The oil market continued its move higher yesterday, after a fairly constructive inventory report from the EIA. While US commercial crude oil inventories increased by 2.03MMbbls over the last week, when taking into account releases from the strategic petroleum reserve total US crude inventories declined by 5.24MMbbls.

Given the strength in the refined products market, it is no surprise that refiners ramped up run rates by 1.6 percentage points to 94.2%, their highest levels since 2019. Despite this increase in run rates, gasoline inventories still declined over the week by 812Mbbls. This leaves US gasoline inventories at a little over 218MMbbls, closer to levels we usually see at the end of driving season, not at the beginning.

Freeport LNG could be down for at least three weeks

Strong demand over the week contributed to the stock decline, with implied gasoline demand increasing by 222Mbbls/d. As for distillates, stronger refinery activity and weaker implied demand saw stocks grow by 2.59MMbbls, the largest weekly increase since December 2021.

Comments from the UAE energy minister would have also provided some support to the market, with the minister pointing out the struggle that OPEC+ is facing in boosting output and hitting its production targets under the OPEC+ deal. In addition, the minister noted the recovery in Chinese consumption following an easing in Covid related lockdowns, suggesting that there is further upside to prices.

Latest trade data released from China this morning shows that crude oil imports in May averaged around 10.9MMbbls/d, up around 13% YoY and almost 4% higher MoM. Cumulative imports over the first 5 months of the year still lag last year, by 1.7%.

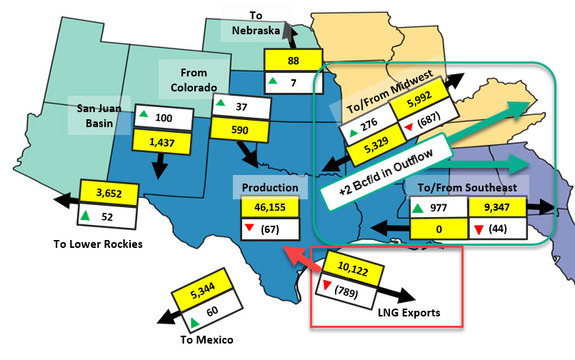

A fire at the Freeport LNG export facility in the US has led to a stoppage in operations and it is reported that the plant could be down for at least three weeks. The Freeport LNG facility has a capacity of 15mtpta (around 20bcm), which makes up around 17% of total US liquefaction capacity.

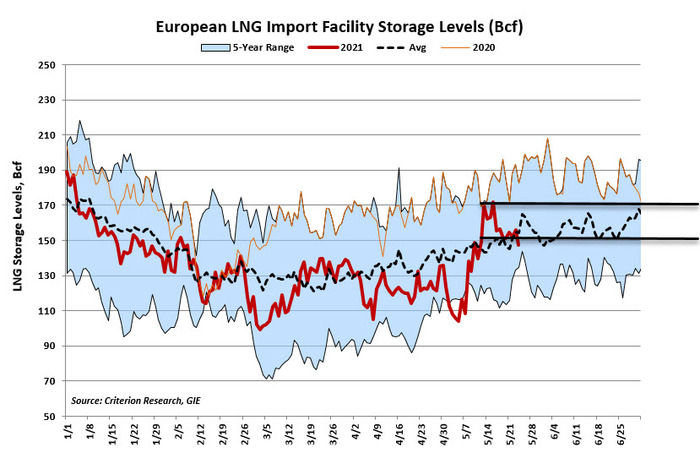

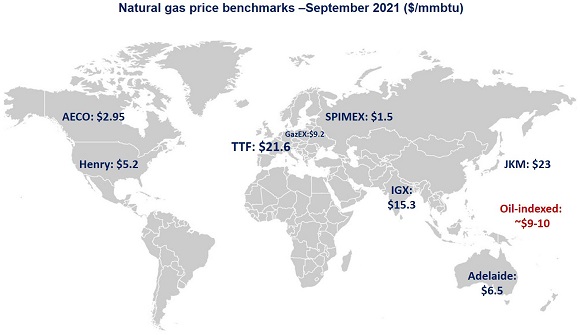

The impact on US gas prices has been bearish, given that this will weigh on LNG exports and leave more gas in the domestic market. However, this should prove supportive for European hub prices as well as spot Asian LNG prices, given that the LNG market is already tight, with Europe increasingly turning to LNG as it tries to reduce its dependency on Russian gas.

Source: ING