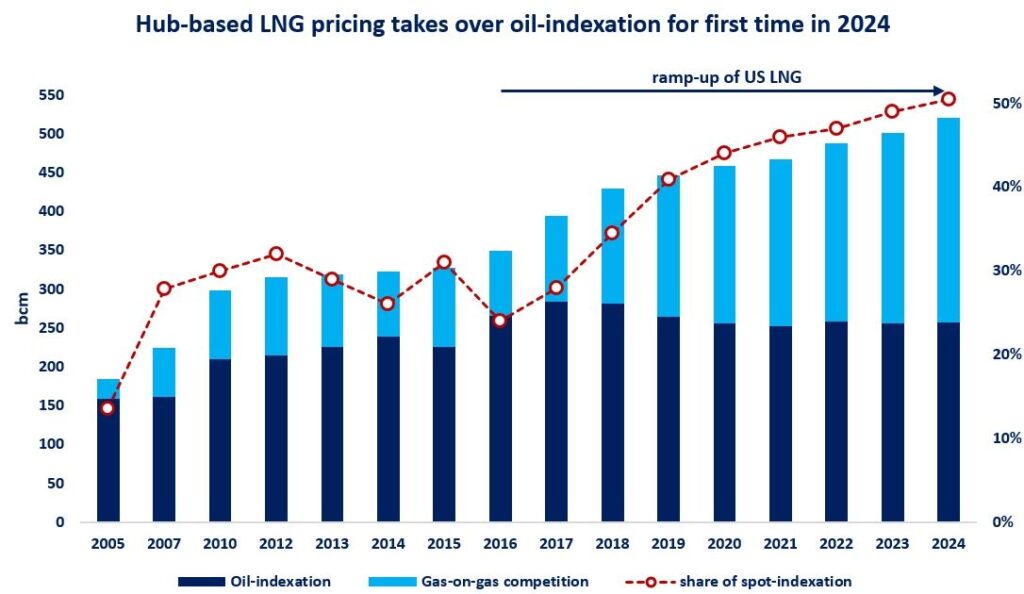

The share of hub-based LNG pricing rose to over 50% for the very first time in 2024, according to IGU’s latest Gas Price Report, just released yesterday.

The share of hub-based pricing rose from less than 15% in 2005 to near 51% in 2024, while the share of oil-indexation dropped from 85% to just below 50% during the same period of time.

This also means, that LNG flows are increasingly following price signals, contributing to a more liquid and more flexible global LNG market.

There are four key structural drivers behind this profound change:

(1) US LNG: US LNG contracts are typically linked to Henry Hub and are destination-flexible, which encourages secondary trading operations. US LNG ramped-up at a staggering space since 2016 and today accounts for more than 20% of global LNG trade;

(2) The rise of spot trading: the share spot volumes grew from less than 10% in the early 2000s to over 30% of global LNG trade in recent years. this is partly driven by the growing flex requirements of buyers, but also sellers’ strategies increasingly focusing on short-term marketing opportunities;

(3) The emergence of new players: aggregators and traders are playing an increasingly important role, embracing the growing liquidity of the LNG market;

(4) Market opening reforms: first in Europe, now in Asia, market reforms are incentivising buyers to seek greater pricing diversity and engage in short-term trading activities.

What is your view? How will LNG pricing evolve in the coming years?

Will the next LNG wave further erode oil-indexation? could we see more spot trading emerging? How will major players position themselves in this rapidly changing landscape?

Source : Greg Molnár