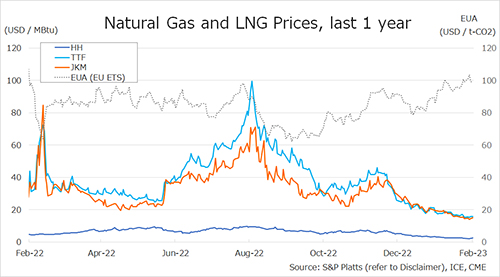

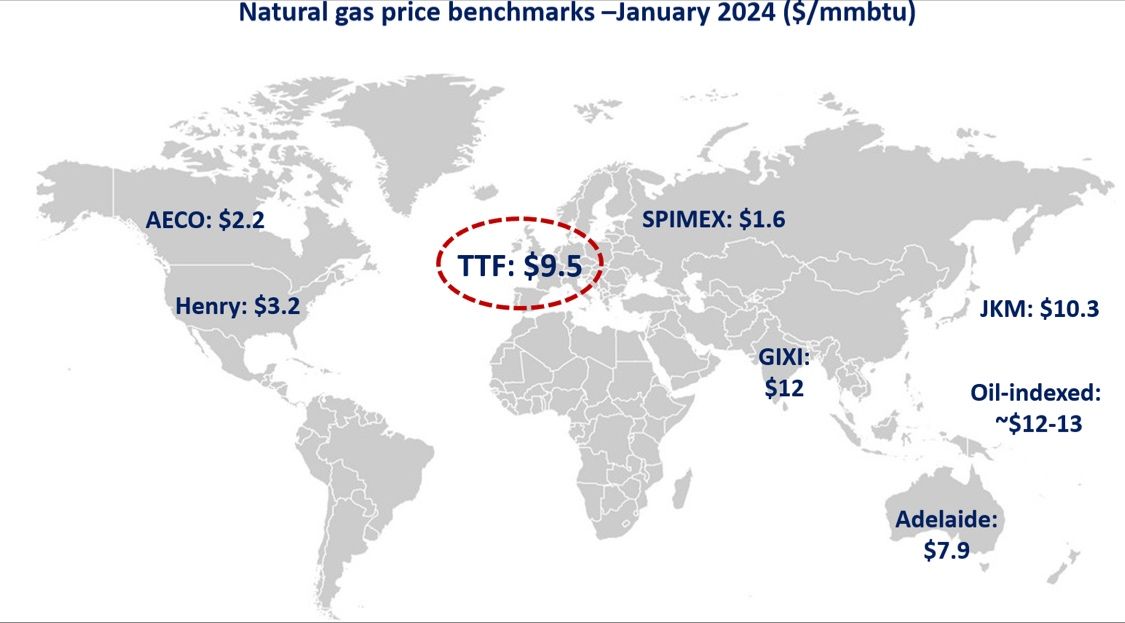

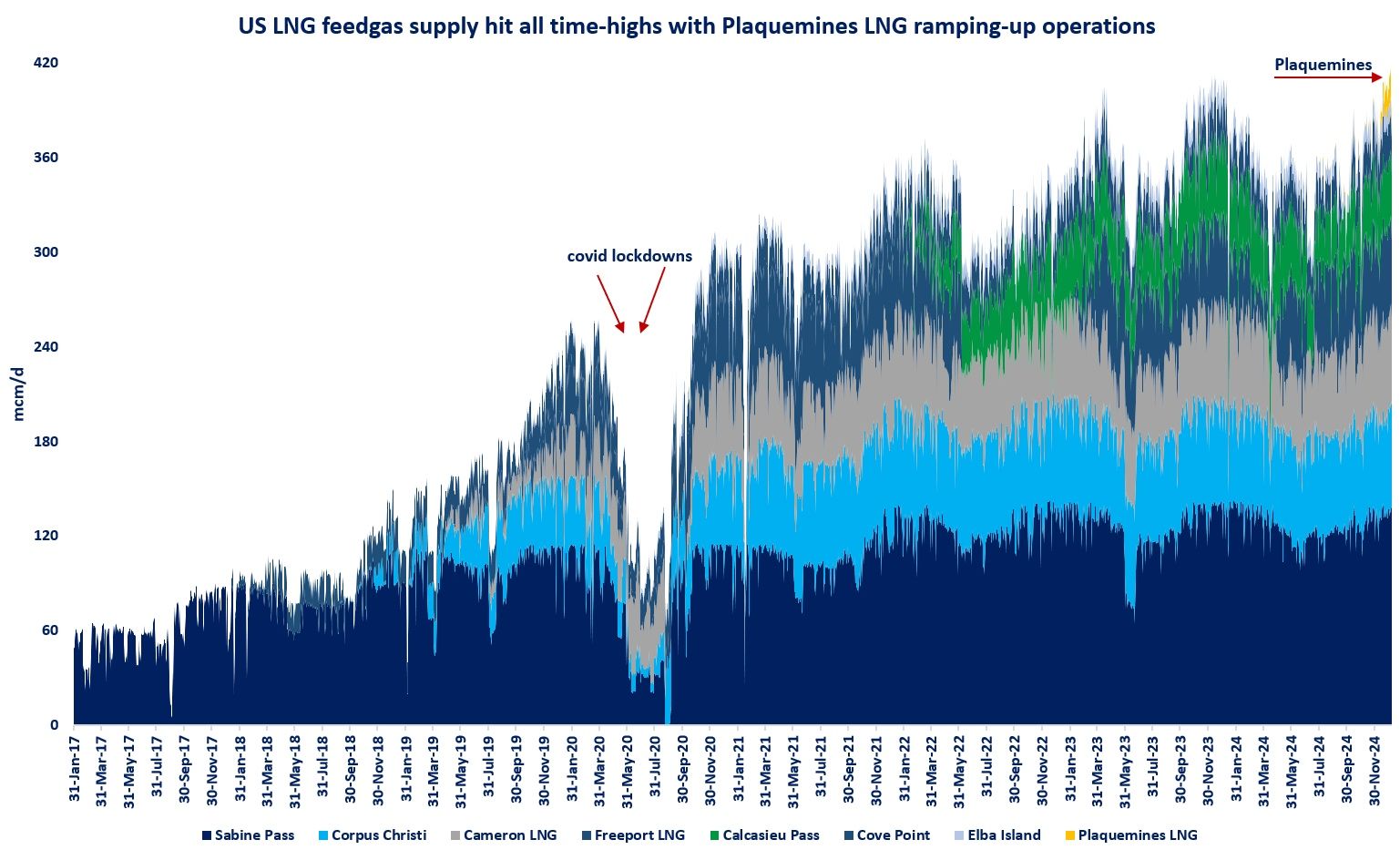

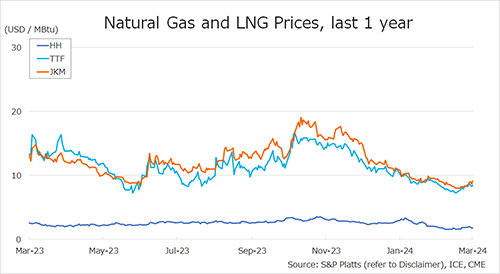

The Northeast Asian assessed spot LNG price JKM for the previous week (4 March – 8 March) increased to low-USD 9s on 8 March from low-USD 8s the previous weekend. JKM rose due to increased buying interest to meet short-term demand. METI announced on 6 March that Japan’s LNG inventories for power generation as of 3 March stood at 1.95 million tonnes, down 0.21 million tonnes from the previous week.

The European gas price TTF increased to USD 8.5/MBtu on 8 March from USD 8.2/MBtu the previous weekend. TTF increased due to a positive sign of cargo procurement ahead of the gas storage injection season (usually from April