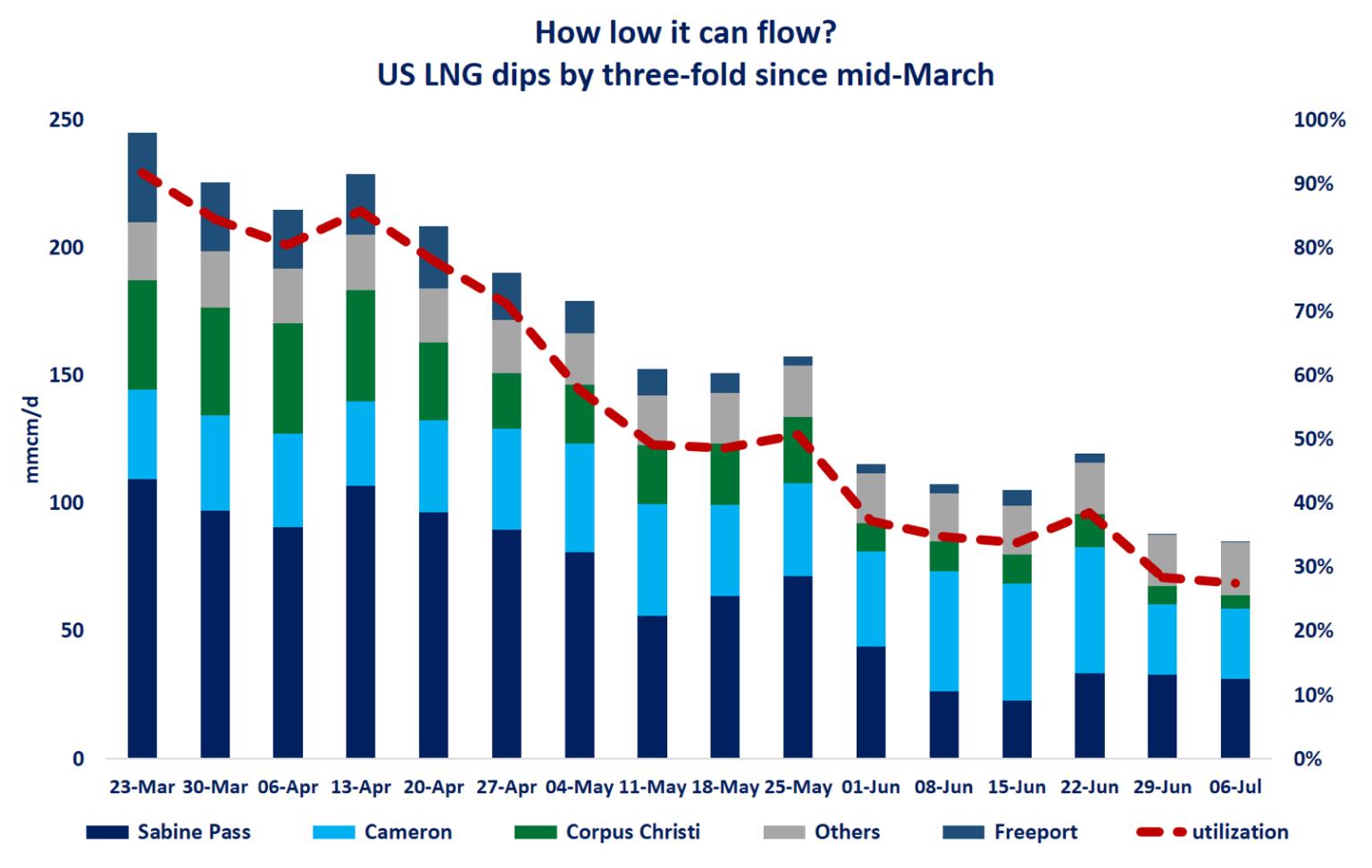

Shoulder season: gas markets continued to ease in April amidst high storage levels, reduced space heating demand and improving LNG availability as Freeport now runs at full scale.

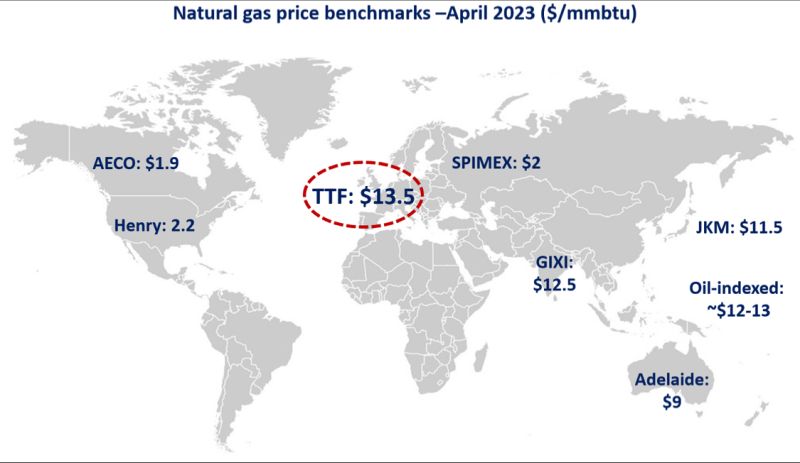

In Europe, TTF month-ahead prices dropped by 60% yoy to average at $13.5/mmbtu.

Lower gas demand (down by 10%) together with strong LNG inflows (up by 13%) and high storage levels (filled up to 60%) continuer to provide downward pressure on prices, despite the dry up of Russian piped gas and some unplanned outages in Norway.

In Asia, JKM prices followed a similar trajectory, now down by 70% yoy to an average of $11.5/mmbtu -falling to the lower end of the oil-indexed price range.

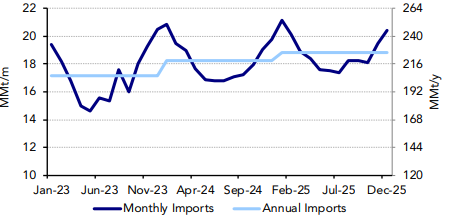

One key development to note: China’s LNG imports are up now by 18% yoy, a strong return to growth although remaining below their 2021 levels.

In the US, Henry Hub prices dropped to an average of $2.2/mmbtu -their lowest monthly since Sep20.

Strong production growth (+5%) combined with lower demand (-2.5%) and high storage levels is weighing on gas prices.

Lower exports to the US are providing downward pressure on AECO prices in Canada, dropping to an average below $2/mmbtu.

What is your view? How will gas prices play out over the spring? Do you see further downside in the coming months?

Source: Greg Molnar (LinkedIn)