Despite a short-lived cold snap pushing demand upward in parts of Europe, the coming week’s outlook for natural gas prices appears largely stable.

Kpler argues that ample global supply, ramped-up pipeline flows, and moderating temperatures will offset demand pressures.

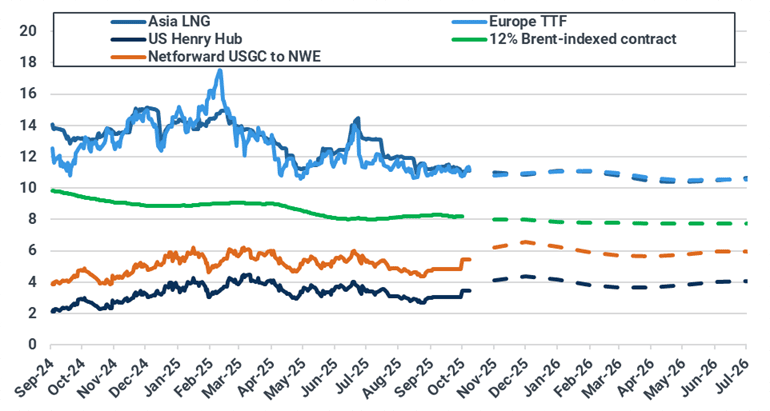

European TTF, Asian LNG, and US Henry Hub are all expected to trade within recent ranges rather than spike sharply.

That said, the balance remains delicate: further shifts in weather forecasts, unplanned supply outages, or higher regional consumption could tip the scale. The ability of supply to respond quickly will be key.

“We anticipate increased demand in the coming days … to be met by higher Algerian pipeline exports and stable LNG imports.” says Laura Page of Kpler

Key Points:

TTF front-month contract is expected to remain stable, supported by forecasts of warmer weather after mid-October.

In Europe, demand from the recent cold snap is projected to be absorbed through higher Algerian pipeline flowsand steady LNG imports.

On the supply side, EU pipeline inflows rose ~2.5% week-on-week, with gains from Norway, Algeria, and TurkStream offsetting UK-to-EU interconnector works.

Asian LNG prices also look rangebound, with inventories and soft prompt demand limiting upside momentum.

US Henry Hub is similarly expected to stay within recent boundaries; cooler eastern/western regions are partly offset by warmer central forecasts.

Source: Kpler