to October) in preparation for winter due to daily price falls, as well as lower temperature forecasts. According to AGSI+, the EU-wide underground gas storage declined to 60.8% as of 8 March from 62.3% the previous week.

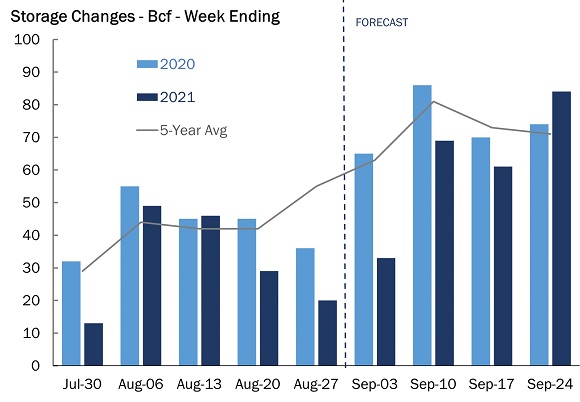

The U.S. gas price HH remained unchanged at USD 1.8/MBtu on 8 March from USD 1.8/MBtu the previous weekend. HH increased due to US shale gas EQT’s announcement that it will continue to cut production from March onwards, but the abundant inventory offset the gains. The EIA Weekly Natural Gas Storage Report released on 7 March showed U.S. natural gas inventories as of 1 March at 2,334 Bcf, down 40 Bcf from the previous week, up 13.6% from the same period last year, and 30.9% increase over the five-year average.

Source: JOGMEC