On its last day of trading, the October contract zoomed upwards to lock in a new high of $6.28, first posting the $6-handle in extended trading hours.

As mentioned in our last iteration of the newsletter, the October contract has not closed past $4 since 2008 in the pre-shale era. Today’s remarkable 20+ cent rally picked up where yesterday’s 50+ cent rally left off, confirming Newton’s 1st law that an object in motion will remain in motion.

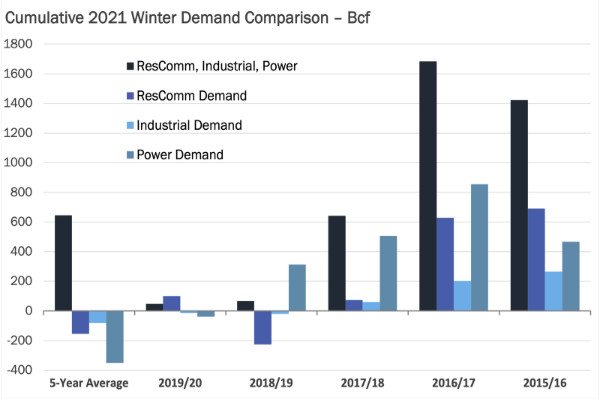

Weather forecasts over the last two days have slightly strengthened an otherwise very-mild period and will tamp down expectations of injections deep in triple-digit territory over the next two weeks.

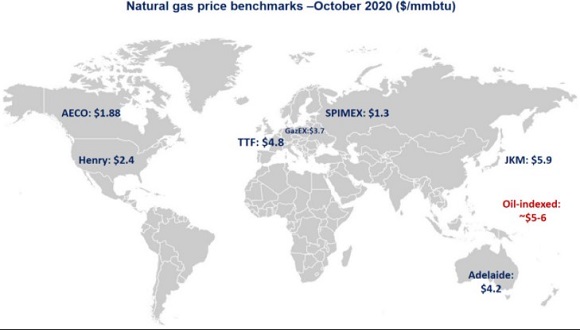

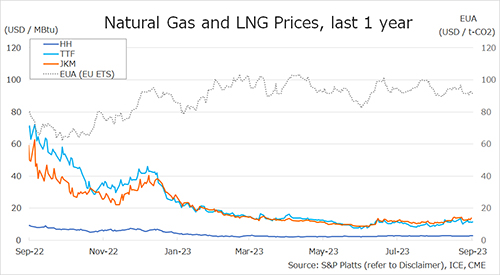

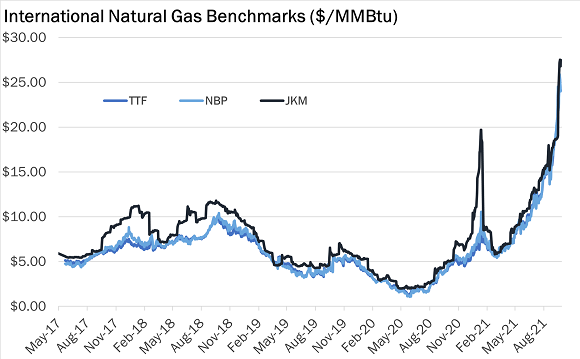

However, for the most part, today’s slight modulation in weather forecasts does not justify the magnitude of the jump in price over the last two days. Concerns over the strength of winter have baked in a hefty winter risk premium into the market, and with international prices soaring to over $26 in Europe and $29 in Asia, the Henry Hub has ecstatically moved higher in an effort to maintain proportionality.

Spikes in other energy commodities, such as crude and coal, have moved alongside that of natural gas and limited options for substitution.

Source: Gelber and Associates