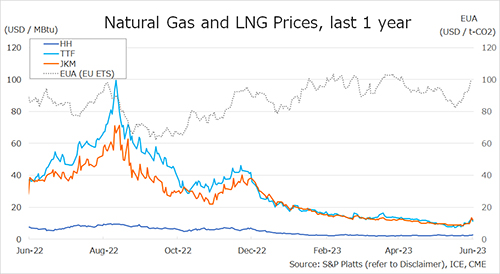

TTF prices rose to above €40/MWh this morning, the highest level since early April, amid the escalating conflict between Israel and Iran.

TTF surger by more than 15% since 10 June, and while some of this has been sentiment (fear) driven, the conflict is already impacting natural gas markets:

(1) Israel shut production at the Leviathan and Karish fields (around 60% of the country’s production);

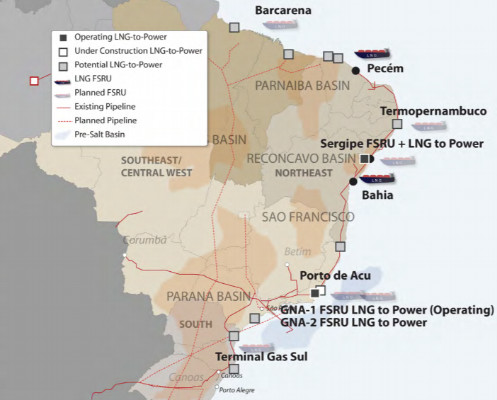

(2) Israeli piped exports to Egypt halted, forcing the country to curtail fertiliser production and likely to increase further its LNG imports (Israel exported every 3 days the equivalent of 1 LNG cargo to Egypt);

(3) In Jordan, the National Electricity Company activated its emergency plan after Israel halted piped supplies to the country;

(4) In Iran, South Pars phase 14 refinery caught fire following Israeli attacks, potentially reducing supply by around 12 mcm/d, and further tightening the country’s already fragile gas balance;

(5) Qatar asked LNG carriers to wait outside the Strait of Hormuz until they’re ready to load, in a way to reduce risks amid the escalating tensions;

Unfortunately, geopolitical forces are back in full swing and driving short-term price volatility and supporting risk premiums across markets.

Source: Greg Molnar