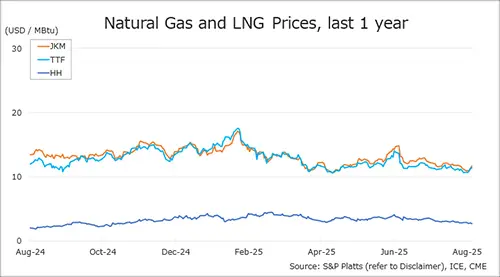

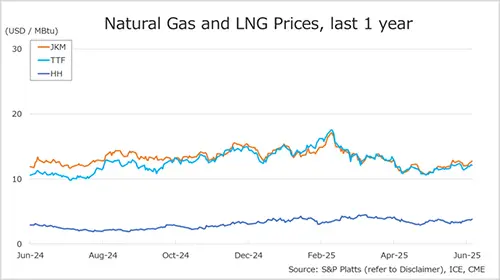

The Northeast Asian assessed spot LNG price JKM (July delivery) for last week (2 June – 6 June) rose to high-USD 12s/MBtu on 6 June from low-USD 12s/MBtu the previous weekend (30 May).

Although demand in Asia is currently sluggish, JKM rose for a fifth consecutive day on the back of expected increased summer demand, reduced supply due to buying spot cargoes by Egypt and strong buying interest from trading houses and portfolio players.

METI announced on 4 June that Japan’s LNG inventories for power generation as of 1 June stood at 2.26 million tonnes, up 0.10 million tonnes from the previous week.

The European gas price TTF (July delivery) for last week (2 June – 6 June) rose to USD 12.1/MBtu on 6 June from USD 11.4/MBtu the previous weekend (30 May). TTF fell to USD 11.4/MBtu previous weekend due to low demand and ample LNG supply, but rebounded to USD 12.0/MBtu in the first half of the week.

In the middle of the week, it temporarily fell due to an increase in renewable energy power generation, but rose again to USD 12.2/MBtu on expectations of a resolution to trade friction through U.S. – China talks and rising oil prices, and then fell slightly to around USD 12.1/MBtu following the recovery of supply capacity in Norway.

According to AGSI+, the EU-wide underground gas storage was 50.5% on 6 June, up from 47.9% the previous weekend, down 29.0% from the same period last year, and down 16.9% over the five-year average.

The U.S. gas price HH (July delivery) for last week (2 June – 6 June) rose to USD 3.8/MBtu on 6 June from USD 3.5/MBtu the previous weekend (30 May). HH rose to USD 3.7/MBtu at the beginning of the week due to the impact of wildfires in Alberta, Canada, which affected some oil and gas production facilities, and continued to move around USD 3.7/MBtu.

The EIA Weekly Natural Gas Storage Report released on 6 June showed U.S. natural gas inventories as of 30 May at 2,598 Bcf, up 122 Bcf from the previous week, down 10.0% from the same period last year, and 4.7% increase over the five-year average.

Updated: June 9

Source: JOGMEC